- Hungary

- /

- Electric Utilities

- /

- BUSE:ENEFI

ENEFI Vagyonkezelo Nyrt (BUSE:ENEFI) Shareholders Should Be Cautious Despite Solid Earnings

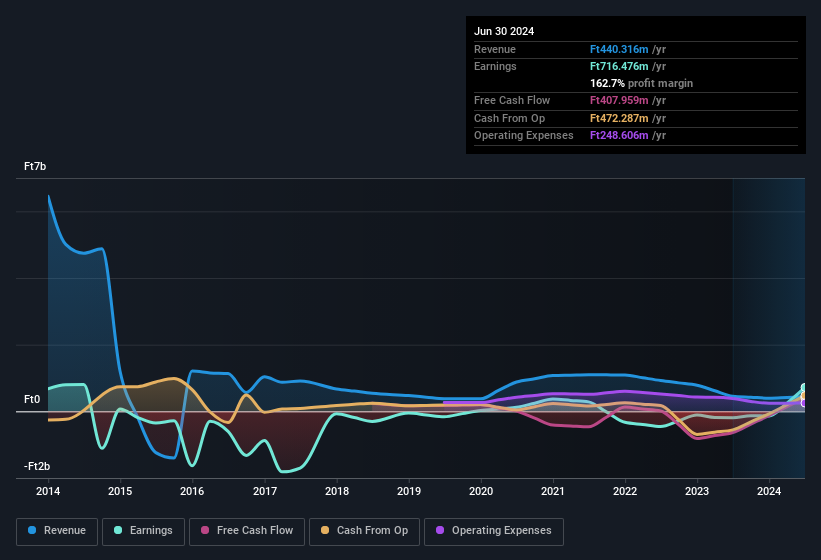

Solid profit numbers didn't seem to be enough to please ENEFI Vagyonkezelo Nyrt.'s (BUSE:ENEFI) shareholders. Our analysis has found some concerning factors which weaken the profit's foundation.

See our latest analysis for ENEFI Vagyonkezelo Nyrt

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, ENEFI Vagyonkezelo Nyrt increased the number of shares on issue by 32% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of ENEFI Vagyonkezelo Nyrt's EPS by clicking here.

A Look At The Impact Of ENEFI Vagyonkezelo Nyrt's Dilution On Its Earnings Per Share (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

If ENEFI Vagyonkezelo Nyrt's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ENEFI Vagyonkezelo Nyrt.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted ENEFI Vagyonkezelo Nyrt's net profit by Ft225m over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. ENEFI Vagyonkezelo Nyrt had a rather significant contribution from unusual items relative to its profit to June 2024. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On ENEFI Vagyonkezelo Nyrt's Profit Performance

To sum it all up, ENEFI Vagyonkezelo Nyrt got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue ENEFI Vagyonkezelo Nyrt's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing ENEFI Vagyonkezelo Nyrt at this point in time. Every company has risks, and we've spotted 4 warning signs for ENEFI Vagyonkezelo Nyrt (of which 1 makes us a bit uncomfortable!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ENEFI Vagyonkezelo Nyrt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:ENEFI

ENEFI Vagyonkezelo Nyrt

Engages in the production and sale of thermal energy in Hungary, Cyprus, and Romania.

Solid track record and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion