Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that 4iG Nyrt. (BUSE:4IG) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for 4iG Nyrt

What Is 4iG Nyrt's Debt?

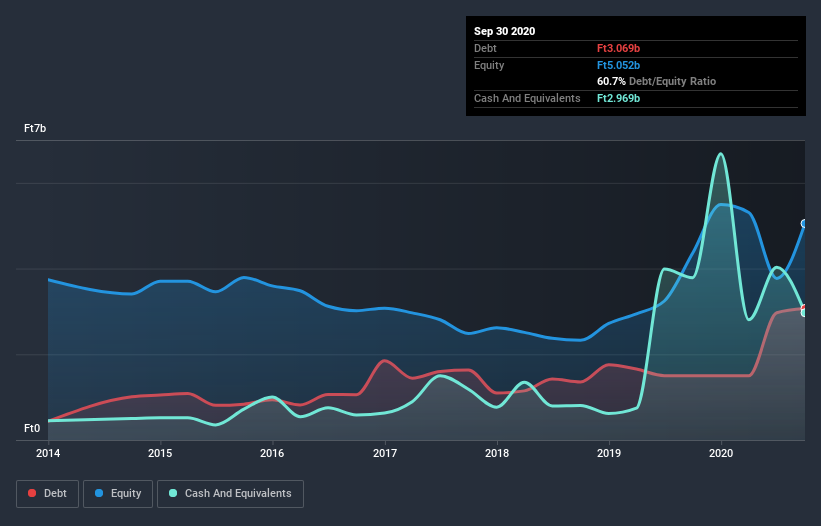

As you can see below, at the end of September 2020, 4iG Nyrt had Ft3.07b of debt, up from Ft1.50b a year ago. Click the image for more detail. However, it also had Ft2.97b in cash, and so its net debt is Ft99.4m.

A Look At 4iG Nyrt's Liabilities

According to the last reported balance sheet, 4iG Nyrt had liabilities of Ft16.6b due within 12 months, and liabilities of Ft289.8m due beyond 12 months. Offsetting these obligations, it had cash of Ft2.97b as well as receivables valued at Ft14.4b due within 12 months. So it can boast Ft479.6m more liquid assets than total liabilities.

Having regard to 4iG Nyrt's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the Ft57.7b company is struggling for cash, we still think it's worth monitoring its balance sheet. Carrying virtually no net debt, 4iG Nyrt has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

4iG Nyrt has barely any net debt, as demonstrated by its net debt to EBITDA ratio of only 0.025. Happily, it actually managed to receive more interest than it paid, over the last year. So there's no doubt this company can take on debt as easily as enthusiastic spray-tanners take on an orange hue. On top of that, 4iG Nyrt grew its EBIT by 34% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine 4iG Nyrt's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent two years, 4iG Nyrt recorded free cash flow of 36% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Happily, 4iG Nyrt's impressive interest cover implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Looking at the bigger picture, we think 4iG Nyrt's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for 4iG Nyrt (of which 1 is concerning!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading 4iG Nyrt or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BUSE:4IG

4iG Nyrt

Engages in the telecommunication and information technology (IT) businesses in Hungary and the Western Balkans.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success