Subdued Growth No Barrier To 4iG Nyrt. (BUSE:4IG) With Shares Advancing 25%

4iG Nyrt. (BUSE:4IG) shares have continued their recent momentum with a 25% gain in the last month alone. This latest share price bounce rounds out a remarkable 493% gain over the last twelve months.

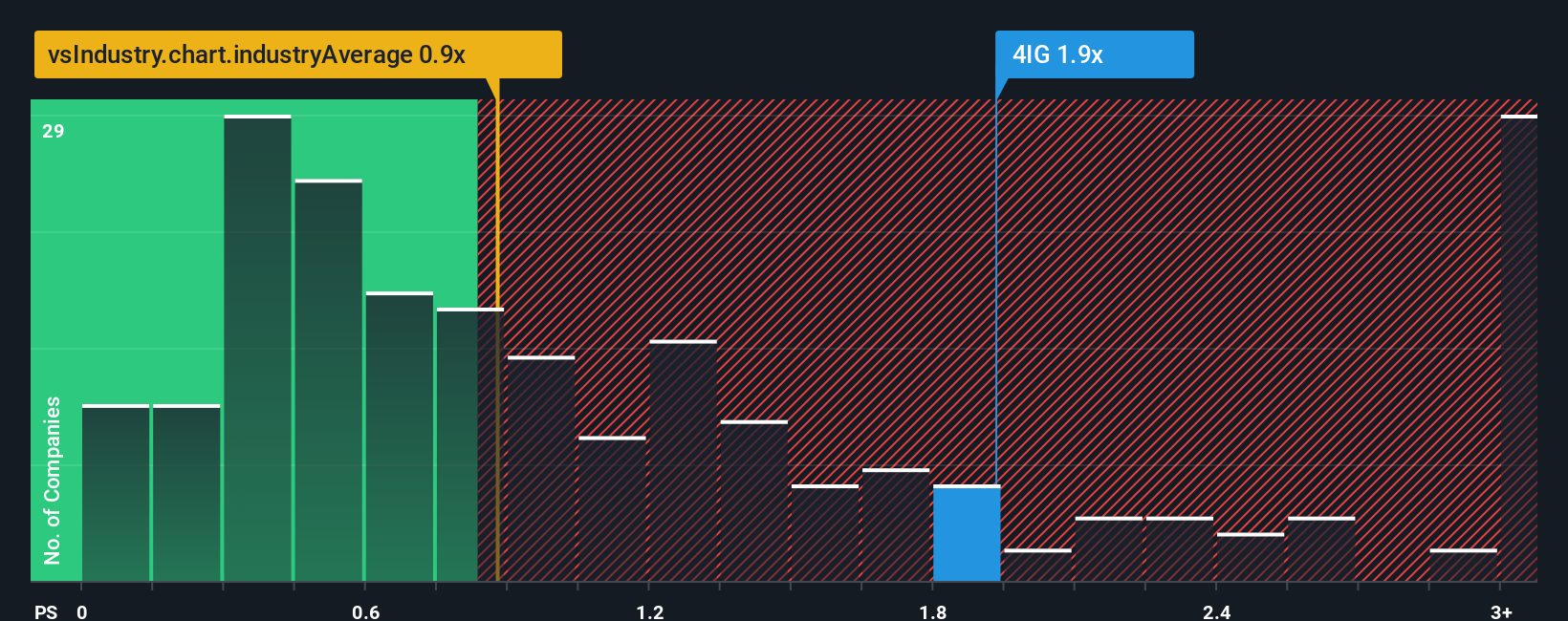

After such a large jump in price, when almost half of the companies in Hungary's IT industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider 4iG Nyrt as a stock probably not worth researching with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for 4iG Nyrt

How Has 4iG Nyrt Performed Recently?

There hasn't been much to differentiate 4iG Nyrt's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think 4iG Nyrt's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For 4iG Nyrt?

The only time you'd be truly comfortable seeing a P/S as high as 4iG Nyrt's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.6%. The latest three year period has also seen an excellent 283% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 81% as estimated by the sole analyst watching the company. That's not great when the rest of the industry is expected to grow by 3.3%.

With this information, we find it concerning that 4iG Nyrt is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On 4iG Nyrt's P/S

4iG Nyrt shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of 4iG Nyrt's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 2 warning signs for 4iG Nyrt (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of 4iG Nyrt's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:4IG

4iG Nyrt

Engages in the telecommunication and information technology (IT) businesses in Hungary and the Western Balkans.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives