- Hungary

- /

- Real Estate

- /

- BUSE:GSPARK

Graphisoft Park SE Real Estate Development European (BUSE:GSPARK) Has A Pretty Healthy Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Graphisoft Park SE Real Estate Development European Company Limited (BUSE:GSPARK) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Graphisoft Park SE Real Estate Development European

What Is Graphisoft Park SE Real Estate Development European's Net Debt?

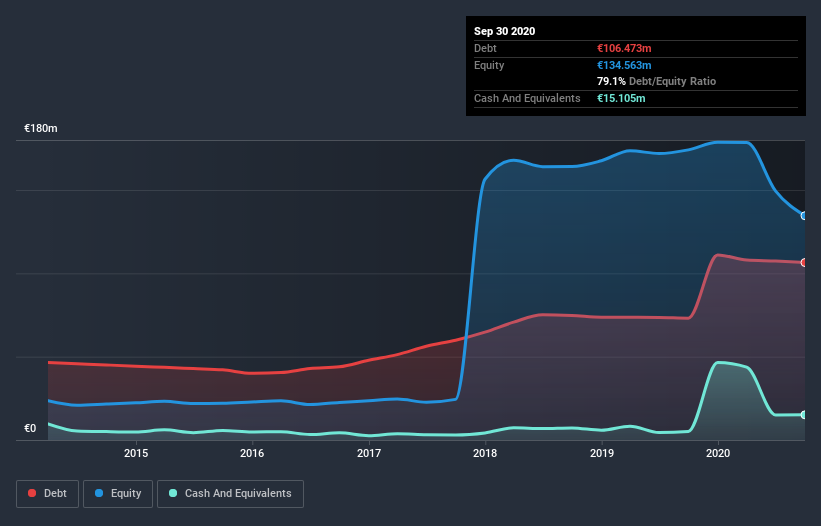

As you can see below, at the end of September 2020, Graphisoft Park SE Real Estate Development European had €106.5m of debt, up from €73.1m a year ago. Click the image for more detail. However, it also had €15.1m in cash, and so its net debt is €91.4m.

How Healthy Is Graphisoft Park SE Real Estate Development European's Balance Sheet?

According to the last reported balance sheet, Graphisoft Park SE Real Estate Development European had liabilities of €10.3m due within 12 months, and liabilities of €104.2m due beyond 12 months. Offsetting this, it had €15.1m in cash and €1.58m in receivables that were due within 12 months. So its liabilities total €97.7m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of €98.6m, so it does suggest shareholders should keep an eye on Graphisoft Park SE Real Estate Development European's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Graphisoft Park SE Real Estate Development European's debt to EBITDA ratio of 6.9 suggests a heavy debt load, its interest coverage of 9.6 implies it services that debt with ease. Overall we'd say it seems likely the company is carrying a fairly heavy swag of debt. Importantly, Graphisoft Park SE Real Estate Development European grew its EBIT by 37% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Graphisoft Park SE Real Estate Development European's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, Graphisoft Park SE Real Estate Development European actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Based on what we've seen Graphisoft Park SE Real Estate Development European is not finding it easy, given its net debt to EBITDA, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. When we consider all the elements mentioned above, it seems to us that Graphisoft Park SE Real Estate Development European is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Graphisoft Park SE Real Estate Development European (1 is potentially serious!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Graphisoft Park SE Real Estate Development European, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUSE:GSPARK

Graphisoft Park SE Ingatlanfejleszto Európai Részvénytársaság

Engages in the real estate development and management activities in Hungary.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion