- Hungary

- /

- Real Estate

- /

- BUSE:EPROLIUSIA

Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság's (BUSE:EPROLIUSIA) Shareholders Will Receive A Bigger Dividend Than Last Year

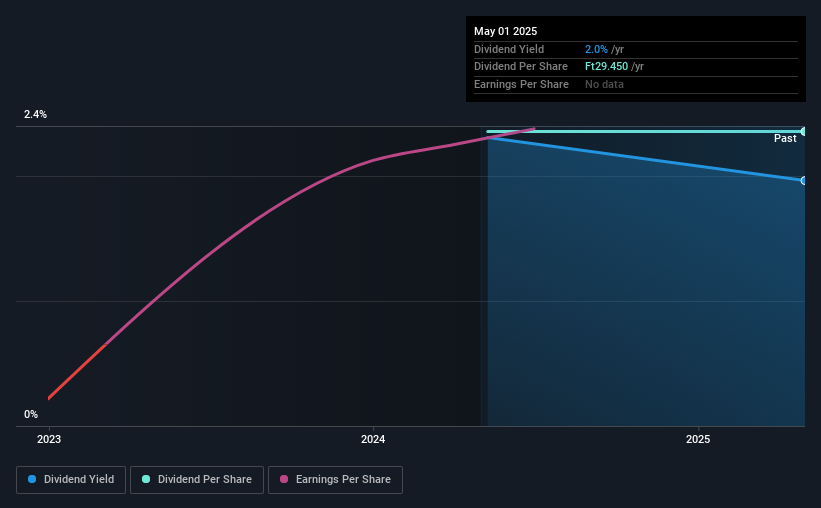

Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság (BUSE:EPROLIUSIA) has announced that it will be increasing its periodic dividend on the 15th of May to HUF70.00, which will be 138% higher than last year's comparable payment amount of HUF29.45. Even though the dividend went up, the yield is still quite low at only 2.0%.

We've discovered 6 warning signs about Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság. View them for free.Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság's Payment Could Potentially Have Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. However, Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 494.2% over the next year if recent trends continue. If the dividend extends its recent trend, estimates say the dividend could reach 35%, which is in a pretty sustainable range.

View our latest analysis for Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság

Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság has grown its EPS by 494% over the past 12 months. It's nice to see earnings per share rising, but one year is too short a period to get excited about. Were this trend to continue, we'd be interested. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

We Really Like Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság's Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság has 6 warning signs (and 2 which shouldn't be ignored) we think you should know about. Is Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:EPROLIUSIA

Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság

Eprolius Ingatlan Nyilvánosan Muködo Részvénytársaság purchases, owns, operates, and leases industrial, retail, and logistics commercial real estate properties in Hungary.

Moderate risk second-rate dividend payer.

Market Insights

Community Narratives