- Hungary

- /

- Real Estate

- /

- BUSE:DUNAHOUSE

Duna House Holding Nyrt. (BUSE:DUNAHOUSE) Stocks Shoot Up 38% But Its P/E Still Looks Reasonable

Despite an already strong run, Duna House Holding Nyrt. (BUSE:DUNAHOUSE) shares have been powering on, with a gain of 38% in the last thirty days. The last 30 days bring the annual gain to a very sharp 99%.

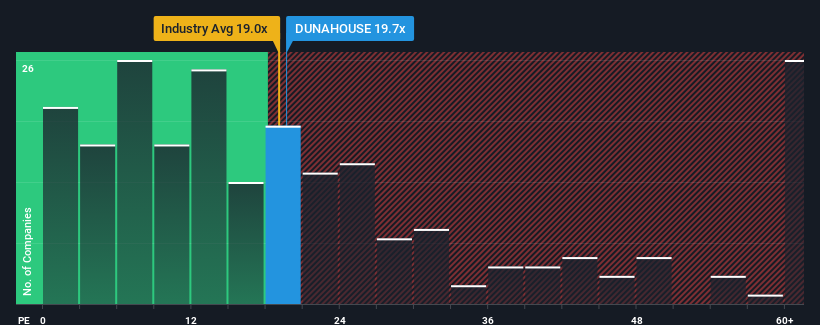

Since its price has surged higher, given close to half the companies in Hungary have price-to-earnings ratios (or "P/E's") below 10x, you may consider Duna House Holding Nyrt as a stock to avoid entirely with its 19.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Duna House Holding Nyrt over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Duna House Holding Nyrt

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Duna House Holding Nyrt's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. Still, the latest three year period has seen an excellent 87% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Duna House Holding Nyrt's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Duna House Holding Nyrt's P/E

Shares in Duna House Holding Nyrt have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Duna House Holding Nyrt maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Duna House Holding Nyrt (1 makes us a bit uncomfortable!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:DUNAHOUSE

Duna House Holding Nyrt

Provides real estate agency services to the real estate and financial services sectors in Hungary, Poland, the Czech Republic, and Italy.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives