Here's Why I Think Cakovecki mlinovi d.d (ZGSE:CKML) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Cakovecki mlinovi d.d (ZGSE:CKML). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Cakovecki mlinovi d.d

Cakovecki mlinovi d.d's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Cakovecki mlinovi d.d boosted its trailing twelve month EPS from Kn314 to Kn390, in the last year. That's a 24% gain; respectable growth in the broader scheme of things.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Cakovecki mlinovi d.d's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Cakovecki mlinovi d.d reported flat revenue and EBIT margins over the last year. That's not bad, but it doesn't point to ongoing future growth, either.

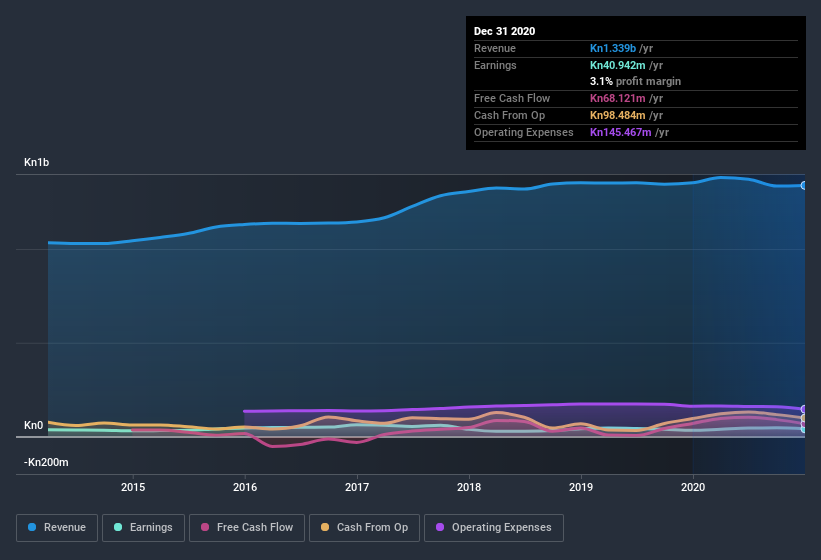

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Cakovecki mlinovi d.d isn't a huge company, given its market capitalization of Kn756m. That makes it extra important to check on its balance sheet strength.

Are Cakovecki mlinovi d.d Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Cakovecki mlinovi d.d insiders have a significant amount of capital invested in the stock. Indeed, they hold Kn264m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 35% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Cakovecki mlinovi d.d Deserve A Spot On Your Watchlist?

As I already mentioned, Cakovecki mlinovi d.d is a growing business, which is what I like to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Cakovecki mlinovi d.d that you need to be mindful of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Cakovecki mlinovi d.d, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ZGSE:CKML

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives