- Croatia

- /

- Oil and Gas

- /

- ZGSE:JNAF

Jadranski naftovod d.d.'s (ZGSE:JNAF) Shares May Have Run Too Fast Too Soon

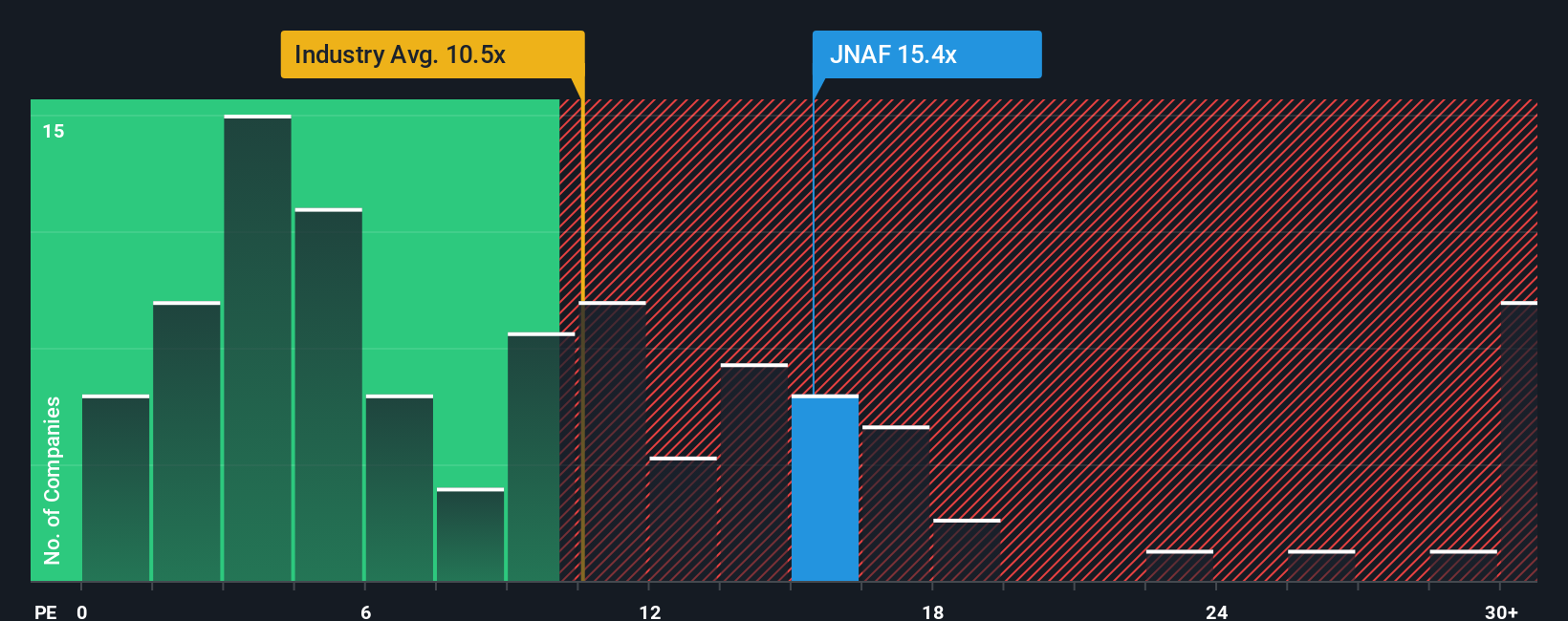

It's not a stretch to say that Jadranski naftovod d.d.'s (ZGSE:JNAF) price-to-earnings (or "P/E") ratio of 15.4x right now seems quite "middle-of-the-road" compared to the market in Croatia, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Jadranski naftovod d.d's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Jadranski naftovod d.d

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Jadranski naftovod d.d would need to produce growth that's similar to the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 48% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's curious that Jadranski naftovod d.d's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Jadranski naftovod d.d's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jadranski naftovod d.d revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Jadranski naftovod d.d (1 shouldn't be ignored) you should be aware of.

If you're unsure about the strength of Jadranski naftovod d.d's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:JNAF

Jadranski naftovod d.d

Engages in the transport and storage of oil and oil products in the Republic of Croatia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives