- Croatia

- /

- Hospitality

- /

- ZGSE:MAIS

The Maistra d.d (ZGSE:MAIS) Share Price Is Up 42% And Shareholders Are Holding On

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Maistra d.d share price has climbed 42% in five years, easily topping the market return of 3.5% (ignoring dividends).

See our latest analysis for Maistra d.d

Maistra d.d isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Maistra d.d saw its revenue grow at 3.7% per year. That's not a very high growth rate considering the bottom line. The modest growth is probably broadly reflected in the share price, which is up 7%, per year over 5 years. The business could be one worth watching but we generally prefer faster revenue growth.

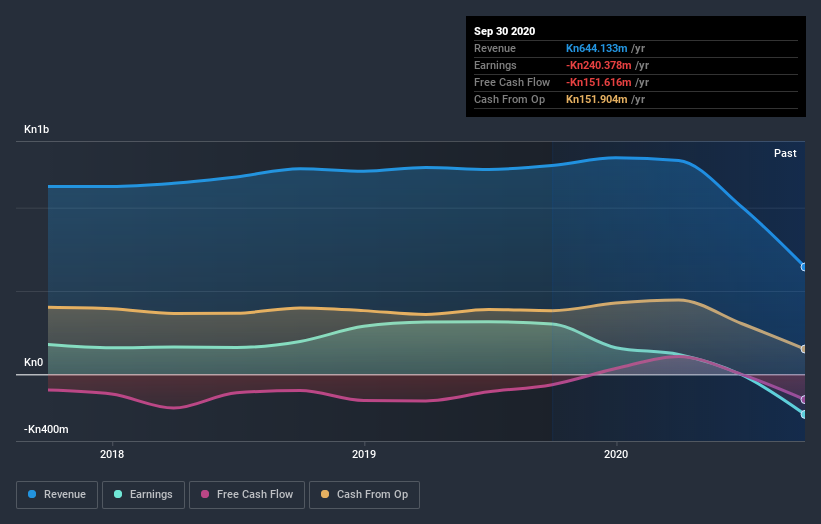

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Maistra d.d's financial health with this free report on its balance sheet.

A Different Perspective

Although it hurts that Maistra d.d returned a loss of 3.3% in the last twelve months, the broader market was actually worse, returning a loss of 4.6%. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Maistra d.d that you should be aware of before investing here.

But note: Maistra d.d may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HR exchanges.

If you decide to trade Maistra d.d, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ZGSE:MAIS

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives