- Croatia

- /

- Auto Components

- /

- ZGSE:ADPL

AD Plastik d.d. (ZGSE:ADPL) Analysts Just Trimmed Their Revenue Forecasts By 17%

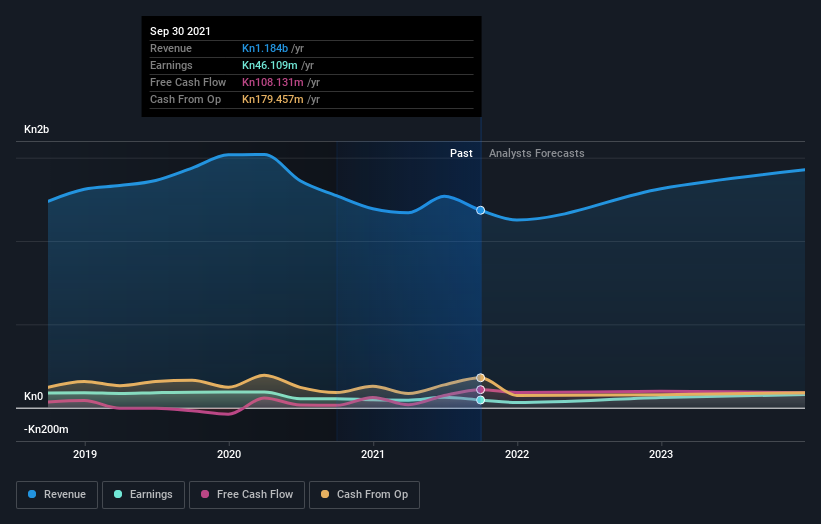

One thing we could say about the analysts on AD Plastik d.d. (ZGSE:ADPL) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the downgrade, the consensus from dual analysts covering AD Plastik d.d is for revenues of Kn1.1b in 2021, implying a discernible 4.9% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of Kn1.4b in 2021. It looks like forecasts have become a fair bit less optimistic on AD Plastik d.d, given the substantial drop in revenue estimates.

View our latest analysis for AD Plastik d.d

There was no particular change to the consensus price target of Kn195, with AD Plastik d.d's latest outlook seemingly not enough to result in a change of valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on AD Plastik d.d, with the most bullish analyst valuing it at Kn215 and the most bearish at Kn176 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 4.9% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 6.5% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 7.3% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - AD Plastik d.d is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for AD Plastik d.d this year. They're also anticipating slower revenue growth than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of AD Plastik d.d going forwards.

In light of the downgrade, our automated discounted cash flow valuation tool suggests that AD Plastik d.d could now be moderately overvalued. Find out why, and see how we estimate the valuation for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ZGSE:ADPL

AD Plastik d.d

Develops, produces, and sells interior and exterior automotive components in Slovenia, Romania, Russia, France, Hungary, Italy, the United Kingdom, Germany, Spain, Serbia, Czech Republic, Vietnam, Slovakia, Croatia, Poland, the United States, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives