- Hong Kong

- /

- Auto Components

- /

- SEHK:1899

SEHK Dividend Stocks Featuring Xingda International Holdings And 2 Other Top Picks

Reviewed by Simply Wall St

The Hong Kong market has recently seen a modest uptick, with the Hang Seng Index climbing 1.99%, reflecting cautious optimism despite weaker-than-expected economic activity in China. In this context, dividend stocks remain an attractive option for investors seeking stable returns amidst market volatility. When evaluating dividend stocks, it's crucial to consider not only the yield but also the company's ability to sustain its payouts in varying economic conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.52% | ★★★★★☆ |

| Lenovo Group (SEHK:992) | 3.96% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.65% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.91% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.11% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.16% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 7.20% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 8.63% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.21% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.09% | ★★★★★☆ |

Click here to see the full list of 82 stocks from our Top SEHK Dividend Stocks screener.

We'll examine a selection from our screener results.

Xingda International Holdings (SEHK:1899)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xingda International Holdings Limited, with a market cap of HK$2.49 billion, manufactures and trades in radial tire cords, bead wires, and other wires across various international markets including China, India, the United States, Thailand, Korea, Slovakia, and Brazil.

Operations: Xingda International Holdings Limited generates CN¥11.49 billion in revenue from its radial tire cords, bead wires, and other wire products across multiple global markets.

Dividend Yield: 9.9%

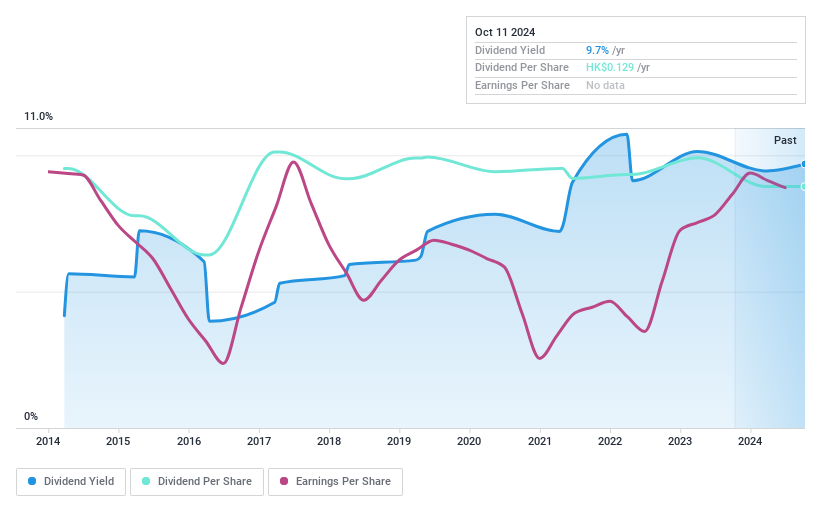

Xingda International Holdings offers a high dividend yield of 9.91%, placing it in the top 25% of dividend payers in Hong Kong. Despite recent executive changes, including Mr. Wang's appointment as CFO and chairman of key committees, the company's dividends are well-covered by both earnings (43.6% payout ratio) and cash flows (55.3%). However, its dividends have been unreliable over the past decade and were recently decreased to HK$0.13 per share for 2023, reflecting some instability in payouts despite strong financial coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Xingda International Holdings.

- According our valuation report, there's an indication that Xingda International Holdings' share price might be on the cheaper side.

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People’s Republic of China and Hong Kong with a market cap of HK$6.22 billion.

Operations: China Shineway Pharmaceutical Group Limited generates CN¥4.52 billion from its Chinese Pharmaceutical Products segment.

Dividend Yield: 7.0%

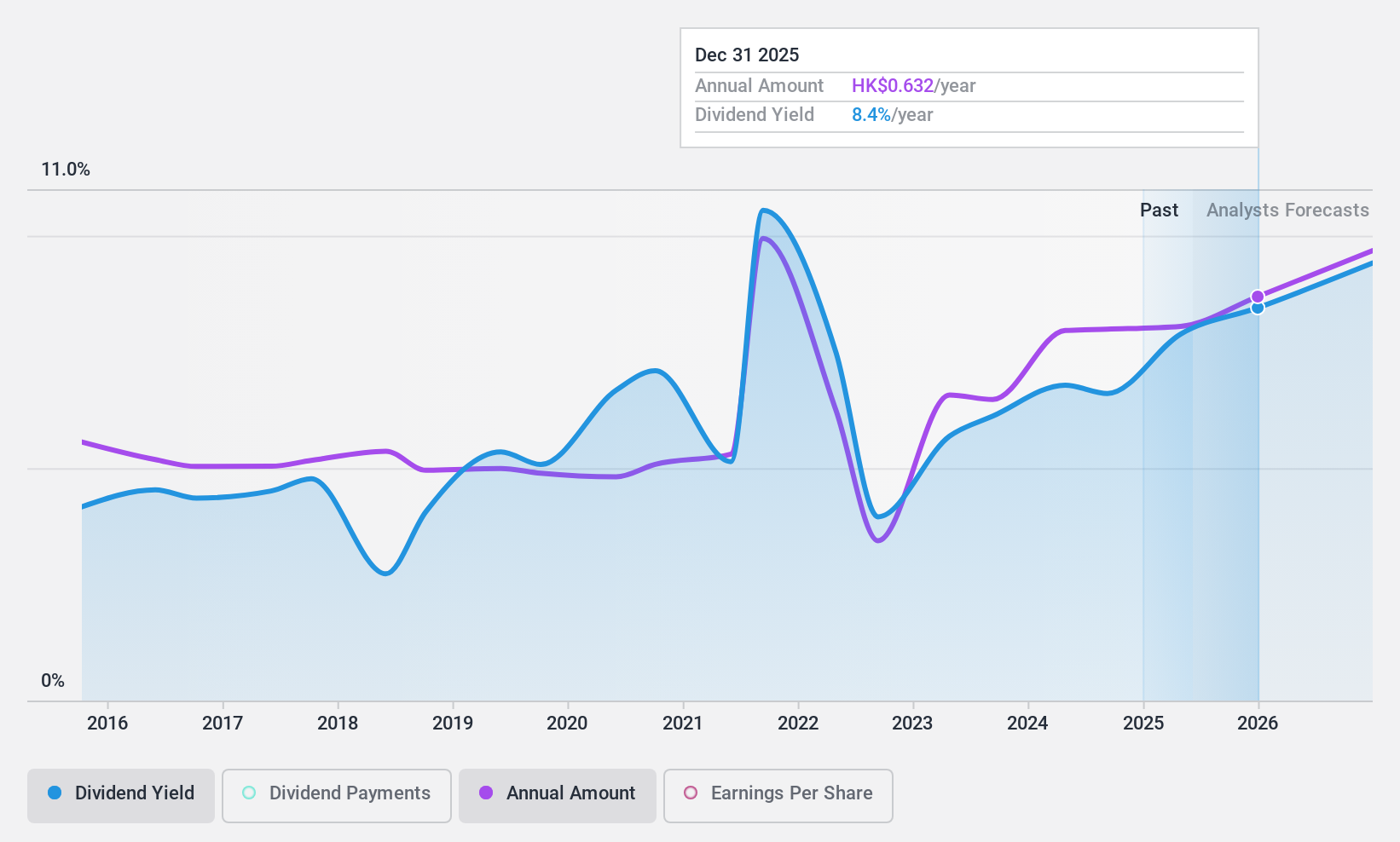

China Shineway Pharmaceutical Group, trading at 77.4% below its estimated fair value, has seen earnings grow by 34.1% over the past year and forecasts suggest a 13.04% annual growth rate. Despite this, the company's dividend payments have been volatile over the past decade and remain low compared to top-tier payers in Hong Kong. However, dividends are well-covered by both earnings (32.7% payout ratio) and cash flows (50.8%), indicating sustainability despite historical unreliability.

- Unlock comprehensive insights into our analysis of China Shineway Pharmaceutical Group stock in this dividend report.

- Our valuation report unveils the possibility China Shineway Pharmaceutical Group's shares may be trading at a discount.

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianjin Development Holdings Limited, with a market cap of HK$1.92 billion, supplies water, heat, thermal power, and electricity to various sectors in the Tianjin Economic and Technological Development Area in China through its subsidiaries.

Operations: Tianjin Development Holdings Limited generates revenue from four main segments: HK$1.60 billion from Utilities, HK$1.44 billion from Pharmaceuticals, HK$166.77 million from Electrical and Mechanical services, and HK$130.38 million from its Hotel operations.

Dividend Yield: 6.8%

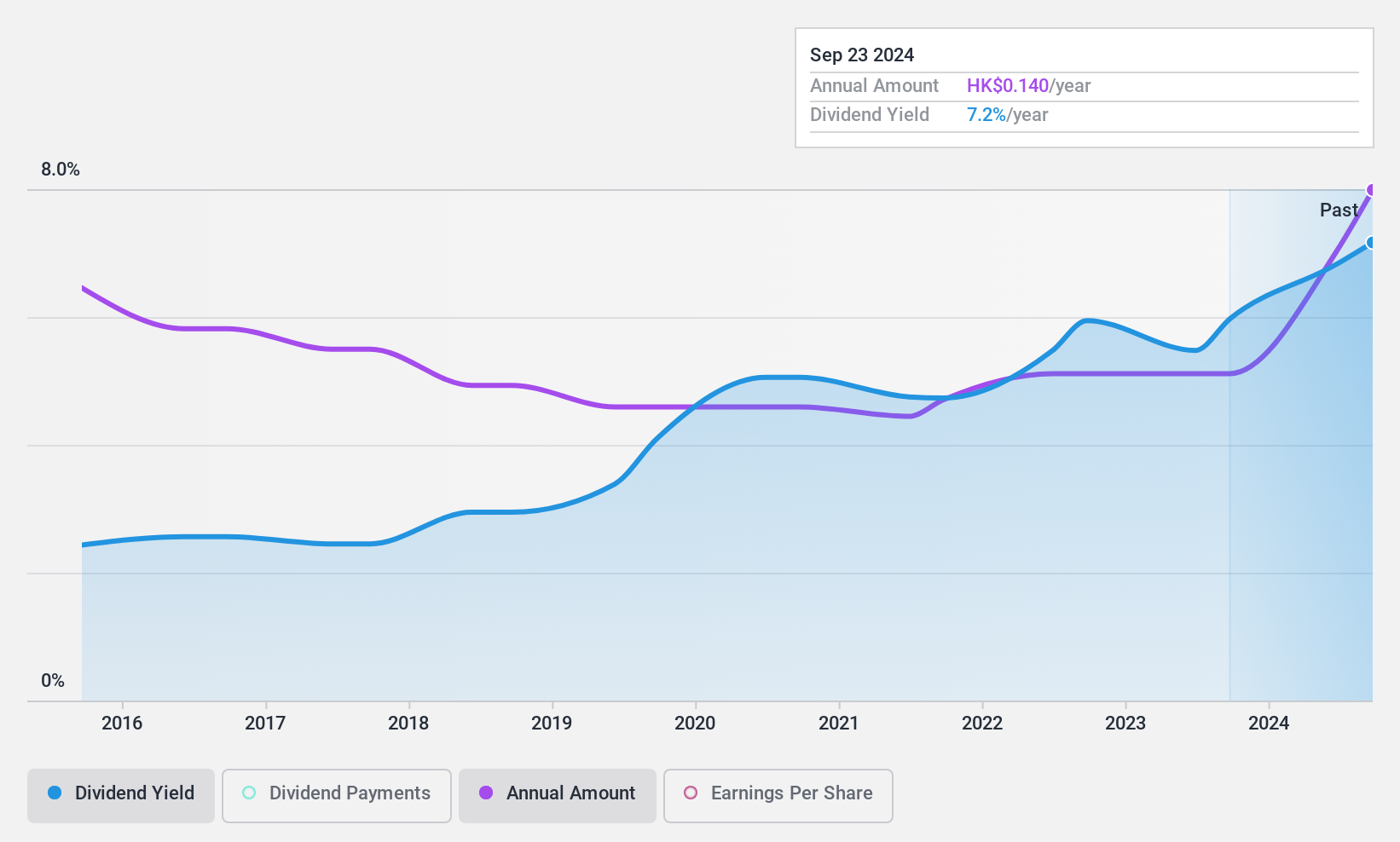

Tianjin Development Holdings declared a final dividend of HK$0.088 per share in June 2024, reflecting its stable and growing dividend payments over the past decade. Despite earnings growth of 77.5% last year and a low payout ratio of 20.7%, the dividend yield of 6.84% is below Hong Kong’s top-tier payers, and dividends are not covered by free cash flows, raising concerns about long-term sustainability despite recent bylaw changes aimed at improving governance.

- Take a closer look at Tianjin Development Holdings' potential here in our dividend report.

- The valuation report we've compiled suggests that Tianjin Development Holdings' current price could be quite moderate.

Summing It All Up

- Investigate our full lineup of 82 Top SEHK Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1899

Xingda International Holdings

An investment holding company, manufactures and trades in radial tire cords, bead wires, and other wires in the People's Republic of China, India, the United States, Thailand, Korea, Slovakia, Brazil, and internationally.

Solid track record, good value and pays a dividend.