- Hong Kong

- /

- Renewable Energy

- /

- SEHK:8326

Tonking New Energy Group Holdings (HKG:8326) Is Making Moderate Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Tonking New Energy Group Holdings Limited (HKG:8326) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Tonking New Energy Group Holdings

How Much Debt Does Tonking New Energy Group Holdings Carry?

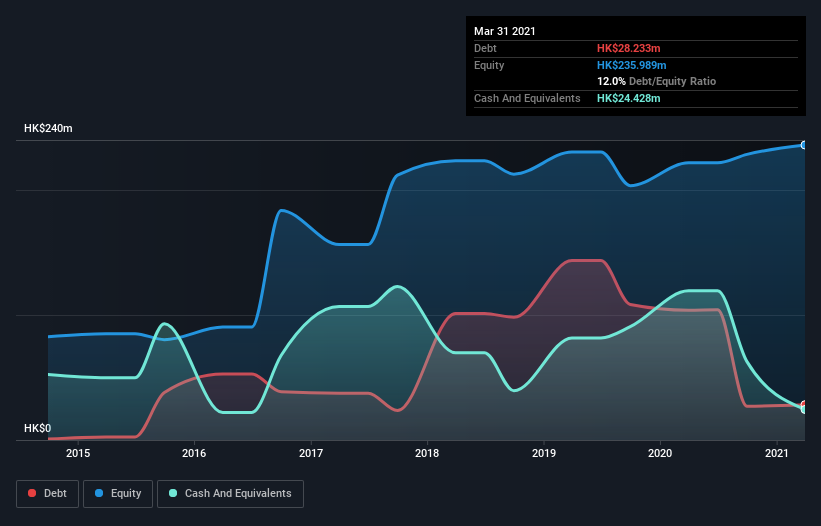

The image below, which you can click on for greater detail, shows that Tonking New Energy Group Holdings had debt of HK$28.1m at the end of March 2021, a reduction from HK$103.9m over a year. On the flip side, it has HK$24.4m in cash leading to net debt of about HK$3.68m.

A Look At Tonking New Energy Group Holdings' Liabilities

According to the balance sheet data, Tonking New Energy Group Holdings had liabilities of HK$145.9m due within 12 months, but no longer term liabilities. Offsetting this, it had HK$24.4m in cash and HK$247.8m in receivables that were due within 12 months. So it actually has HK$126.3m more liquid assets than total liabilities.

This surplus liquidity suggests that Tonking New Energy Group Holdings' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tonking New Energy Group Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Tonking New Energy Group Holdings made a loss at the EBIT level, and saw its revenue drop to HK$191m, which is a fall of 34%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Tonking New Energy Group Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost HK$11m at the EBIT level. That said, we're impressed with the strong balance sheet liquidity. That should give the business time to grow its cashflow. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Tonking New Energy Group Holdings (of which 1 is a bit concerning!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tonking New Energy Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8326

Tonking New Energy Group Holdings

An investment holding company, engages in the renewable energy business in the People’s Republic of China.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026