- Hong Kong

- /

- Gas Utilities

- /

- SEHK:603

Further weakness as China Oil And Gas Group (HKG:603) drops 11% this week, taking five-year losses to 39%

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in China Oil And Gas Group Limited (HKG:603), since the last five years saw the share price fall 40%. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days. However, we note the price may have been impacted by the broader market, which is down 23% in the same time period.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for China Oil And Gas Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

China Oil And Gas Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

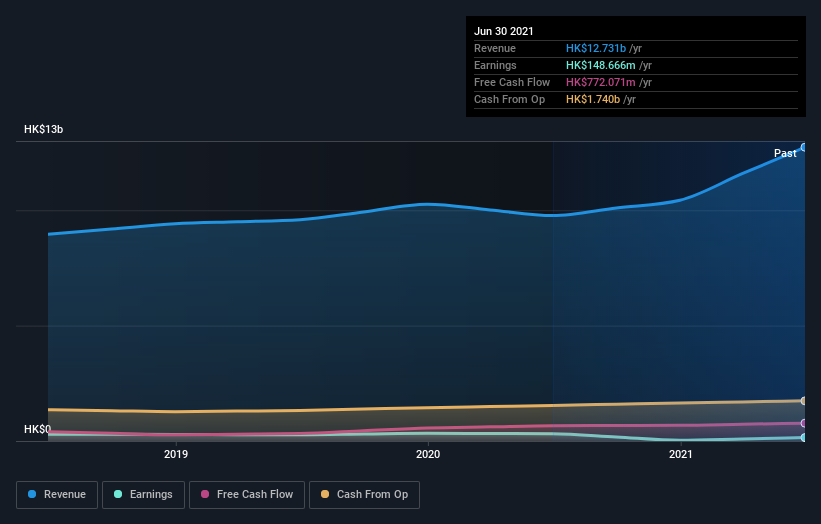

In contrast to the share price, revenue has actually increased by 12% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at China Oil And Gas Group's financial health with this free report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, China Oil And Gas Group shareholders can take comfort that their trailing twelve month loss of 2.6% wasn't as bad as the market loss of around 31%. What is more upsetting is the 7% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. It's always interesting to track share price performance over the longer term. But to understand China Oil And Gas Group better, we need to consider many other factors. Take risks, for example - China Oil And Gas Group has 3 warning signs (and 1 which is concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:603

China Oil And Gas Group

An investment holding company, engages in the natural gas and energy-related businesses in Hong Kong, Mainland China, and Canada.

Good value with mediocre balance sheet.

Market Insights

Community Narratives