- Hong Kong

- /

- Electric Utilities

- /

- SEHK:6

How Should Investors View Power Assets Holdings After Latest Earnings Reveal for 2025?

Reviewed by Simply Wall St

Trying to decide what to do with Power Assets Holdings stock? You are definitely not alone. This is a company that tends to spark debate among investors, especially after its recent share price behavior. Over the last year, the stock is up a modest 1.0%. When you take a step back and look at the bigger picture, Power Assets Holdings has delivered an impressive 41.1% return over three years and a strong 63.4% over five years. In contrast, its most recent performance shows the stock dipped 0.3% in the past week and 0.6% over the last month. This suggests there is something interesting going on beneath the surface.

Market watchers have been keeping an eye on global infrastructure demand and shifting regulatory landscapes, both of which continue to shape investor sentiment around Power Assets Holdings. Recent moves appear to reflect broader views of the sector’s long-term resilience and income potential rather than company-specific news. Investors weighing the current risk-reward balance may notice that the company’s value score is 0, indicating it is not currently identified as undervalued by any of the six major valuation checks.

Of course, valuation is never just about a single number or metric. In the next section, we will break down how these different valuation approaches size up the stock. Stay tuned until the end, where I will introduce an even more insightful and practical way to judge if Power Assets Holdings is fairly priced for your portfolio.

Power Assets Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Power Assets Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to today’s value. This helps investors gauge what a business is really worth, independent of market sentiment or short-term price swings.

For Power Assets Holdings, the most recent twelve months' free cash flow stood at HK$876 million. Looking forward, analysts expect an annual free cash flow of HK$552 million in 2026 and HK$449 million in 2027. Beyond this, projections are extrapolated by Simply Wall St, with estimates showing free cash flow gradually decreasing and ranging between around HK$385 million and HK$232 million by 2035.

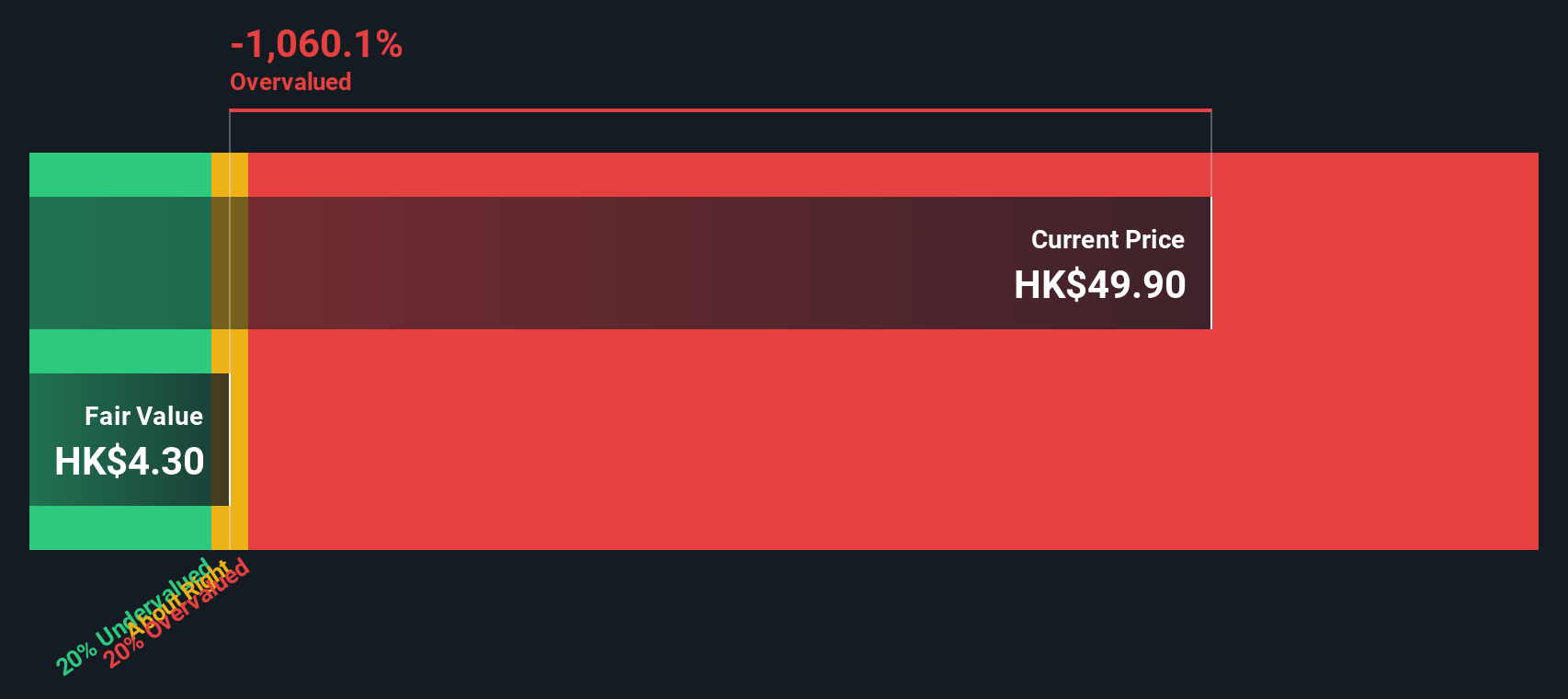

After running these figures through the 2 Stage Free Cash Flow to Equity model, the DCF analysis estimates an intrinsic value per share of HK$4.30. Compared to today’s share price, this suggests the stock is trading at a significant premium, with a calculated discount of -1089.2%. In simple terms, the DCF model sees Power Assets Holdings as substantially overvalued at present.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Power Assets Holdings.

Approach 2: Power Assets Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for companies that are consistently profitable, as it provides a direct snapshot of how much investors are willing to pay per dollar of earnings. It is particularly relevant for established, dividend-paying firms like Power Assets Holdings, where earnings tend to be stable and recurring.

What counts as a “fair” PE ratio can vary widely depending on growth expectations and risk. Faster-growing and less risky companies often justify higher PE ratios, while slower-growing businesses or those facing uncertainties tend to trade at lower multiples. For context, Power Assets Holdings currently trades at a PE ratio of 17.7x. This is higher than both its peer average of 13.6x and the broader Electric Utilities industry average of 14.6x. This suggests that the market may be assigning a premium to the stock.

To go a step further, Simply Wall St calculates a proprietary "Fair Ratio" for Power Assets Holdings, which is currently 9.7x. Unlike simple comparisons to peers or industry averages, the Fair Ratio attempts to reflect the company’s true valuation by taking into account its unique mix of earnings growth, profit margins, market cap, and sector-specific risks. This makes it a more comprehensive tool for investors trying to decide if the stock is appropriately priced.

With Power Assets Holdings’ PE multiple standing well above its Fair Ratio, this metric suggests the stock is overvalued on an earnings basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Power Assets Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized story or thesis about a company, combining your perspective with key financial forecasts such as assumed fair value, expected revenue, earnings, and profit margins. Narratives connect the dots between how you see Power Assets Holdings’ future potential, what numbers that expectation leads to, and the fair value calculation that results. This approach, available for free on Simply Wall St’s Community page and already used by millions of investors, makes forecasting both simple and approachable, even for beginners.

With Narratives, you get a clear and visual way to decide if now is the right time to buy or sell, as you can instantly compare the Fair Value derived from your story to the current market price. Narratives automatically update when new information, such as news or earnings releases, comes in, so you are always viewing the most up-to-date analysis. For Power Assets Holdings, one investor might build a narrative that sets a significantly higher fair value based on long-term infrastructure trends, while another may see a much lower fair value if concerned about declining cash flows and market risks. This demonstrates how Narratives reflect a diverse range of informed viewpoints and help guide confident investment decisions.

Do you think there's more to the story for Power Assets Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6

Power Assets Holdings

An investment holding company, engages in the generation, transmission, and distribution of electricity in Hong Kong, the United Kingdom, Australia, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives