- Hong Kong

- /

- Electric Utilities

- /

- SEHK:6

Assessing Power Assets Holdings (SEHK:6) Valuation After Recent Lull in Share Price Momentum

Reviewed by Simply Wall St

Price-to-Earnings of 17.5x: Is it justified?

Power Assets Holdings currently trades at a Price-to-Earnings (P/E) ratio of 17.5x, making it appear expensive compared to both its sector peers and the broader market. This raises questions about whether the current share price fully reflects the company's earnings potential relative to its industry.

The P/E ratio is a widely used metric that compares a company's share price to its earnings per share. For utilities like Power Assets Holdings, this multiple helps investors judge whether the market is paying a premium for steady, predictable profits or if expectations for future growth are included in the price.

Compared to the Asian Electric Utilities industry average of 16.7x and a peer group average of 13.4x, Power Assets' higher multiple suggests the market may be overvaluing its future growth and earnings stability. However, the company’s earnings growth has recently lagged behind both the market and its industry peers, casting doubt on whether such a premium is warranted at this time.

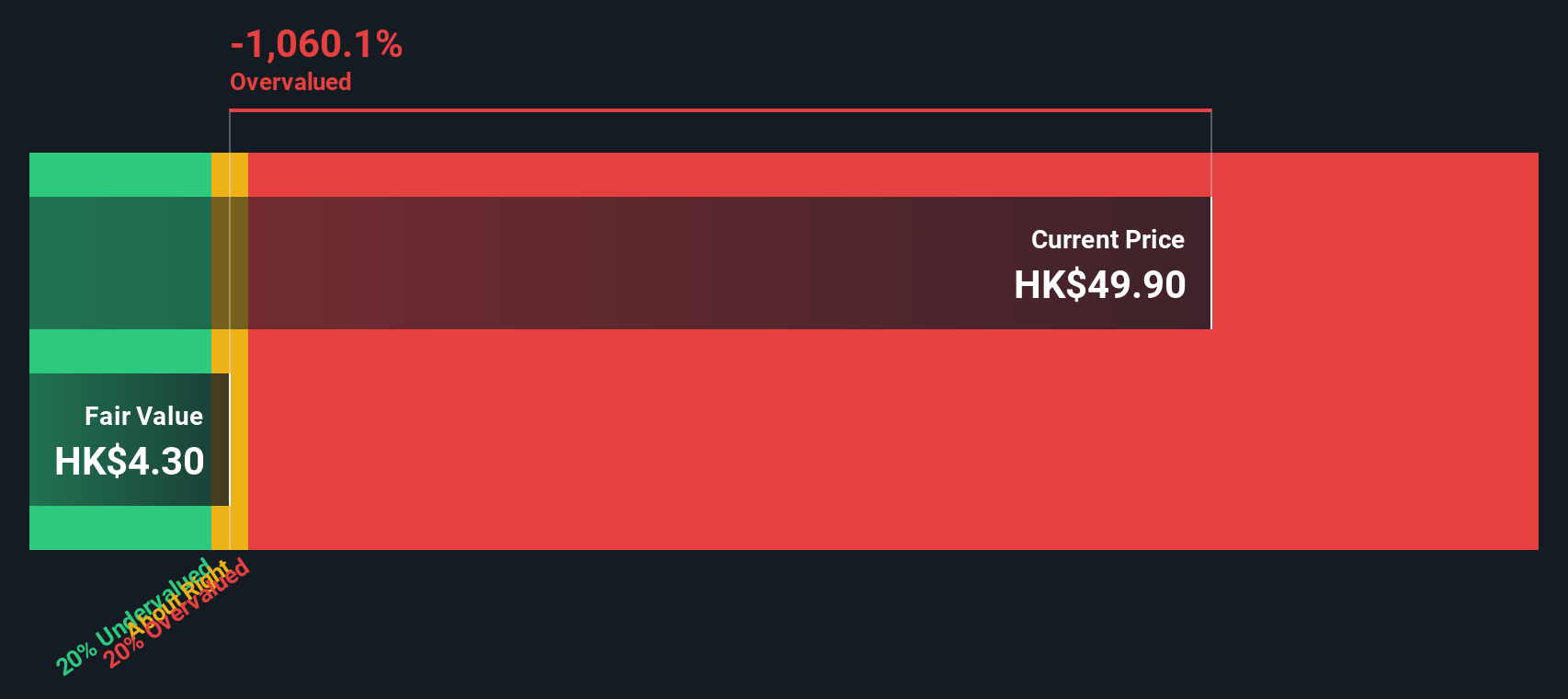

Result: Fair Value of $4.3 (OVERVALUED)

See our latest analysis for Power Assets Holdings.However, any unexpected shifts in regulatory policy or a slowdown in revenue growth could quickly change the company’s valuation outlook and investor sentiment.

Find out about the key risks to this Power Assets Holdings narrative.Another View: SWS DCF Model Perspective

Looking at Power Assets Holdings through our SWS DCF model provides a different lens compared to focusing on earnings multiples. This approach also suggests the stock is overvalued, despite what the market may be pricing in. Could the current share price be missing something deeper, or is it just market optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Power Assets Holdings Narrative

If this perspective does not align with your own analysis, or if you prefer to dig into the numbers yourself, you can construct your own narrative in just a few minutes. Do it your way.

A great starting point for your Power Assets Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for Smarter Investment Ideas?

Don’t let great opportunities slip by while you focus on a single stock. Expand your research to fresh, compelling investment themes using the tools below.

- Seize rare chances in emerging tech with quantum computing stocks, powering the evolution of quantum innovation, high-speed computing, and next-level breakthroughs.

- Boost your portfolio’s income by targeting companies offering stable and generous payouts. Explore dividend stocks with yields > 3% designed for high-yield potential.

- Spot market mispricings quickly by tapping into undervalued stocks based on cash flows to pinpoint stocks trading below their intrinsic worth and maximize tomorrow’s upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6

Power Assets Holdings

An investment holding company, engages in the generation, transmission, and distribution of electricity in Hong Kong, the United Kingdom, Australia, and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives