Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Beijing Jingneng Clean Energy Co., Limited (HKG:579) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Beijing Jingneng Clean Energy

How Much Debt Does Beijing Jingneng Clean Energy Carry?

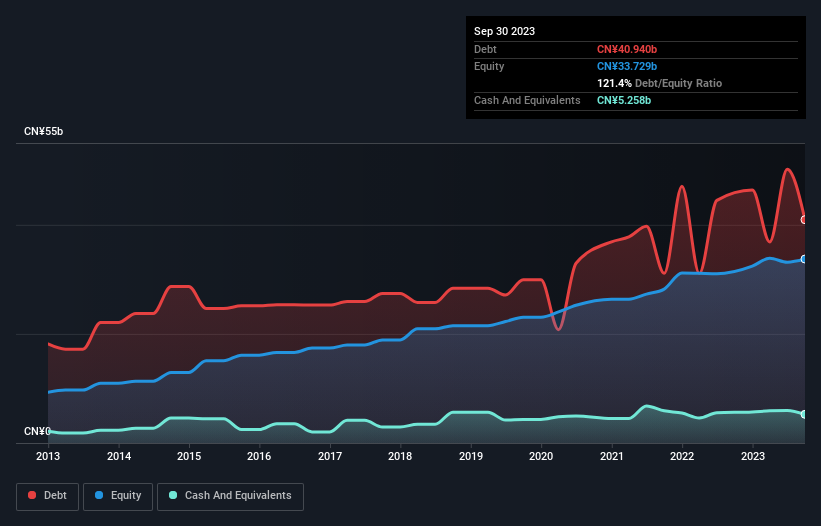

As you can see below, Beijing Jingneng Clean Energy had CN¥40.9b of debt at September 2023, down from CN¥46.4b a year prior. However, it does have CN¥5.26b in cash offsetting this, leading to net debt of about CN¥35.7b.

How Healthy Is Beijing Jingneng Clean Energy's Balance Sheet?

The latest balance sheet data shows that Beijing Jingneng Clean Energy had liabilities of CN¥21.6b due within a year, and liabilities of CN¥37.1b falling due after that. Offsetting this, it had CN¥5.26b in cash and CN¥13.5b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥39.9b.

This deficit casts a shadow over the CN¥12.4b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Beijing Jingneng Clean Energy would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Beijing Jingneng Clean Energy's debt is 3.9 times its EBITDA, and its EBIT cover its interest expense 3.9 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Another concern for investors might be that Beijing Jingneng Clean Energy's EBIT fell 11% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Beijing Jingneng Clean Energy's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Beijing Jingneng Clean Energy saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Beijing Jingneng Clean Energy's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its net debt to EBITDA also fails to instill confidence. Taking into account all the aforementioned factors, it looks like Beijing Jingneng Clean Energy has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Beijing Jingneng Clean Energy .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingneng Clean Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:579

Beijing Jingneng Clean Energy

Generates gas-fired power and heat energy, wind power, photovoltaic power, and hydropower in Mainland China and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success