- Hong Kong

- /

- Renewable Energy

- /

- SEHK:579

Here's Why We Think Beijing Jingneng Clean Energy (HKG:579) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Beijing Jingneng Clean Energy (HKG:579), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Beijing Jingneng Clean Energy

How Fast Is Beijing Jingneng Clean Energy Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Beijing Jingneng Clean Energy has grown its trailing twelve month EPS from CN¥0.28 to CN¥0.30, in the last year. That amounts to a small improvement of 5.9%.

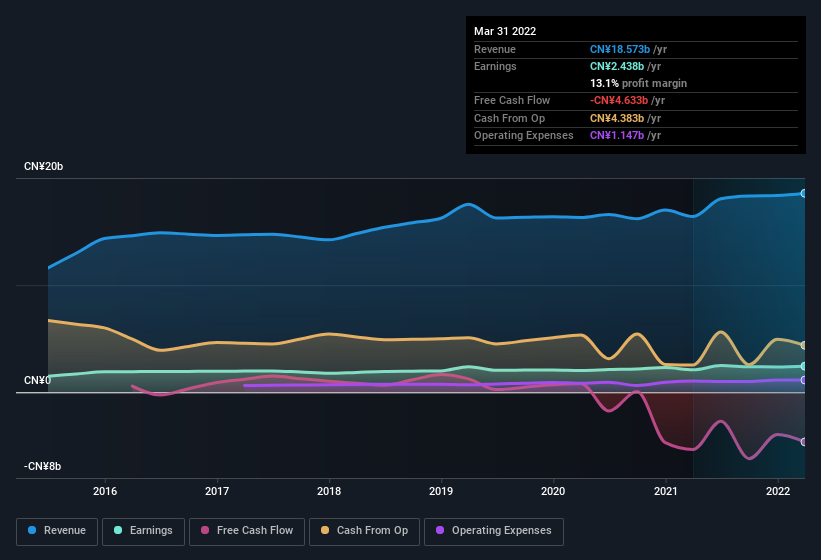

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Beijing Jingneng Clean Energy shareholders is that EBIT margins have grown from 22% to 25% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Beijing Jingneng Clean Energy's future EPS 100% free.

Are Beijing Jingneng Clean Energy Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Beijing Jingneng Clean Energy insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at CN¥311m. That's a lot of money, and no small incentive to work hard. Despite being just 2.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between CN¥6.8b and CN¥22b, like Beijing Jingneng Clean Energy, the median CEO pay is around CN¥4.0m.

The Beijing Jingneng Clean Energy CEO received total compensation of just CN¥947k in the year to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Beijing Jingneng Clean Energy Deserve A Spot On Your Watchlist?

One positive for Beijing Jingneng Clean Energy is that it is growing EPS. That's nice to see. The fact that EPS is growing is a genuine positive for Beijing Jingneng Clean Energy, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 3 warning signs for Beijing Jingneng Clean Energy you should be aware of, and 1 of them is a bit unpleasant.

Although Beijing Jingneng Clean Energy certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingneng Clean Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:579

Beijing Jingneng Clean Energy

Generates gas-fired power and heat energy, wind power, photovoltaic power, and hydropower in Mainland China and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success