- Hong Kong

- /

- Renewable Energy

- /

- SEHK:412

Shandong Hi-Speed Holdings Group Limited (HKG:412) Stocks Pounded By 54% But Not Lagging Industry On Growth Or Pricing

Unfortunately for some shareholders, the Shandong Hi-Speed Holdings Group Limited (HKG:412) share price has dived 54% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

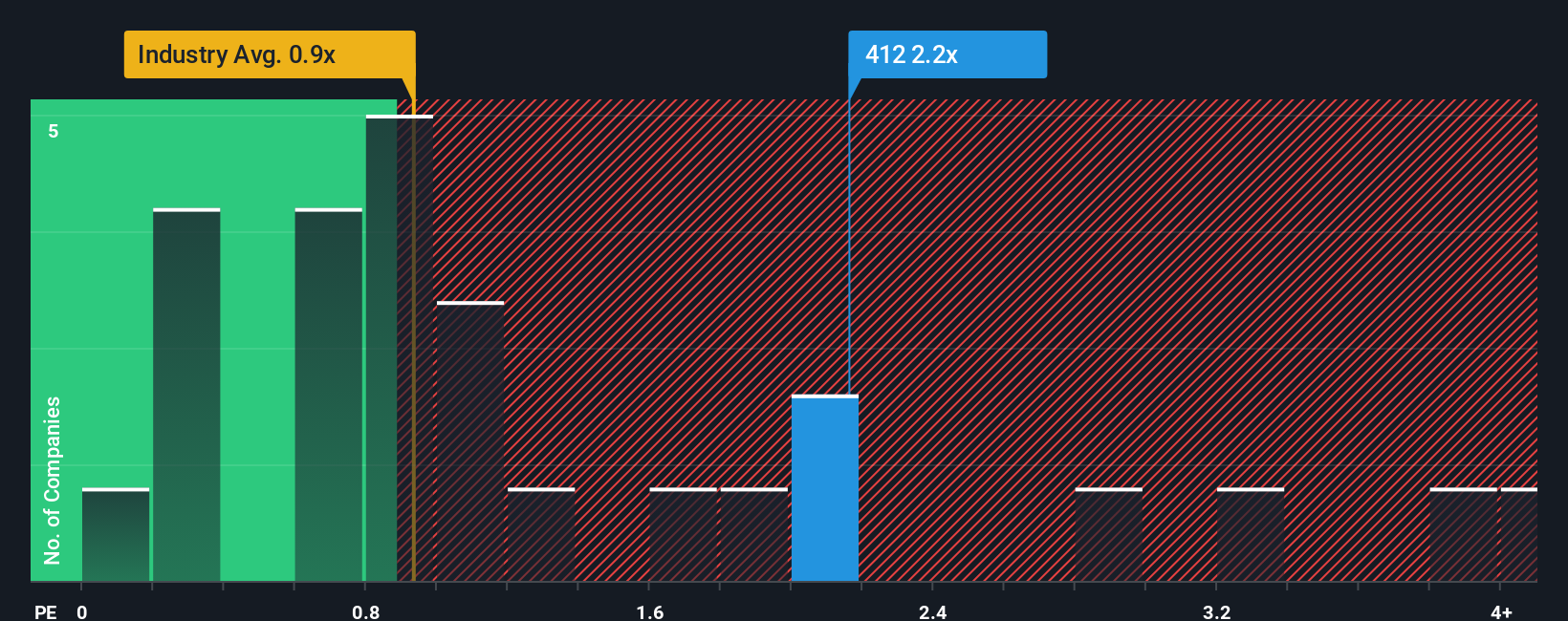

Even after such a large drop in price, when almost half of the companies in Hong Kong's Renewable Energy industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Shandong Hi-Speed Holdings Group as a stock probably not worth researching with its 2.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Shandong Hi-Speed Holdings Group

What Does Shandong Hi-Speed Holdings Group's P/S Mean For Shareholders?

Recent times have been pleasing for Shandong Hi-Speed Holdings Group as its revenue has risen in spite of the industry's average revenue going into reverse. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shandong Hi-Speed Holdings Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shandong Hi-Speed Holdings Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.7% last year. Pleasingly, revenue has also lifted 253% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.2%, which is noticeably less attractive.

With this information, we can see why Shandong Hi-Speed Holdings Group is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

There's still some elevation in Shandong Hi-Speed Holdings Group's P/S, even if the same can't be said for its share price recently. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Shandong Hi-Speed Holdings Group shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Shandong Hi-Speed Holdings Group (3 make us uncomfortable!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:412

Shandong Hi-Speed Holdings Group

An investment holding company, operates photovoltaic and wind power plants in the People’s Republic of China.

Slight risk with questionable track record.

Similar Companies

Market Insights

Community Narratives