Stock Analysis

- Hong Kong

- /

- Renewable Energy

- /

- SEHK:3868

I Built A List Of Growing Companies And Xinyi Energy Holdings (HKG:3868) Made The Cut

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Xinyi Energy Holdings (HKG:3868). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Xinyi Energy Holdings

How Fast Is Xinyi Energy Holdings Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Xinyi Energy Holdings has grown its trailing twelve month EPS from HK$0.14 to HK$0.16, in the last year. That amounts to a small improvement of 9.2%.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While Xinyi Energy Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

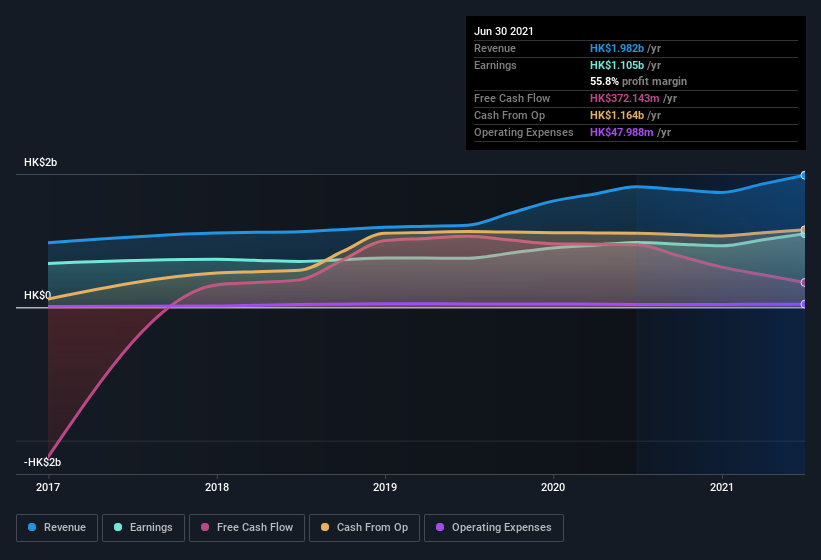

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Xinyi Energy Holdings?

Are Xinyi Energy Holdings Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Xinyi Energy Holdings insiders have a significant amount of capital invested in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at HK$7.6b. Coming in at 21% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Should You Add Xinyi Energy Holdings To Your Watchlist?

As I already mentioned, Xinyi Energy Holdings is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. It is worth noting though that we have found 3 warning signs for Xinyi Energy Holdings (1 is potentially serious!) that you need to take into consideration.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Xinyi Energy Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3868

Xinyi Energy Holdings

An investment holding company, owns, operates, and manages solar farms in the People's Republic of China.

Good value with moderate growth potential.