- Hong Kong

- /

- Water Utilities

- /

- SEHK:3768

Does Kunming Dianchi Water Treatment (HKG:3768) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Kunming Dianchi Water Treatment Co., Ltd. (HKG:3768) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

What Is Kunming Dianchi Water Treatment's Debt?

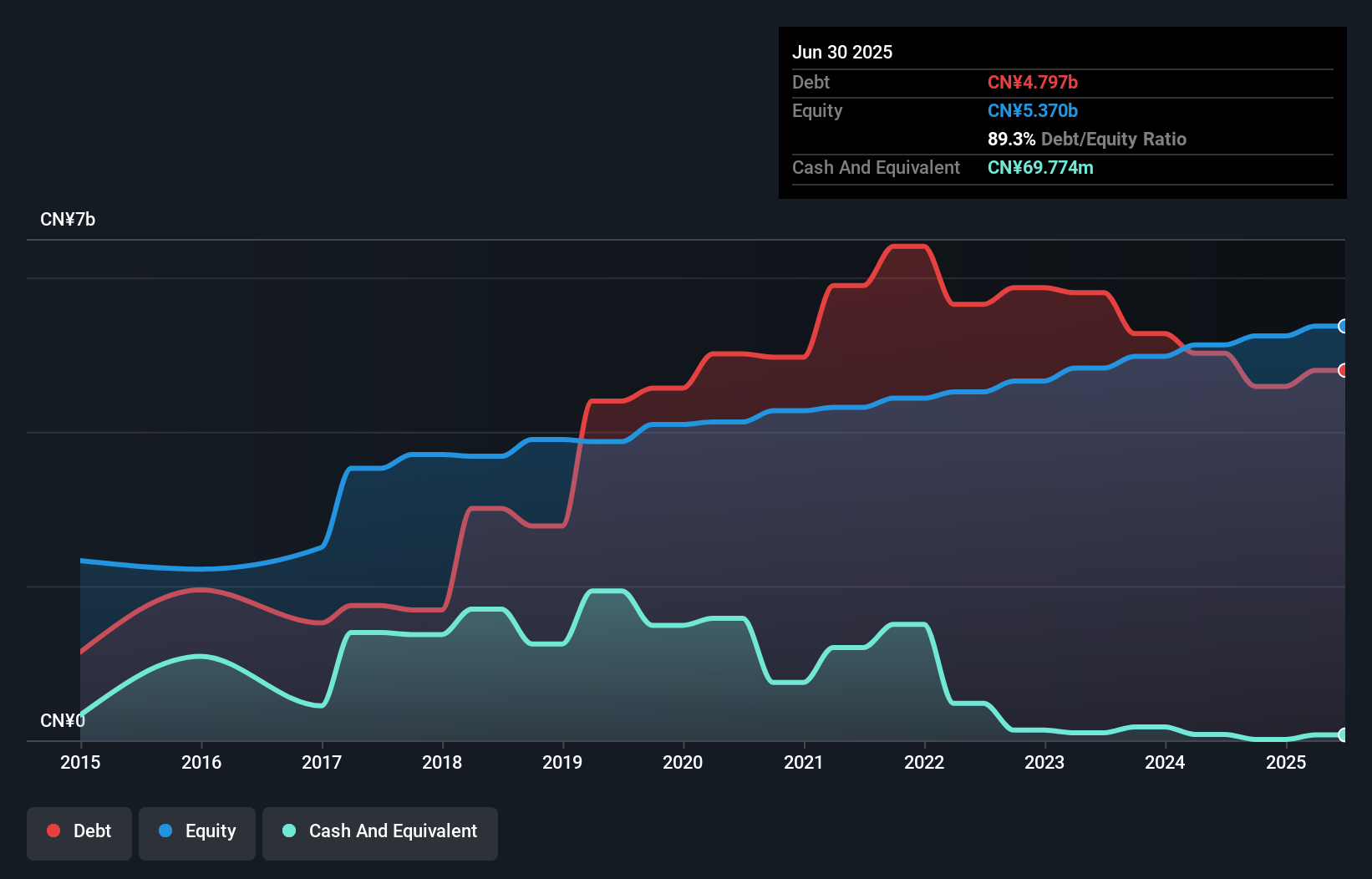

You can click the graphic below for the historical numbers, but it shows that Kunming Dianchi Water Treatment had CN¥4.80b of debt in June 2025, down from CN¥5.02b, one year before. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Kunming Dianchi Water Treatment's Balance Sheet?

According to the last reported balance sheet, Kunming Dianchi Water Treatment had liabilities of CN¥4.66b due within 12 months, and liabilities of CN¥2.78b due beyond 12 months. Offsetting these obligations, it had cash of CN¥69.8m as well as receivables valued at CN¥6.30b due within 12 months. So its liabilities total CN¥1.07b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of CN¥789.9m, we think shareholders really should watch Kunming Dianchi Water Treatment's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

See our latest analysis for Kunming Dianchi Water Treatment

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Kunming Dianchi Water Treatment has a rather high debt to EBITDA ratio of 6.1 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 2.6 times, suggesting it can responsibly service its obligations. Investors should also be troubled by the fact that Kunming Dianchi Water Treatment saw its EBIT drop by 11% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Kunming Dianchi Water Treatment will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Considering the last three years, Kunming Dianchi Water Treatment actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On the face of it, Kunming Dianchi Water Treatment's conversion of EBIT to free cash flow left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its interest cover also fails to instill confidence. It's also worth noting that Kunming Dianchi Water Treatment is in the Water Utilities industry, which is often considered to be quite defensive. Taking into account all the aforementioned factors, it looks like Kunming Dianchi Water Treatment has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Kunming Dianchi Water Treatment is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Kunming Dianchi Water Treatment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3768

Kunming Dianchi Water Treatment

Designs, develops, constructs, operates, and maintains water supply and wastewater treatment facilities in the People’s Republic of China.

Good value with mediocre balance sheet.

Market Insights

Community Narratives