- Hong Kong

- /

- Water Utilities

- /

- SEHK:371

Getting In Cheap On Beijing Enterprises Water Group Limited (HKG:371) Might Be Difficult

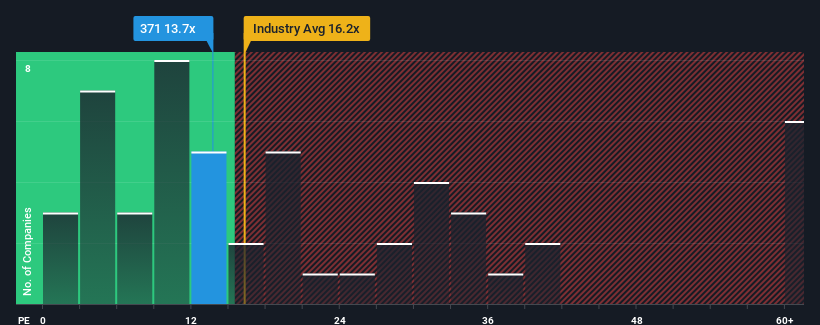

Beijing Enterprises Water Group Limited's (HKG:371) price-to-earnings (or "P/E") ratio of 13.7x might make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 6x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Beijing Enterprises Water Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Beijing Enterprises Water Group

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Beijing Enterprises Water Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. As a result, earnings from three years ago have also fallen 57% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the seven analysts following the company. With the market only predicted to deliver 12% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Beijing Enterprises Water Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Beijing Enterprises Water Group's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Beijing Enterprises Water Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Beijing Enterprises Water Group that we have uncovered.

If you're unsure about the strength of Beijing Enterprises Water Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Water Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:371

Beijing Enterprises Water Group

An investment holding company, provides water treatment services.

Second-rate dividend payer and slightly overvalued.

Market Insights

Community Narratives