- Hong Kong

- /

- Gas Utilities

- /

- SEHK:3633

Does Zhongyu Energy Holdings (HKG:3633) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Zhongyu Energy Holdings (HKG:3633), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Zhongyu Energy Holdings

How Fast Is Zhongyu Energy Holdings Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Zhongyu Energy Holdings has managed to grow EPS by 20% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

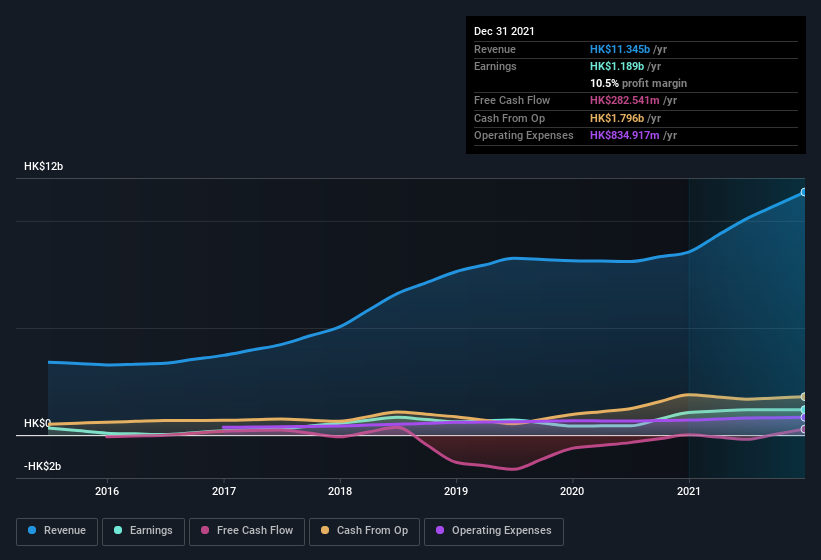

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the one hand, Zhongyu Energy Holdings' EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Zhongyu Energy Holdings' balance sheet strength, before getting too excited.

Are Zhongyu Energy Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold HK$49m worth of shares. But that's far less than the HK$1.3b insiders spent purchasing stock. This bodes well for Zhongyu Energy Holdings as it highlights the fact that those who are important to the company having a lot of faith in its future. Zooming in, we can see that the biggest insider purchase was by Vice Chairman Chi Shing Yiu for HK$1.1b worth of shares, at about HK$5.80 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Zhongyu Energy Holdings insiders own more than a third of the company. In fact, they own 36% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. HK$7.0b That level of investment from insiders is nothing to sneeze at.

Should You Add Zhongyu Energy Holdings To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Zhongyu Energy Holdings' strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. Astute investors will want to keep this stock on watch. However, before you get too excited we've discovered 2 warning signs for Zhongyu Energy Holdings (1 is potentially serious!) that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Zhongyu Energy Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zhongyu Energy Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3633

Zhongyu Energy Holdings

An investment holding company, engages in the development, construction, and operation of natural gas projects in the People’s Republic of China.

Low risk with poor track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026