Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that The Hong Kong and China Gas Company Limited (HKG:3) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hong Kong and China Gas

What Is Hong Kong and China Gas's Net Debt?

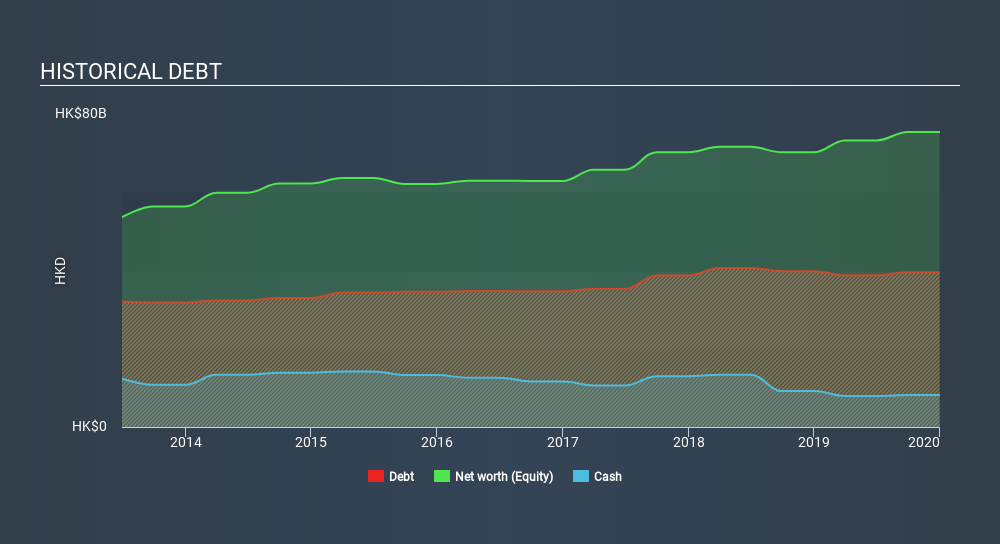

The chart below, which you can click on for greater detail, shows that Hong Kong and China Gas had HK$39.6b in debt in December 2019; about the same as the year before. However, it also had HK$8.20b in cash, and so its net debt is HK$31.4b.

How Strong Is Hong Kong and China Gas's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hong Kong and China Gas had liabilities of HK$26.2b due within 12 months and liabilities of HK$38.9b due beyond that. On the other hand, it had cash of HK$8.20b and HK$7.83b worth of receivables due within a year. So its liabilities total HK$49.0b more than the combination of its cash and short-term receivables.

Hong Kong and China Gas has a very large market capitalization of HK$238.3b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Hong Kong and China Gas's debt is 3.0 times its EBITDA, and its EBIT cover its interest expense 6.5 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Sadly, Hong Kong and China Gas's EBIT actually dropped 4.3% in the last year. If that earnings trend continues then its debt load will grow heavy like the heart of a polar bear watching its sole cub. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hong Kong and China Gas can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, Hong Kong and China Gas recorded free cash flow of 22% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

While Hong Kong and China Gas's net debt to EBITDA makes us cautious about it, its track record of converting EBIT to free cash flow is no better. At least its interest cover gives us reason to be optimistic. It's also worth noting that Hong Kong and China Gas is in the Gas Utilities industry, which is often considered to be quite defensive. We think that Hong Kong and China Gas's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Hong Kong and China Gas is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:3

Hong Kong and China Gas

Produces, distributes, and markets gas, water supply and energy services in Hong Kong and Mainland China.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives