If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at Kong Sun Holdings (HKG:295) so let's look a bit deeper.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Kong Sun Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.05 = CN¥678m ÷ (CN¥16b - CN¥2.4b) (Based on the trailing twelve months to June 2020).

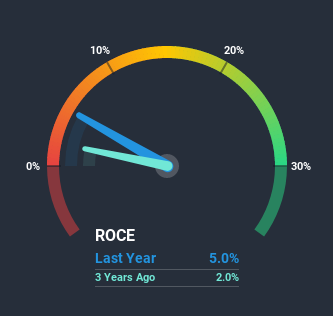

So, Kong Sun Holdings has an ROCE of 5.0%. In absolute terms, that's a low return and it also under-performs the Renewable Energy industry average of 7.5%.

See our latest analysis for Kong Sun Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Kong Sun Holdings has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

While in absolute terms it isn't a high ROCE, it's promising to see that it has been moving in the right direction. Over the last five years, returns on capital employed have risen substantially to 5.0%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 232%. So we're very much inspired by what we're seeing at Kong Sun Holdings thanks to its ability to profitably reinvest capital.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 15%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.The Bottom Line

All in all, it's terrific to see that Kong Sun Holdings is reaping the rewards from prior investments and is growing its capital base. Although the company may be facing some issues elsewhere since the stock has plunged 91% in the last five years. Regardless, we think the underlying fundamentals warrant this stock for further investigation.

If you'd like to know more about Kong Sun Holdings, we've spotted 3 warning signs, and 1 of them is a bit concerning.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Kong Sun Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kong Sun Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:295

Kong Sun Holdings

An investment holding company, invests in, operates, and maintains solar power plants in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026