- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Will Guangdong Investment's (SEHK:270) New HK$2.25 Billion Loan and Ownership Terms Shift Its Narrative?

Reviewed by Sasha Jovanovic

- On November 19, 2025, Guangdong Investment Limited announced it accepted a committed term loan facility of HK$2.25 billion from a bank to support general corporate funding and refinance existing debt, excluding real estate, toll road, and electric power plants.

- A key provision of the facility requires Guangdong Investment to maintain majority ownership by the Guangdong Provincial Government, potentially providing additional assurance around its ownership and financial stability.

- We’ll explore how this new loan facility and the reinforced government ownership requirements influence Guangdong Investment’s ongoing investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Guangdong Investment's Investment Narrative?

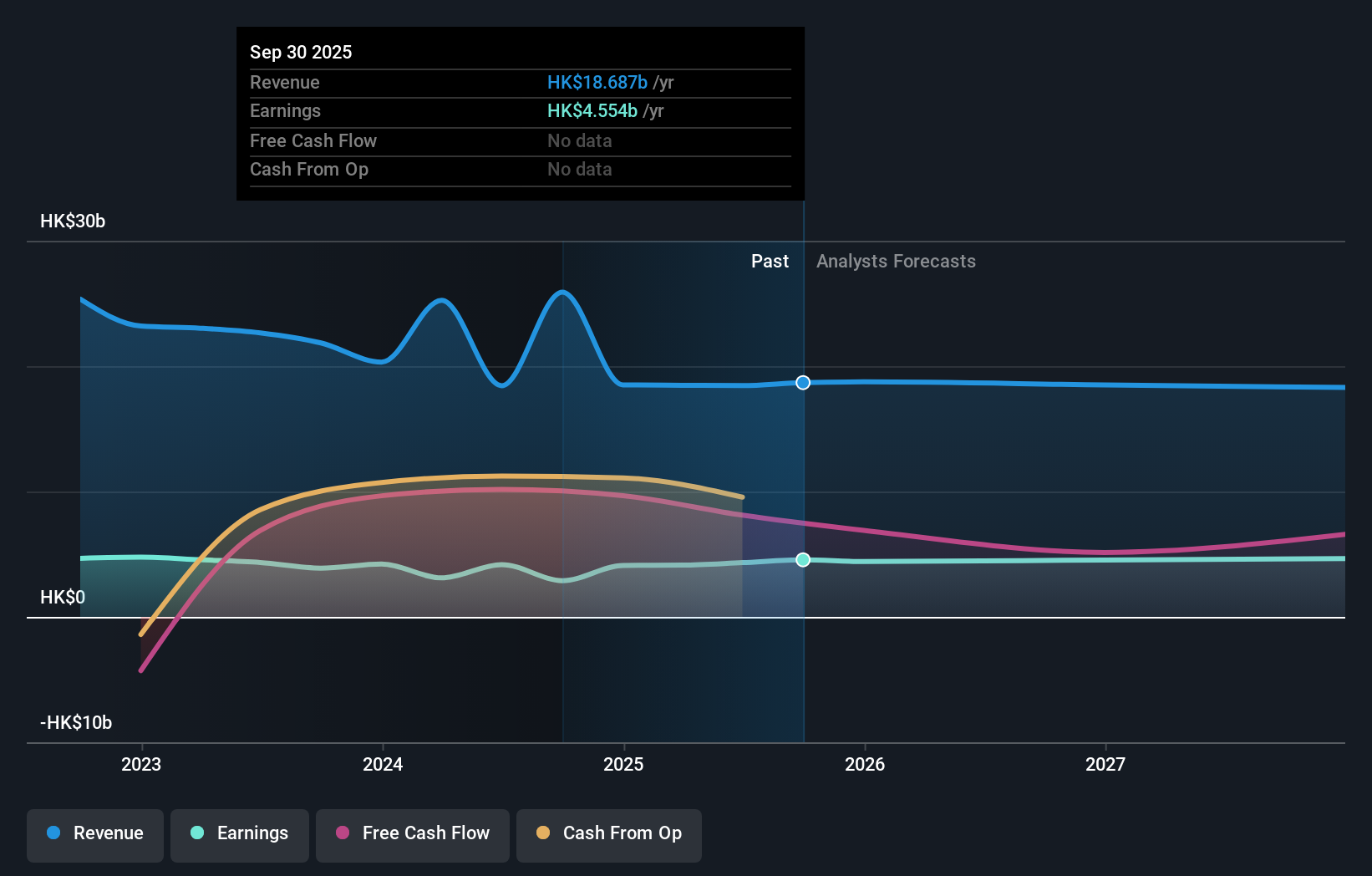

For those considering Guangdong Investment as a long-term holding, the investment story often centres on its stable roots in the water utilities sector, reliable government support, and steady, if unspectacular, financial performance. The recent acceptance of a HK$2.25 billion one-year term loan, now formally tying majority government ownership to debt conditions, may act as a short-term catalyst by underlining state backing at a time of management changes and dividend increases. This added credit assurance could temper concerns over refinancing and help navigate upcoming debt maturities, although it doesn't meaningfully shift the ongoing risk profile around revenue stagnation and limited long-term earnings growth. While recent results revealed improved earnings and higher dividends, the outlook for revenue remains muted and the management transition, alongside board turnover, leaves execution risk at the forefront. As such, the new financing supports near-term stability, but doesn't fundamentally alter the biggest questions around sluggish growth and governance continuity.

Yet, beneath these assurances, board turnover presents an important risk investors need to watch.

Exploring Other Perspectives

Explore another fair value estimate on Guangdong Investment - why the stock might be worth just HK$8.15!

Build Your Own Guangdong Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guangdong Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Guangdong Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guangdong Investment's overall financial health at a glance.

No Opportunity In Guangdong Investment?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026