- Hong Kong

- /

- Water Utilities

- /

- SEHK:270

Guangdong Investment (SEHK:270): Reviewing Valuation After Securing HKD 2.25 Billion Debt Facility

Reviewed by Simply Wall St

Guangdong Investment (SEHK:270) revealed acceptance of a HKD 2.25 billion committed term loan facility on 19 November 2025. The loan is aimed at funding general corporate needs and refinancing existing debt, subject to specific ownership-related covenants.

See our latest analysis for Guangdong Investment.

The new loan announcement comes as Guangdong Investment’s share price has steadily gained traction this year, climbing 14.8% year-to-date, with the latest move up to HK$7.59. Momentum has built notably after a strong one-year total shareholder return of 70.8%. This signals renewed investor confidence in the company’s direction as a result of improved funding flexibility.

If a company’s decisive financial maneuvers have you curious, this could be a timely moment to expand your outlook and discover fast growing stocks with high insider ownership

With shares rebounding strongly and a major debt facility secured, the key question now is whether Guangdong Investment’s stock is still trading below its true value, or if the market has already accounted for future growth prospects.

Price-to-Earnings of 10.9x: Is It Justified?

Guangdong Investment currently trades at a price-to-earnings (P/E) ratio of 10.9x, with the last close at HK$7.59. This valuation is above both its estimated fair P/E ratio and the sector average, suggesting the market may be pricing in a premium.

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of earnings. For a company with steady but not high-flying growth prospects, the P/E multiple offers a snapshot of market expectations compared to profitability.

Guangdong Investment’s P/E ratio of 10.9x is higher than the estimated fair P/E ratio of 9.6x. This indicates the stock may be slightly expensive relative to its earnings fundamentals. Compared to the peer average of 8.7x, the premium is even more apparent and suggests investor enthusiasm is running ahead of the sector’s typical valuation standards. However, it is worth noting that the company's P/E is still significantly lower than the Asian Water Utilities industry average of 15.1x, providing some context for its current trading level. Should market sentiment shift, investor focus could return to the fair ratio benchmark.

Explore the SWS fair ratio for Guangdong Investment

Result: Price-to-Earnings of 10.9x (OVERVALUED)

However, sluggish annual revenue growth and a history of underwhelming longer-term returns could still dampen sentiment if profitability stalls.

Find out about the key risks to this Guangdong Investment narrative.

Another View: What Does the SWS DCF Model Say?

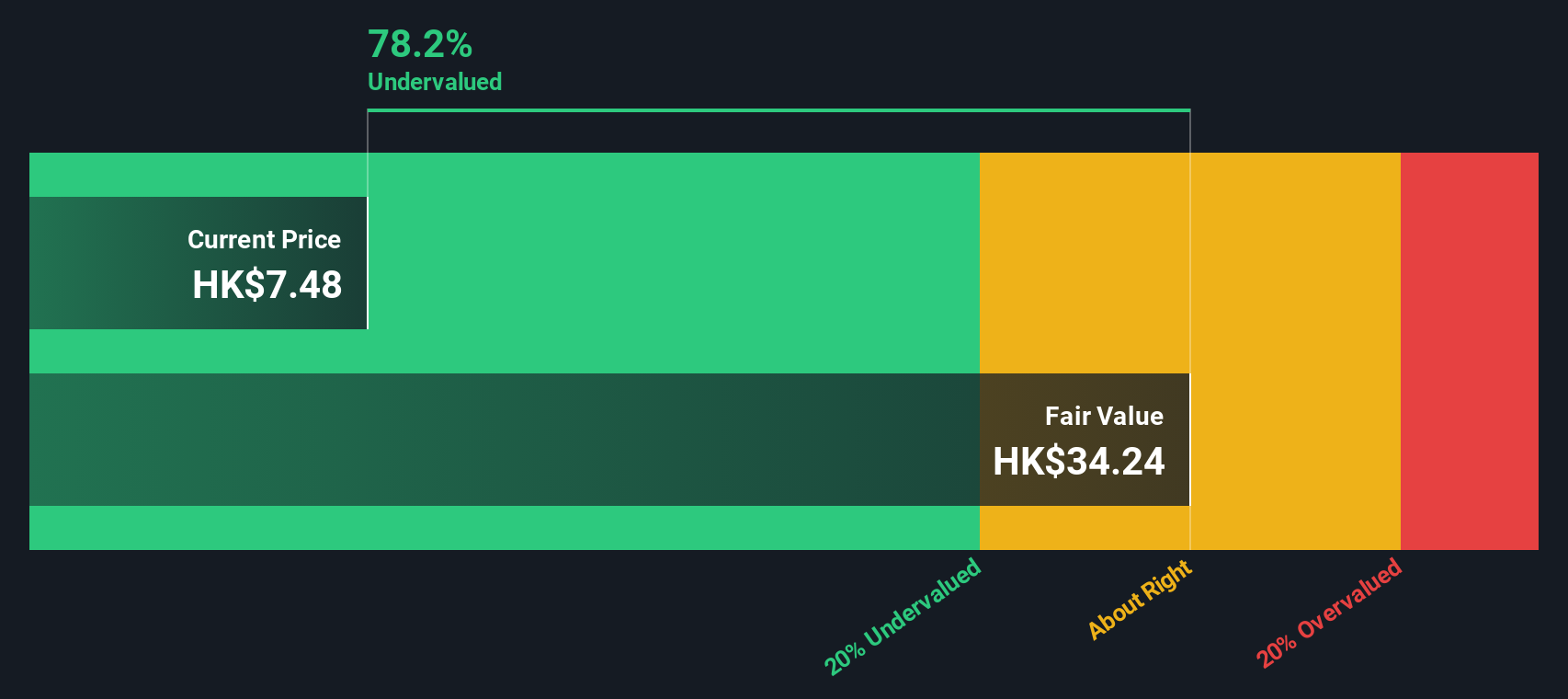

While a higher price-to-earnings ratio implies Guangdong Investment could be a touch expensive, our DCF model paints a different picture. According to the SWS DCF model, the stock is actually trading well below its estimated fair value. This sharp disconnect raises the question: Is the market overlooking the company’s true worth, or is there something the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guangdong Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guangdong Investment Narrative

You might see the numbers differently or want to dig into the data on your own. Crafting a personalized outlook for Guangdong Investment takes less than three minutes, so why not give it a try? Do it your way

A great starting point for your Guangdong Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let your next smart move slip by. Open the door to new possibilities and give your portfolio a tech, healthcare, or income boost today.

- Capture breakthrough growth in artificial intelligence by browsing these 25 AI penny stocks, which are at the forefront of automation, machine learning, and innovation.

- Take advantage of stable income streams when you check out these 15 dividend stocks with yields > 3%, offering generous yields and consistent payouts.

- Ride the healthcare technology wave and level up your watchlist with these 30 healthcare AI stocks, a group gaining traction in digital diagnostics and life sciences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:270

Guangdong Investment

An investment holding company, engages in water resources, property investment and development, department store operation, hotel ownership, energy project operation and management, and road and bridge operation businesses.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success