- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3090

Discover ENN Energy Holdings And 2 Other Compelling Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking stability through dividend stocks. In such an environment, stocks that offer reliable dividend payouts can provide a buffer against market fluctuations while potentially enhancing portfolio returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1935 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

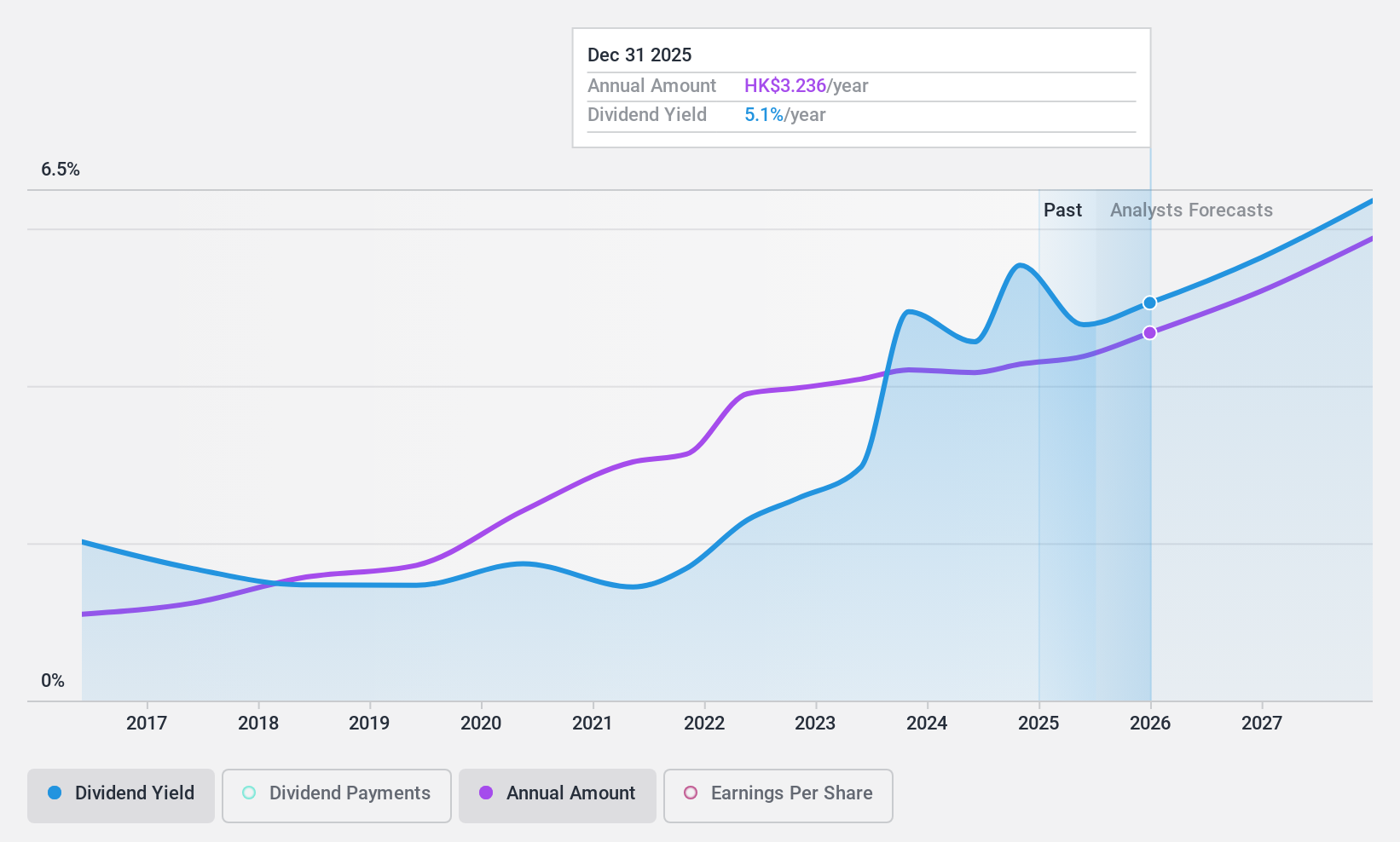

ENN Energy Holdings (SEHK:2688)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Energy Holdings Limited is an investment holding company focused on the investment, construction, operation, and management of gas pipeline infrastructure in the People’s Republic of China with a market cap of approximately HK$63.82 billion.

Operations: ENN Energy Holdings Limited generates revenue from several segments, including CN¥67.73 billion from Retail Gas Sales Business, CN¥40.99 billion from Wholesale of Gas, CN¥15.95 billion from Integrated Energy Business, CN¥7.74 billion from Value Added Business, and CN¥5.58 billion from Construction and Installation services in the People’s Republic of China.

Dividend Yield: 5%

ENN Energy Holdings offers a dividend yield of 4.99%, which is below the top quartile in Hong Kong. While dividends have been stable and growing over the past decade, they are not well covered by free cash flow, with a high cash payout ratio of 113.6%. However, the payout ratio based on earnings is reasonably low at 49.9%. Recent results show growth in energy sales volumes, indicating potential revenue expansion.

- Navigate through the intricacies of ENN Energy Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report ENN Energy Holdings implies its share price may be lower than expected.

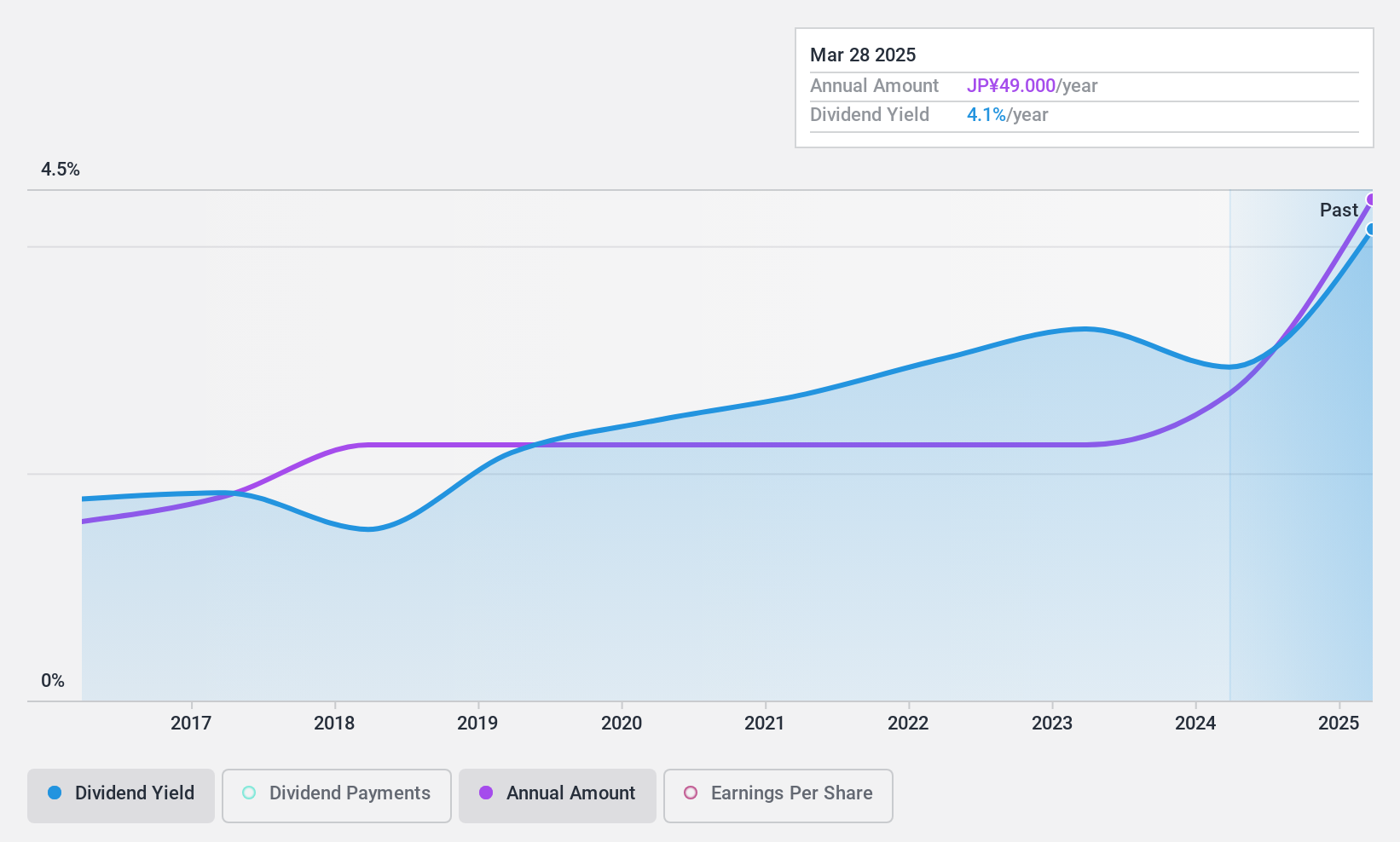

Dai Nippon Toryo Company (TSE:4611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dai Nippon Toryo Company, Limited, along with its subsidiaries, manufactures and sells coatings and jet inks both in Japan and internationally, with a market capitalization of ¥32.15 billion.

Operations: Dai Nippon Toryo Company generates revenue from several segments, including Domestic Coatings at ¥51.41 billion, Overseas Coatings at ¥8.43 billion, Fluorescent Color Materials at ¥1.21 billion, and Lighting at ¥9.98 billion.

Dividend Yield: 4.3%

Dai Nippon Toryo Company offers a dividend yield of 4.28%, placing it among the top 25% of dividend payers in Japan. Despite stable and growing dividends over the past decade, current payouts are not well covered by free cash flows due to a high cash payout ratio of 142.1%. Recent guidance indicates an increase in year-end dividends from ¥35 to ¥49 per share, with expected earnings per share at ¥151.07 for fiscal year ending March 2025.

- Get an in-depth perspective on Dai Nippon Toryo Company's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Dai Nippon Toryo Company is trading behind its estimated value.

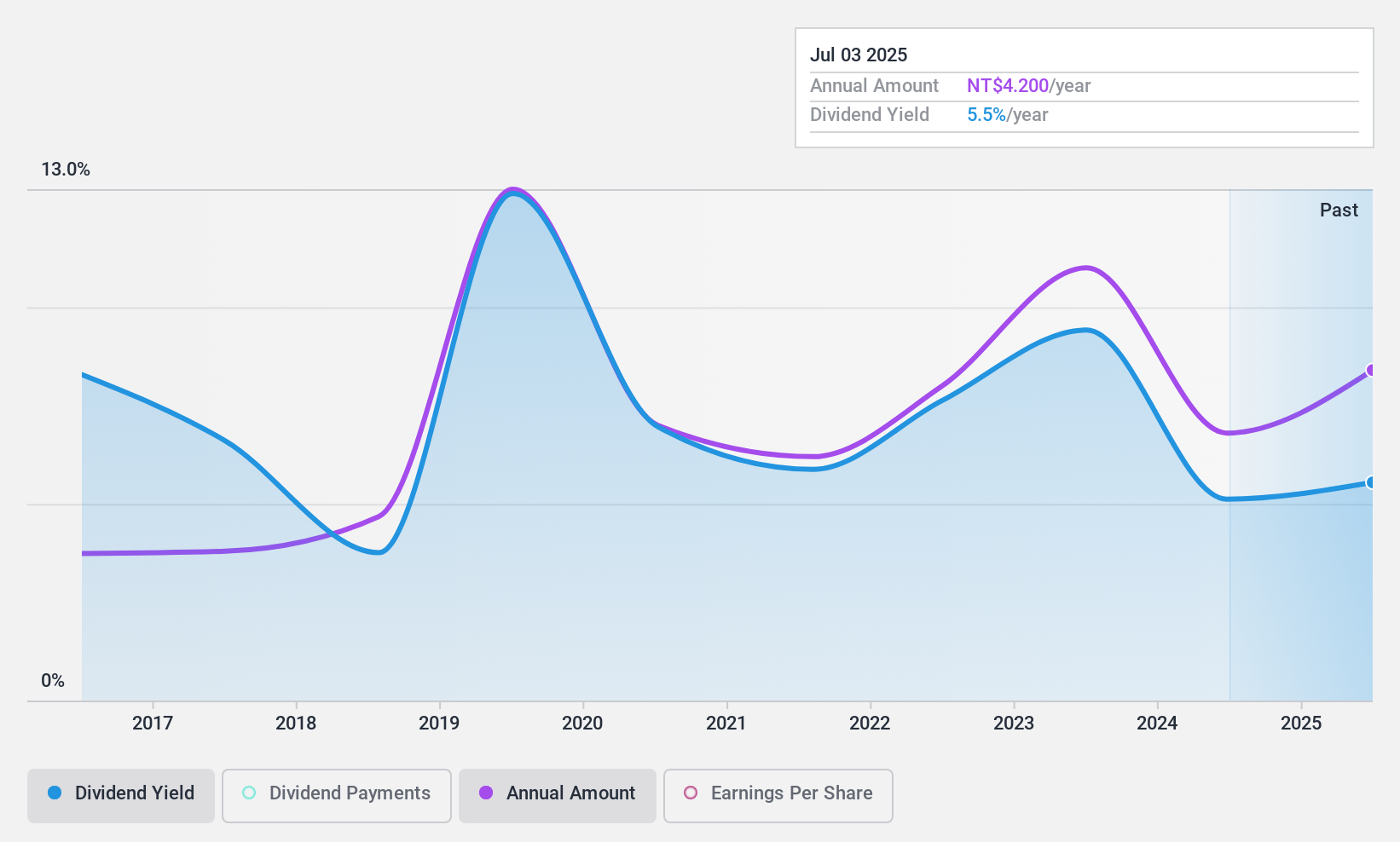

Nichidenbo (TWSE:3090)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nichidenbo Corporation is involved in the global distribution of electronic components and has a market cap of NT$14.84 billion.

Operations: Nichidenbo Corporation generates revenue primarily from Taiwan, amounting to NT$12.55 billion, with additional contributions of NT$0.83 billion from other regions.

Dividend Yield: 4.9%

Nichidenbo's dividend yield of 4.86% ranks in the top 25% of Taiwan's market, yet its high cash payout ratio of 122.1% indicates dividends are not well covered by free cash flows, raising sustainability concerns. Despite past volatility, dividends have grown over the last decade. Recent earnings reports show increased sales and net income for nine months ending September 2024 at TWD 8.99 billion and TWD 740.14 million respectively, reflecting improved financial performance compared to the previous year.

- Take a closer look at Nichidenbo's potential here in our dividend report.

- According our valuation report, there's an indication that Nichidenbo's share price might be on the expensive side.

Next Steps

- Navigate through the entire inventory of 1935 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichidenbo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3090

Nichidenbo

Engages in the distribution of electronic components worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives