- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2638

HK Electric Investments and HK Electric Investments' (HKG:2638) Dividend Will Be HK$0.16

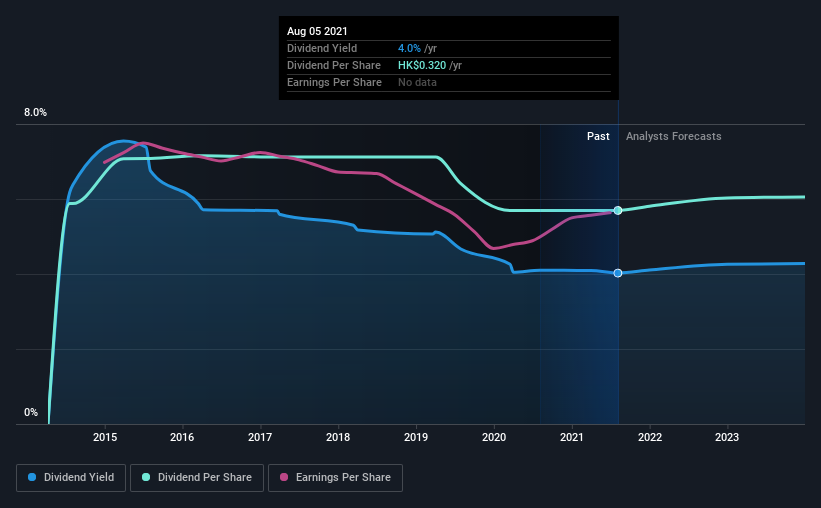

HK Electric Investments and HK Electric Investments Limited's (HKG:2638) investors are due to receive a payment of HK$0.16 per share on 27th of August. This payment means that the dividend yield will be 4.0%, which is around the industry average.

Check out our latest analysis for HK Electric Investments and HK Electric Investments

HK Electric Investments and HK Electric Investments' Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before making this announcement, the company's dividend was much higher than its earnings. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

Earnings per share is forecast to rise by 4.4% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 93%. This is definitely on the higher side, but we wouldn't necessarily say this is unsustainable.

HK Electric Investments and HK Electric Investments' Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The first annual payment during the last 7 years was HK$0.33 in 2014, and the most recent fiscal year payment was HK$0.32. Dividend payments have shrunk at a rate of less than 1% per annum over this time frame. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's not great to see that HK Electric Investments and HK Electric Investments' earnings per share has fallen at approximately 4.3% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

HK Electric Investments and HK Electric Investments' Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for HK Electric Investments and HK Electric Investments that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HK Electric Investments and HK Electric Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2638

HK Electric Investments and HK Electric Investments

An investment holding company, engages in the generation, transmission, distribution, and supply of electricity in Hong Kong Island and Lamma Island.

Undervalued with questionable track record.