- Hong Kong

- /

- Electric Utilities

- /

- SEHK:2

Potential Upside For CLP Holdings Limited (HKG:2) Not Without Risk

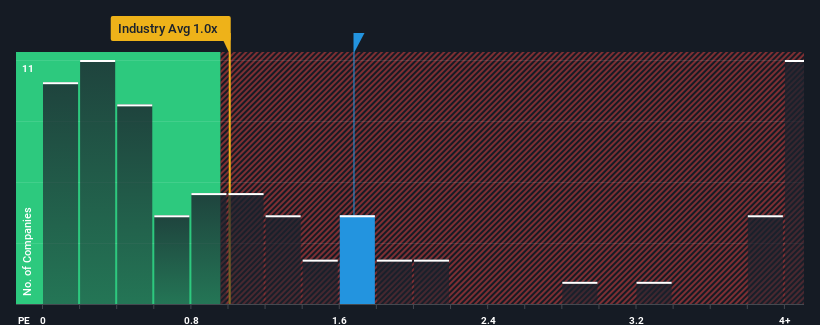

CLP Holdings Limited's (HKG:2) price-to-sales (or "P/S") ratio of 1.7x might make it look like a buy right now compared to the Electric Utilities industry in Hong Kong, where around half of the companies have P/S ratios above 2.7x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for CLP Holdings

What Does CLP Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for CLP Holdings as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think CLP Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

CLP Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.1%. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company are not great, suggesting revenue should decline by 1.6% per year over the next three years. Meanwhile, the industry is forecast to moderate by 0.3% per annum, which suggests the company won't escape the wider industry forces.

With this in consideration, we find it intriguing but understandable that CLP Holdings' P/S falls short of its industry peers. We think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Bottom Line On CLP Holdings' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of CLP Holdings' analyst forecasts revealed despite having an equally shaky outlook against the industry, its P/S much lower than we would have predicted. There could be some further unobserved threats to revenue stability preventing the P/S ratio from matching the outlook. The market could be pricing in revenue growth falling below that of the industry, a possibility given tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should typically see a P/S closer to the industry average.

It is also worth noting that we have found 2 warning signs for CLP Holdings that you need to take into consideration.

If you're unsure about the strength of CLP Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2

CLP Holdings

An investment holding company, engages in the generation, retail, transmission, and distribution of electricity in Hong Kong, Mainland China, India, Thailand, Taiwan, and Australia.

Solid track record average dividend payer.

Market Insights

Community Narratives