- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1816

CGN Power (SEHK:1816) Valuation in Focus After Launch of Zhaoyuan Unit 1 Construction

Reviewed by Simply Wall St

CGN Power (SEHK:1816) has kicked off full-scale construction of its Zhaoyuan Unit 1 reactor, leveraging advanced HPR1000 technology. This latest milestone signals ongoing growth ambitions and an increasingly prominent role in the nuclear power sector.

See our latest analysis for CGN Power.

The fresh momentum from CGN Power’s Zhaoyuan Unit 1 project comes after a year in which its share price has climbed 10.26% and total shareholder return over five years is an impressive 129.10%. This kind of long-term outperformance, combined with recent expansion news, suggests investors are becoming more interested in both the growth potential and the improving outlook for nuclear power in China.

If the sector’s renewed energy has you looking for more opportunities, this could be the right moment to discover fast growing stocks with high insider ownership.

But with CGN Power’s solid track record and ambitious project pipeline already gaining investor attention, is the stock still trading at an attractive valuation? Or has the market already priced in these strong growth prospects?

Price-to-Earnings of 14.8x: Is it justified?

Based on CGN Power’s current price-to-earnings ratio of 14.8x, the stock looks expensive relative to its peer group, despite recent attention and growth momentum. As of the last close at HK$3.01, this ratio suggests investors are paying a premium over sector alternatives.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for a dollar of future earnings. This makes it a core metric for utilities and energy companies. In CGN Power’s case, the 14.8x multiple highlights optimism about its profit outlook and project pipeline. However, it also prompts caution on whether future earnings justify this elevated price tag.

Compared to peers, CGN Power’s P/E is much higher than the sector average of 8.2x. It also trades above its computed fair price-to-earnings ratio of 12.3x, indicating the market may be overpricing the shares relative to likely earnings power. If investor sentiment returns to more typical levels, the multiple could compress toward this fair value.

Explore the SWS fair ratio for CGN Power

Result: Price-to-Earnings of 14.8x (OVERVALUED)

However, factors like slowing revenue and net income growth, or a shift in sector sentiment, could challenge the market’s bullish outlook for CGN Power.

Find out about the key risks to this CGN Power narrative.

Another View: SWS DCF Model Shows Undervaluation

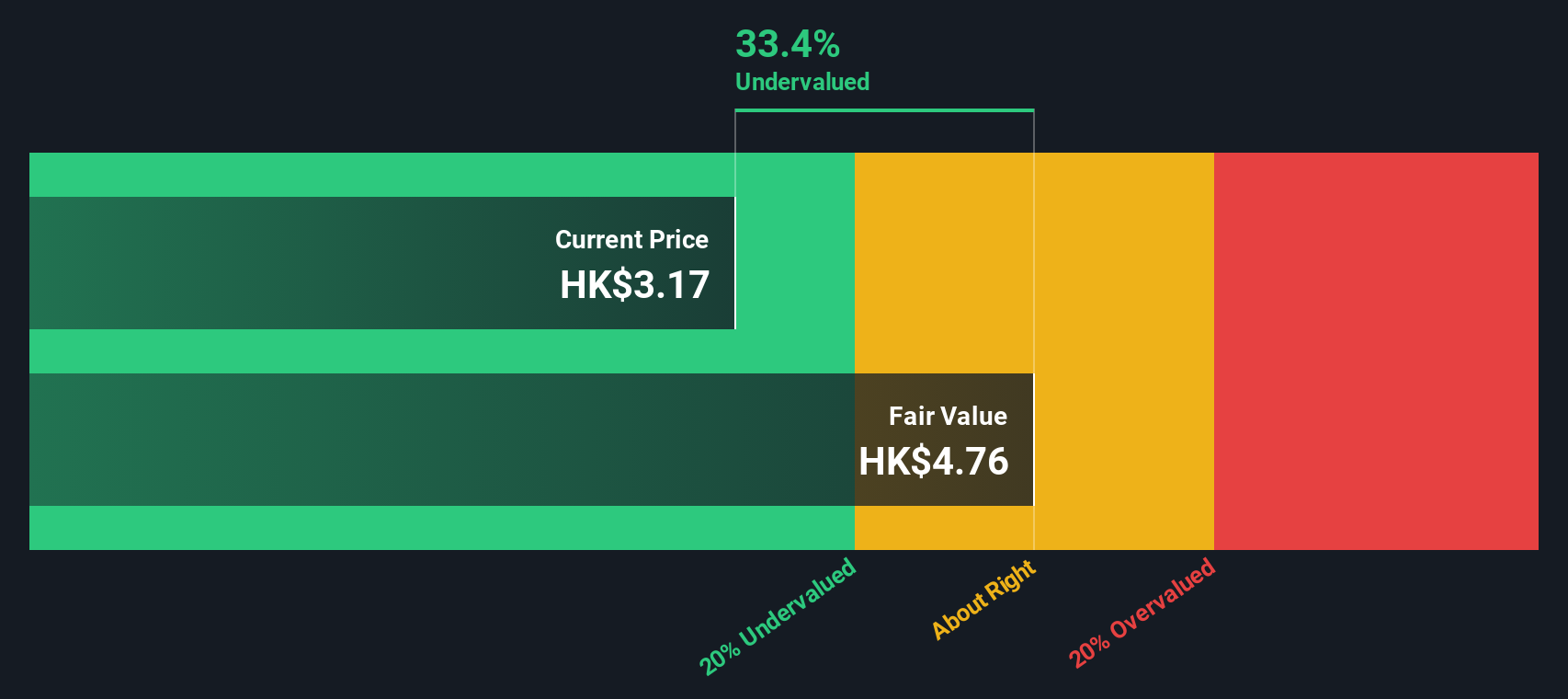

While the price-to-earnings ratio points to CGN Power as expensive, our DCF model presents a more optimistic picture. The shares currently trade at HK$3.01, which is 35.9% below our estimate of fair value at HK$4.70. Could the market be underestimating long-term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CGN Power for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CGN Power Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can build your own narrative in just a few minutes (Do it your way).

A great starting point for your CGN Power research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Don’t Miss Out on More Compelling Investment Picks

Smart investors are always moving ahead. Let Simply Wall St’s top-rated screeners help you catch the next big opportunity before it breaks out.

- Take advantage of cash-generating companies trading at lower prices by checking out these 919 undervalued stocks based on cash flows, where market mispricings could boost your returns.

- Get ahead in healthcare’s next wave by seeing these 30 healthcare AI stocks, featuring firms that are revolutionizing medicine with advanced artificial intelligence.

- Capitalize on new digital trends by reviewing these 81 cryptocurrency and blockchain stocks and spot innovative businesses driving growth in cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1816

CGN Power

Operates and manages nuclear power stations, sells electricity generated by these stations, and provides related technical services in the People’s Republic of China.

Established dividend payer and fair value.

Market Insights

Community Narratives