- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1798

China Datang Corporation Renewable Power Co., Limited's (HKG:1798) Price Is Right But Growth Is Lacking After Shares Rocket 28%

China Datang Corporation Renewable Power Co., Limited (HKG:1798) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

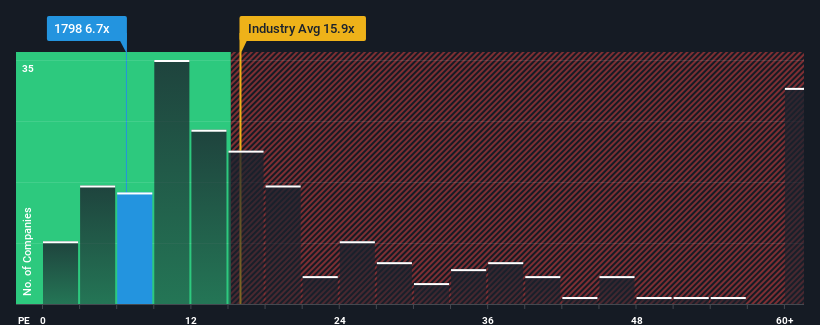

Even after such a large jump in price, China Datang Corporation Renewable Power may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.7x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 19x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, China Datang Corporation Renewable Power's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for China Datang Corporation Renewable Power

Is There Any Growth For China Datang Corporation Renewable Power?

In order to justify its P/E ratio, China Datang Corporation Renewable Power would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. Even so, admirably EPS has lifted 34% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 13% per annum over the next three years. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader market.

With this information, we can see why China Datang Corporation Renewable Power is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift China Datang Corporation Renewable Power's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of China Datang Corporation Renewable Power's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for China Datang Corporation Renewable Power you should be aware of, and 1 of them is a bit concerning.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1798

China Datang Corporation Renewable Power

Engages in the investment, development, construction, and management of wind power and other renewable energy sources in the People's Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives