- Hong Kong

- /

- Electric Utilities

- /

- SEHK:1713

If You Like EPS Growth Then Check Out Sichuan Energy Investment Development (HKG:1713) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Sichuan Energy Investment Development (HKG:1713). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Sichuan Energy Investment Development

How Quickly Is Sichuan Energy Investment Development Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Sichuan Energy Investment Development has grown EPS by 17% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

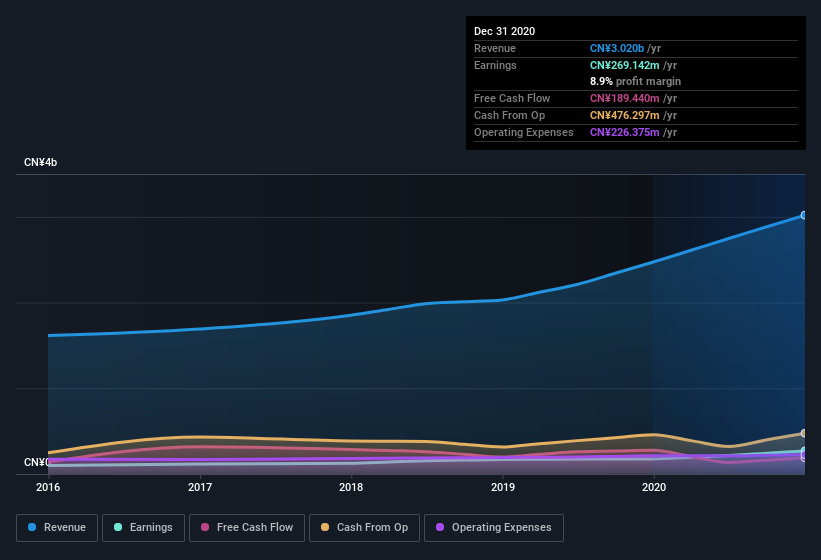

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Sichuan Energy Investment Development maintained stable EBIT margins over the last year, all while growing revenue 22% to CN¥3.0b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Sichuan Energy Investment Development is no giant, with a market capitalization of HK$2.0b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Sichuan Energy Investment Development Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between CN¥647m and CN¥2.6b, like Sichuan Energy Investment Development, the median CEO pay is around CN¥1.9m.

The Sichuan Energy Investment Development CEO received total compensation of just CN¥825k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Sichuan Energy Investment Development Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Sichuan Energy Investment Development's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd venture it may well deserve a spot on your watchlist, or even a little further research. Still, you should learn about the 1 warning sign we've spotted with Sichuan Energy Investment Development .

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1713

Sichuan Energy Investment Development

A vertically integrated power supplier and service provider primarily in Mainland China.

Good value with proven track record.

Market Insights

Community Narratives