- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1600

Exploring Undervalued Small Caps With Insider Action In Hong Kong May 2024

As of May 2024, the Hong Kong market has experienced notable fluctuations, with the Hang Seng Index witnessing a significant downturn of 4.83%. This shift reflects broader concerns about persistent high rates in the U.S. and their impact on global markets. In such a landscape, identifying undervalued small-cap stocks with insider buying can be particularly compelling, as these actions may signal unrecognized potential or confidence from those intimately familiar with the companies.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Luk Fook Holdings (International) | 7.1x | 0.8x | 49.78% | ★★★★★☆ |

| Far East Consortium International | NA | 0.3x | 33.66% | ★★★★★☆ |

| Abbisko Cayman | NA | 107.2x | 26.70% | ★★★★☆☆ |

| Xtep International Holdings | 13.3x | 1.0x | 31.16% | ★★★☆☆☆ |

| Giordano International | 9.2x | 0.8x | 32.00% | ★★★☆☆☆ |

| Nissin Foods | 15.7x | 1.4x | 33.45% | ★★★☆☆☆ |

| China Overseas Grand Oceans Group | 3.1x | 0.1x | -10.95% | ★★★☆☆☆ |

| China Lesso Group Holdings | 4.7x | 0.4x | -7.44% | ★★★☆☆☆ |

| Texwinca Holdings | 222.9x | 0.2x | 1.08% | ★★★☆☆☆ |

| Pizu Group Holdings | 11.0x | 1.0x | 45.89% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

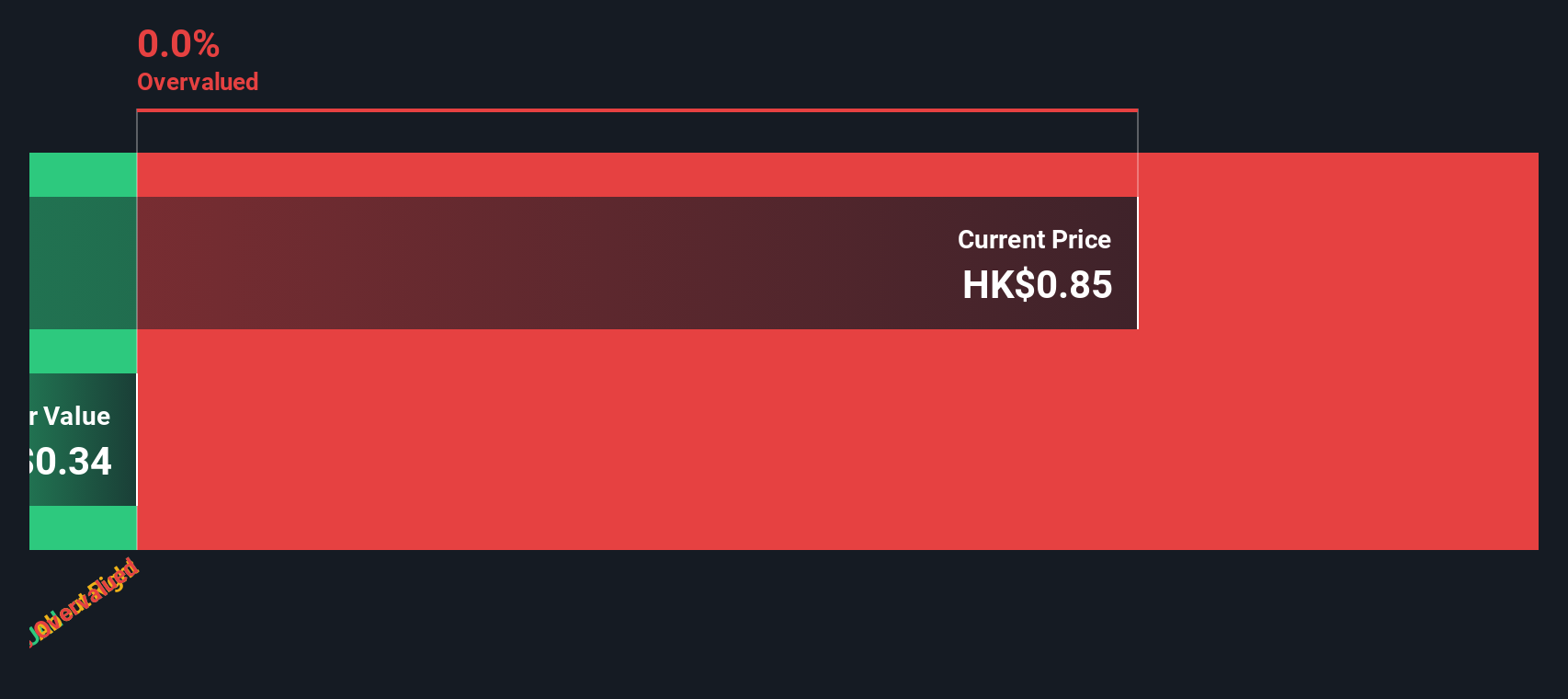

iDreamSky Technology Holdings (SEHK:1119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform, focusing on the publication of games through mobile apps and websites across the People’s Republic of China, with a market capitalization of HK$4.88 billion.

Operations: The company generates revenue primarily through its Game and Information Services, including SaaS and related services, which amounted to CN¥1.92 billion in the latest reporting period. It has experienced a gross profit margin of 35.14% most recently, reflecting the cost of goods sold at CN¥1.24 billion against this revenue stream.

PE: -10.0x

iDreamSky Technology, recently spotlighted by insider Xiangyu Chen's purchase of 1.08 million shares for HK$29.7 million, signals confidence despite a challenging year where sales dipped to CNY 1.92 billion from CNY 2.59 billion and losses narrowed significantly from CNY 2.49 billion to CNY 556.35 million. This strategic move, coupled with an ambitious alliance with Saudi Cloud Computing Company to expand into the gaming sector in Saudi Arabia, underpins its potential rebound and growth prospects in emerging markets.

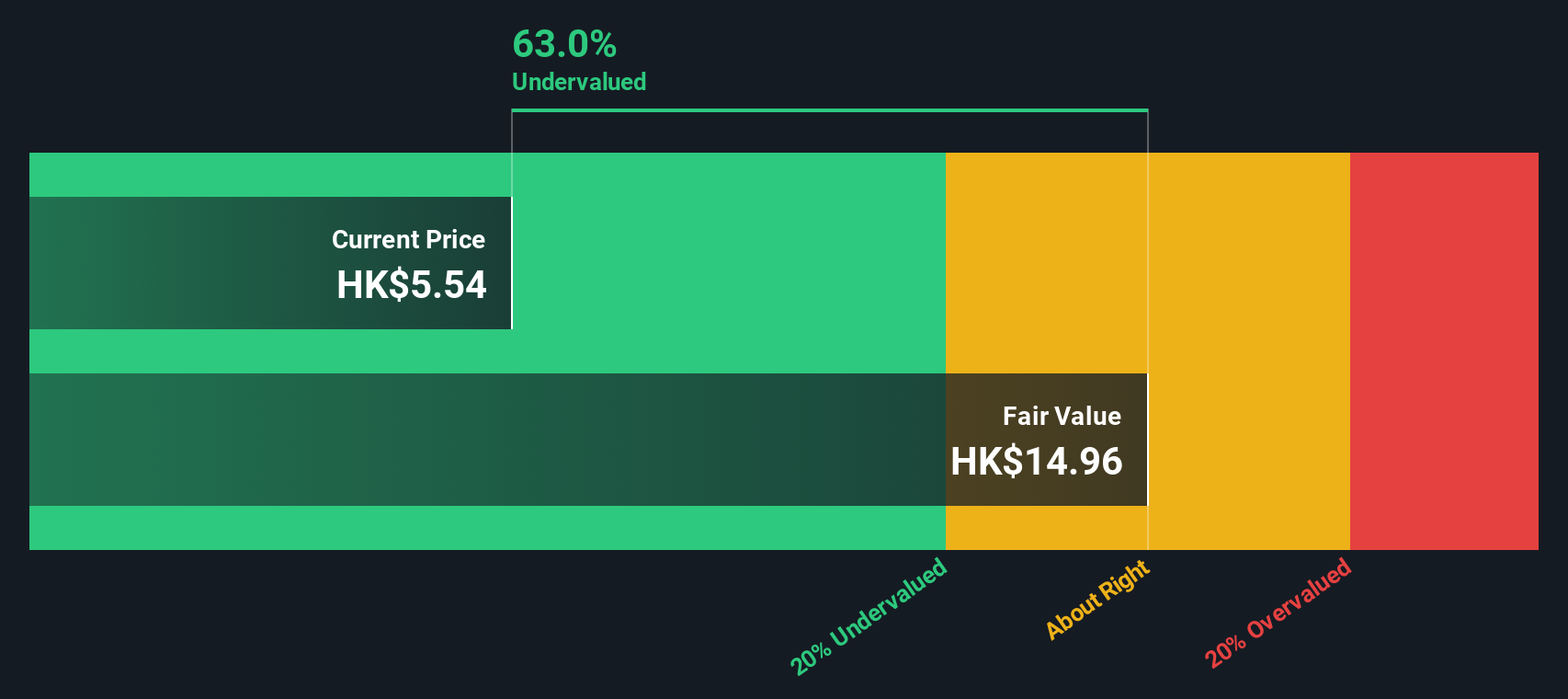

Xtep International Holdings (SEHK:1368)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xtep International Holdings Limited is a prominent player in the Chinese sports industry, specializing in the design, development, manufacturing, and marketing of sports footwear, apparel, and accessories for both adults and children.

Operations: The company generates its primary revenue from the mass market segment, contributing CN¥11.95 billion, supplemented by fashion sports and professional sports segments which add CN¥1.60 billion and CN¥0.80 billion respectively. It has maintained a gross profit margin around 42% in recent periods, indicating a consistent ratio of cost of goods sold relative to sales revenue across its diverse product lines.

PE: 13.3x

Recently, Shui Po Ding increased their stake in Xtep International Holdings by purchasing 2 million shares for HK$14.15 million, signaling strong insider confidence. This move aligns with the company's impressive financial performance, reporting a significant rise in annual sales to CNY 14.35 billion and net income of CNY 1.03 billion. Amendments to corporate bylaws and a consistent dividend payout further underscore Xtep's adaptability and shareholder commitment amidst regulatory changes, positioning it as an intriguing prospect within Hong Kong’s lesser-known equities.

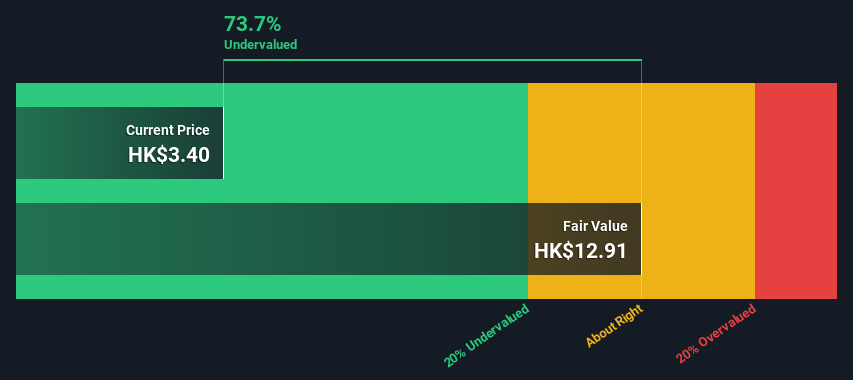

Tian Lun Gas Holdings (SEHK:1600)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tian Lun Gas Holdings Limited operates primarily in the transportation, distribution, and sale of natural gas in China, with a market capitalization of HK$4.52 billion.

Operations: The company generates its primary revenue from the sale of natural gas in cylinders, contributing CN¥5.12 billion, supplemented by engineering construction services and bulk natural gas sales, each adding over CN¥1 billion. It has achieved a gross profit margin of 18.81% as of the latest reporting period in 2024.

PE: 8.7x

Tian Lun Gas Holdings, whose recent earnings climbed to CNY 479.56 million, up from the previous year, showcases potential amidst Hong Kong's underpriced assets. With earnings per share rising to CNY 0.49 and a consistent dividend payout, confidence among insiders seems palpable; they've recently increased their stakes, signaling belief in sustained growth. Despite external borrowing as its sole funding source—typically a higher risk—its financial trajectory and strategic decisions at the latest AGM suggest promising prospects.

- Click here and access our complete valuation analysis report to understand the dynamics of Tian Lun Gas Holdings.

-

Gain insights into Tian Lun Gas Holdings' past trends and performance with our Past report.

Where To Now?

- Gain an insight into the universe of 15 Undervalued Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian Lun Gas Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1600

Tian Lun Gas Holdings

Engages in the transportation, distribution, and sale of natural gas and compressed natural gas through its gas pipeline connections in the People’ Republic of China.

Undervalued with acceptable track record.