The Hong Kong market has been experiencing notable fluctuations, influenced by mixed economic data and shifts in global investor sentiment. Amid this backdrop, identifying growth companies with high insider ownership can provide valuable insights into potential investment opportunities. In the current environment, stocks with strong insider ownership often signal confidence from those closest to the company's operations. This alignment of interests between insiders and shareholders can be particularly compelling for investors seeking growth in a volatile market.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

Let's dive into some prime choices out of the screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence (AI) solutions in the People's Republic of China, with a market cap of HK$22.62 billion.

Operations: The company's revenue segments include CN¥2.51 billion from the Sage AI Platform, CN¥415.50 million from Sagegpt Aigs Services, and CN¥1.28 billion from Shift Intelligent Solutions.

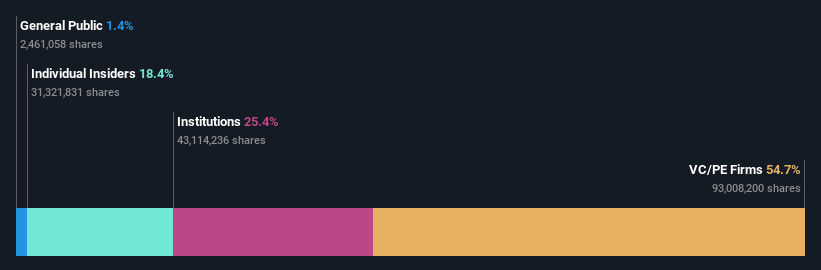

Insider Ownership: 22.8%

Earnings Growth Forecast: 96% p.a.

Beijing Fourth Paradigm Technology, with substantial insider ownership, is poised for significant growth. The company’s revenue grew by 36.4% last year and is forecasted to grow at 19.3% annually, outpacing the Hong Kong market's growth rate. Earnings are expected to increase by nearly 96% per year over the next three years as it approaches profitability. Recent strategic alliances in AI training and executive changes underscore its commitment to innovation and sustainable development.

- Dive into the specifics of Beijing Fourth Paradigm Technology here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Beijing Fourth Paradigm Technology is trading beyond its estimated value.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products globally with a market cap of HK$183.43 billion.

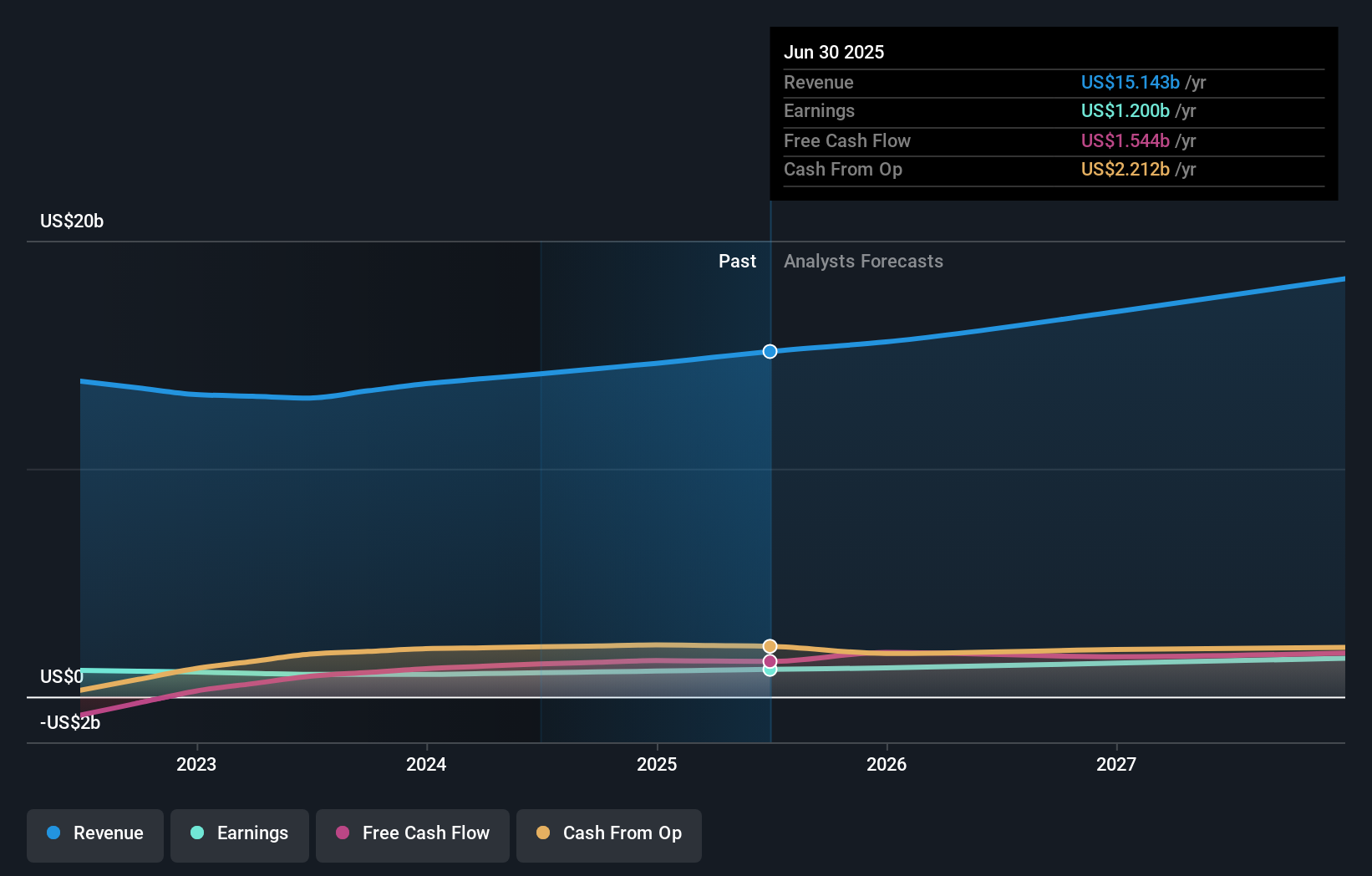

Operations: The company generates revenue primarily from Power Equipment ($12.79 billion) and Floorcare & Cleaning ($974.75 million).

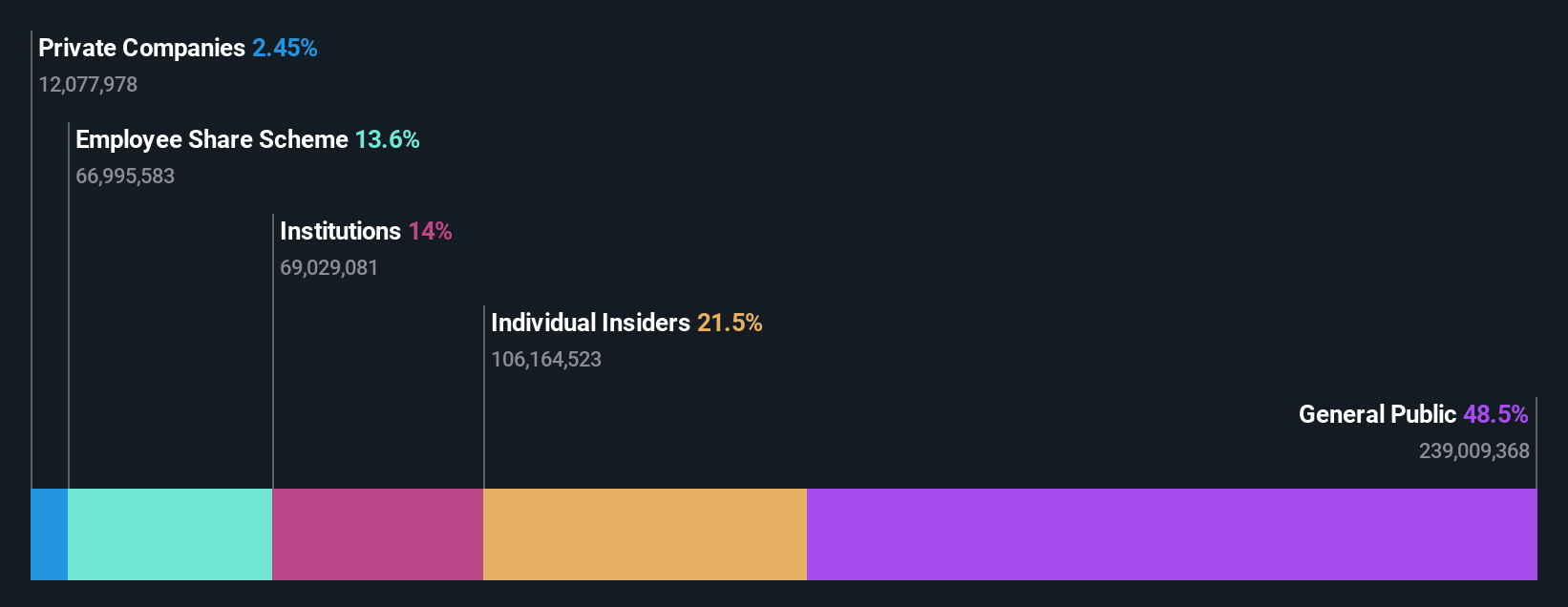

Insider Ownership: 25.4%

Earnings Growth Forecast: 14.9% p.a.

Techtronic Industries, with significant insider ownership, is forecasted to grow earnings by 14.93% annually and revenue by 8.1% per year, outpacing the Hong Kong market's average growth rates. Recent executive changes include the retirement of CEO Joseph Galli Jr., succeeded by Steven Richman. The company commenced a share repurchase program authorized to buy back up to 183 million shares, aimed at enhancing net asset value and earnings per share.

- Delve into the full analysis future growth report here for a deeper understanding of Techtronic Industries.

- The analysis detailed in our Techtronic Industries valuation report hints at an inflated share price compared to its estimated value.

Angelalign Technology (SEHK:6699)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. is an investment holding company that researches, develops, designs, manufactures, and markets clear aligner treatment solutions in the People's Republic of China with a market cap of HK$9.08 billion.

Operations: The company's revenue segment includes Dental Equipment & Supplies, generating CN¥1.48 billion.

Insider Ownership: 18.5%

Earnings Growth Forecast: 51% p.a.

Angelalign Technology, with substantial insider ownership, is expected to see earnings grow at 51.02% annually and revenue at 15.9%, both outpacing the Hong Kong market averages. Recent developments include a special dividend of HK$1.1 per share, executive changes with Mr. Zhu becoming the sole company secretary, and product innovations aimed at expanding their North American market presence, such as new features for orthodontists and entry into Canada.

- Click here and access our complete growth analysis report to understand the dynamics of Angelalign Technology.

- The valuation report we've compiled suggests that Angelalign Technology's current price could be inflated.

Seize The Opportunity

- Reveal the 53 hidden gems among our Fast Growing SEHK Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Techtronic Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:669

Techtronic Industries

Engages in the design, manufacture, and marketing of power tools, outdoor power equipment, and floorcare and cleaning products in the North America, Europe, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.