- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1407

Jy Gas (HKG:1407) Has Announced That Its Dividend Will Be Reduced To CN¥0.033

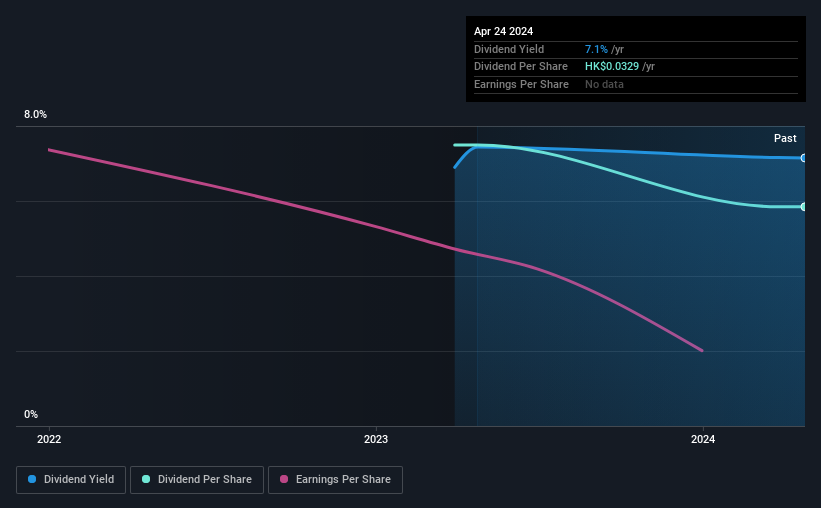

Jy Gas Limited's (HKG:1407) dividend is being reduced from last year's payment covering the same period to CN¥0.033 on the 9th of August. This means the annual payment is 7.1% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Jy Gas

Jy Gas Doesn't Earn Enough To Cover Its Payments

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. The last dividend was quite easily covered by Jy Gas' earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

EPS is set to fall by 62.3% over the next 12 months if recent trends continue. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 157%, which is definitely a bit high to be sustainable going forward.

Jy Gas Is Still Building Its Track Record

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Jy Gas has seen EPS fall by 62% over the last 12 months. Reduced dividend payments are a common consequence of declining earnings. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 4 warning signs for Jy Gas (1 can't be ignored!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1407

Jy Gas

An investment holding company, engages in the sale of natural gas in the People’s Republic of China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion