- Hong Kong

- /

- Water Utilities

- /

- SEHK:1395

Here's Why ELL Environmental Holdings (HKG:1395) Is Weighed Down By Its Debt Load

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that ELL Environmental Holdings Limited (HKG:1395) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for ELL Environmental Holdings

What Is ELL Environmental Holdings's Debt?

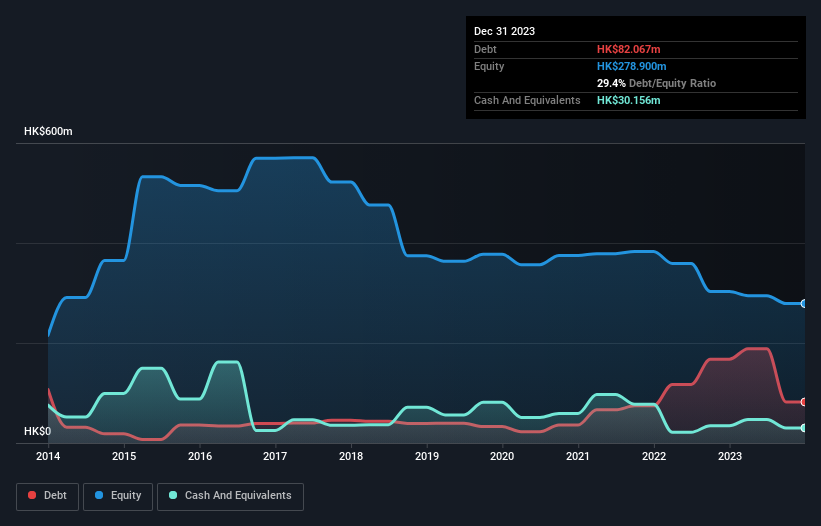

You can click the graphic below for the historical numbers, but it shows that ELL Environmental Holdings had HK$82.1m of debt in December 2023, down from HK$167.4m, one year before. On the flip side, it has HK$30.2m in cash leading to net debt of about HK$51.9m.

A Look At ELL Environmental Holdings' Liabilities

According to the last reported balance sheet, ELL Environmental Holdings had liabilities of HK$117.3m due within 12 months, and liabilities of HK$129.9m due beyond 12 months. On the other hand, it had cash of HK$30.2m and HK$31.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$185.2m.

The deficiency here weighs heavily on the HK$73.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, ELL Environmental Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While ELL Environmental Holdings's debt to EBITDA ratio (2.8) suggests that it uses some debt, its interest cover is very weak, at 1.0, suggesting high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, ELL Environmental Holdings saw its EBIT tank 39% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since ELL Environmental Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, ELL Environmental Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, ELL Environmental Holdings's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. We should also note that Water Utilities industry companies like ELL Environmental Holdings commonly do use debt without problems. Considering all the factors previously mentioned, we think that ELL Environmental Holdings really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for ELL Environmental Holdings you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if ELL Environmental Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1395

ELL Environmental Holdings

An investment holding company, designs, constructs, operates, and maintains wastewater treatment facilities in the People’s Republic of China and Indonesia.

Fair value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026