- Hong Kong

- /

- Water Utilities

- /

- SEHK:1395

ELL Environmental Holdings (HKG:1395) Use Of Debt Could Be Considered Risky

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies ELL Environmental Holdings Limited (HKG:1395) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for ELL Environmental Holdings

What Is ELL Environmental Holdings's Debt?

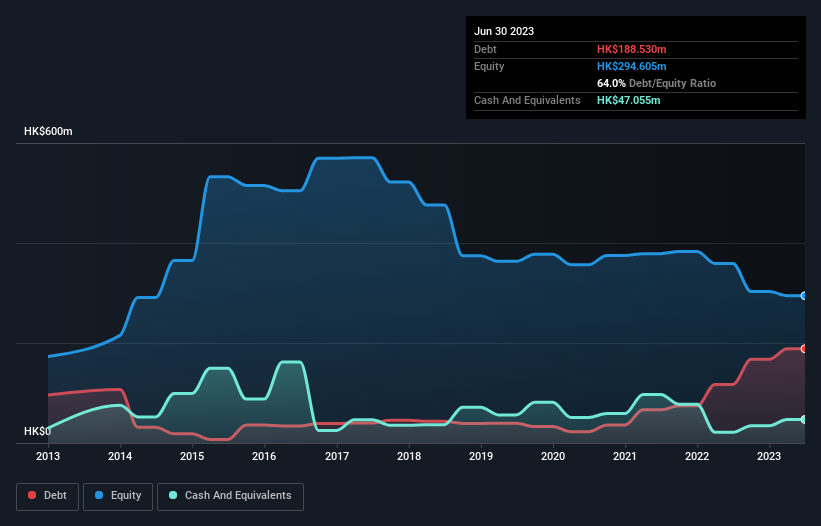

The image below, which you can click on for greater detail, shows that at June 2023 ELL Environmental Holdings had debt of HK$188.5m, up from HK$117.2m in one year. However, it does have HK$47.1m in cash offsetting this, leading to net debt of about HK$141.5m.

How Healthy Is ELL Environmental Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that ELL Environmental Holdings had liabilities of HK$165.5m due within 12 months and liabilities of HK$79.5m due beyond that. Offsetting this, it had HK$47.1m in cash and HK$65.9m in receivables that were due within 12 months. So it has liabilities totalling HK$132.0m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of HK$96.3m, we think shareholders really should watch ELL Environmental Holdings's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 2.1 times and a disturbingly high net debt to EBITDA ratio of 5.8 hit our confidence in ELL Environmental Holdings like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Worse, ELL Environmental Holdings's EBIT was down 32% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But it is ELL Environmental Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, ELL Environmental Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, ELL Environmental Holdings's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its level of total liabilities also fails to instill confidence. We should also note that Water Utilities industry companies like ELL Environmental Holdings commonly do use debt without problems. Considering all the factors previously mentioned, we think that ELL Environmental Holdings really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with ELL Environmental Holdings (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if ELL Environmental Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1395

ELL Environmental Holdings

An investment holding company, designs, constructs, operates, and maintains wastewater treatment facilities in the People’s Republic of China and Indonesia.

Fair value with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026