- Hong Kong

- /

- Real Estate

- /

- SEHK:3658

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent period marked by fluctuating corporate earnings and geopolitical tensions, investors are keenly observing the Federal Reserve's steady interest rate policy and the European Central Bank's recent rate cuts. Amidst these dynamics, dividend stocks offer a potential avenue for stability, providing regular income streams that can be particularly appealing in volatile market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

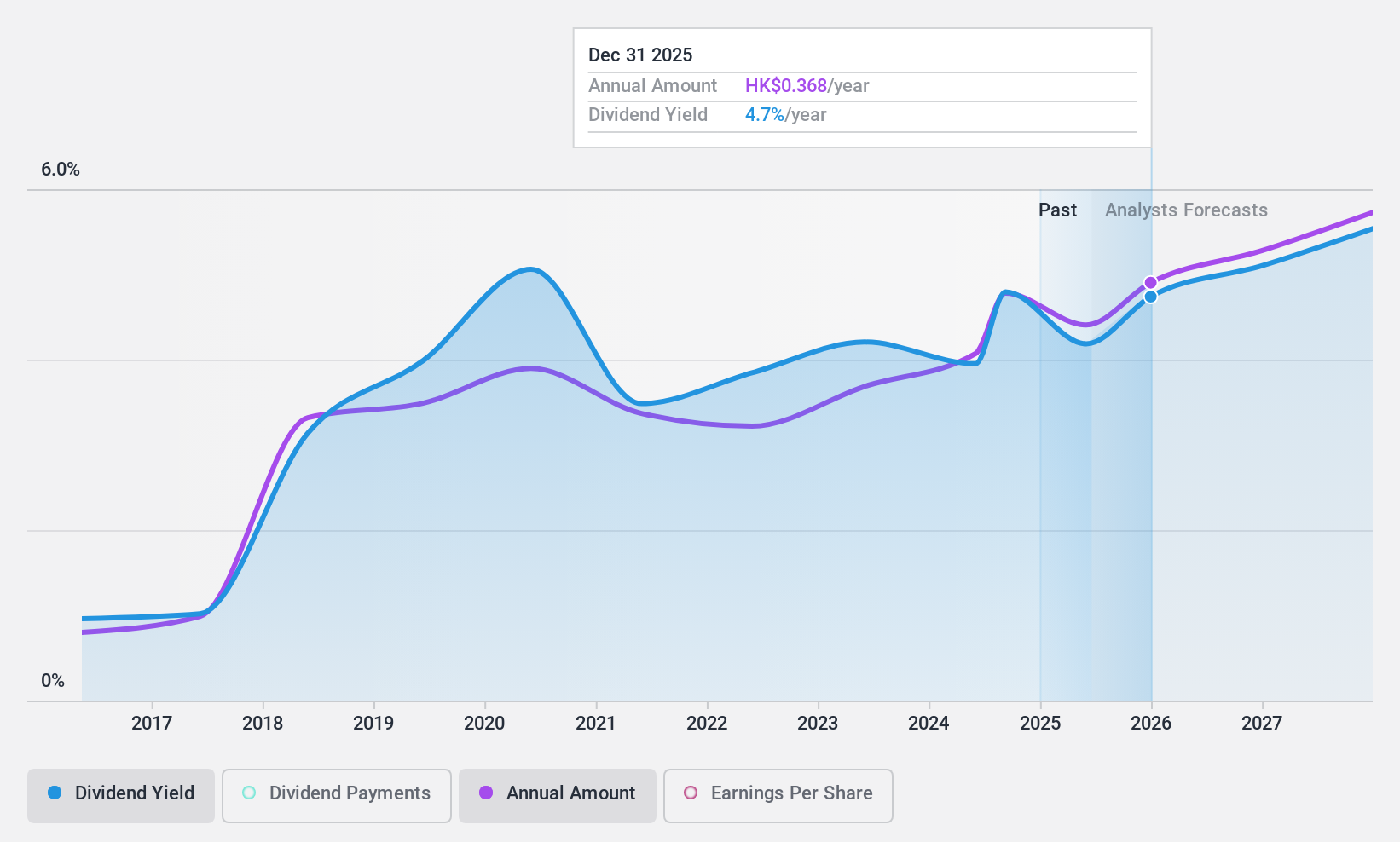

Kunlun Energy (SEHK:135)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kunlun Energy Company Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas, with a market cap of approximately HK$64.59 billion.

Operations: Kunlun Energy's revenue is primarily derived from natural gas sales (excluding LPG) at CN¥149.69 billion, followed by sales of LPG at CN¥25.97 billion, and LNG processing and terminal operations contributing CN¥12.64 billion, with exploration and production adding CN¥391 million.

Dividend Yield: 4.6%

Kunlun Energy's dividend payments are covered by earnings and cash flows, with payout ratios of 67.3% and 37.8%, respectively, indicating sustainability. However, its dividend yield of 4.62% is lower than the top quartile in Hong Kong's market. While dividends have increased over the past decade, they remain unreliable due to volatility exceeding 20% annually at times. Recent auditor changes with KPMG were approved in December 2024, reflecting ongoing corporate governance adjustments.

- Dive into the specifics of Kunlun Energy here with our thorough dividend report.

- Our valuation report here indicates Kunlun Energy may be undervalued.

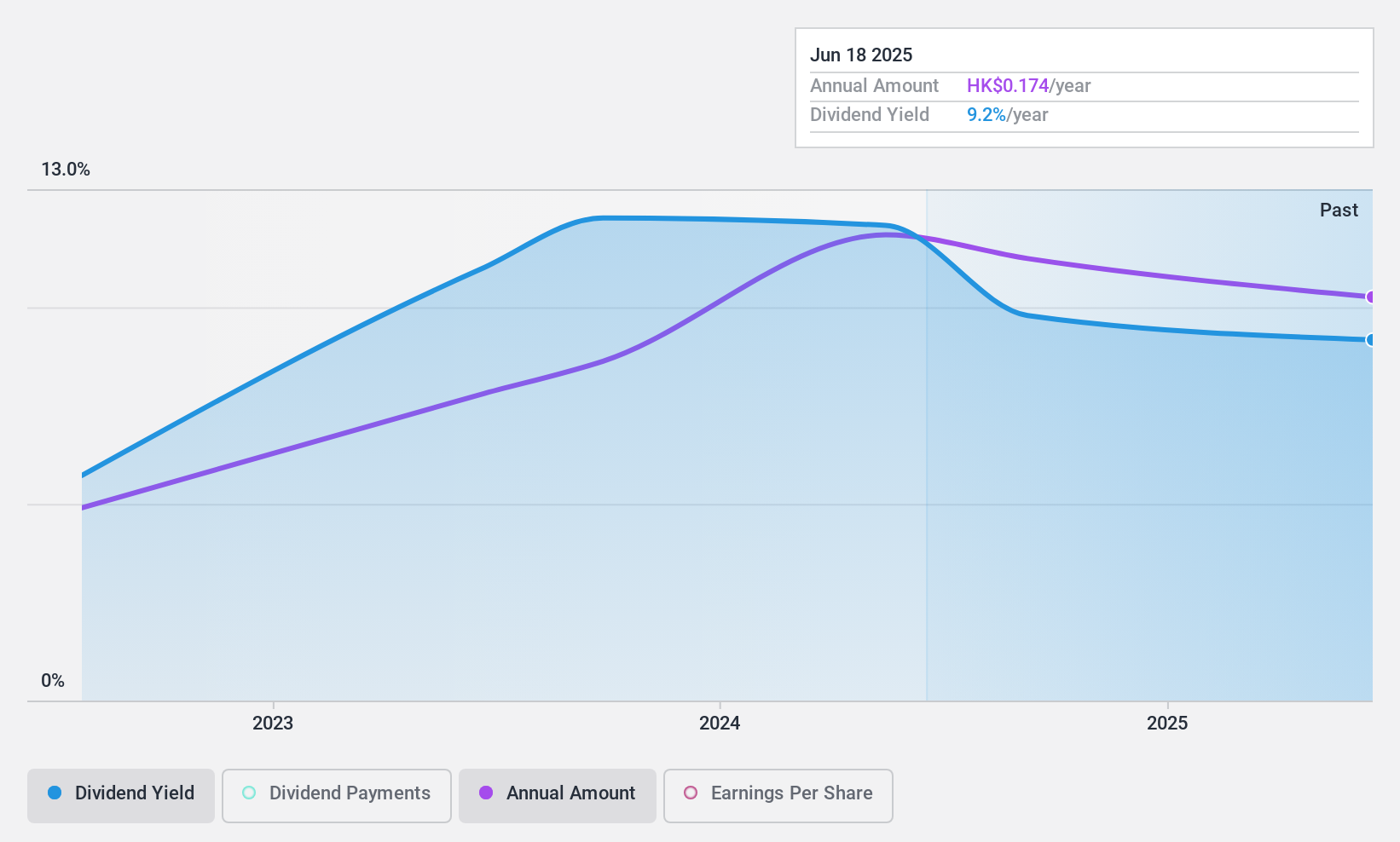

New Hope Service Holdings (SEHK:3658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Service Holdings Limited offers property management, value-added services, commercial operations, and lifestyle services, with a market cap of HK$1.60 billion.

Operations: New Hope Service Holdings Limited generates revenue from several segments: Lifestyle Services (CN¥325.85 million), Property Management Services (CN¥734.92 million), Commercial Operational Services (CN¥146.34 million), and Value-Added Services to Non-Property Owners (CN¥162.85 million).

Dividend Yield: 9.3%

New Hope Service Holdings' dividend payments are supported by earnings and cash flows, with payout ratios of 63.4% and 63.3%, respectively. Its yield of 9.26% places it among the top dividend payers in Hong Kong, yet reliability is a concern due to volatility over the past three years. Trading significantly below estimated fair value suggests potential for capital appreciation, though its short dividend history and unstable track record warrant caution for income-focused investors.

- Click to explore a detailed breakdown of our findings in New Hope Service Holdings' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of New Hope Service Holdings shares in the market.

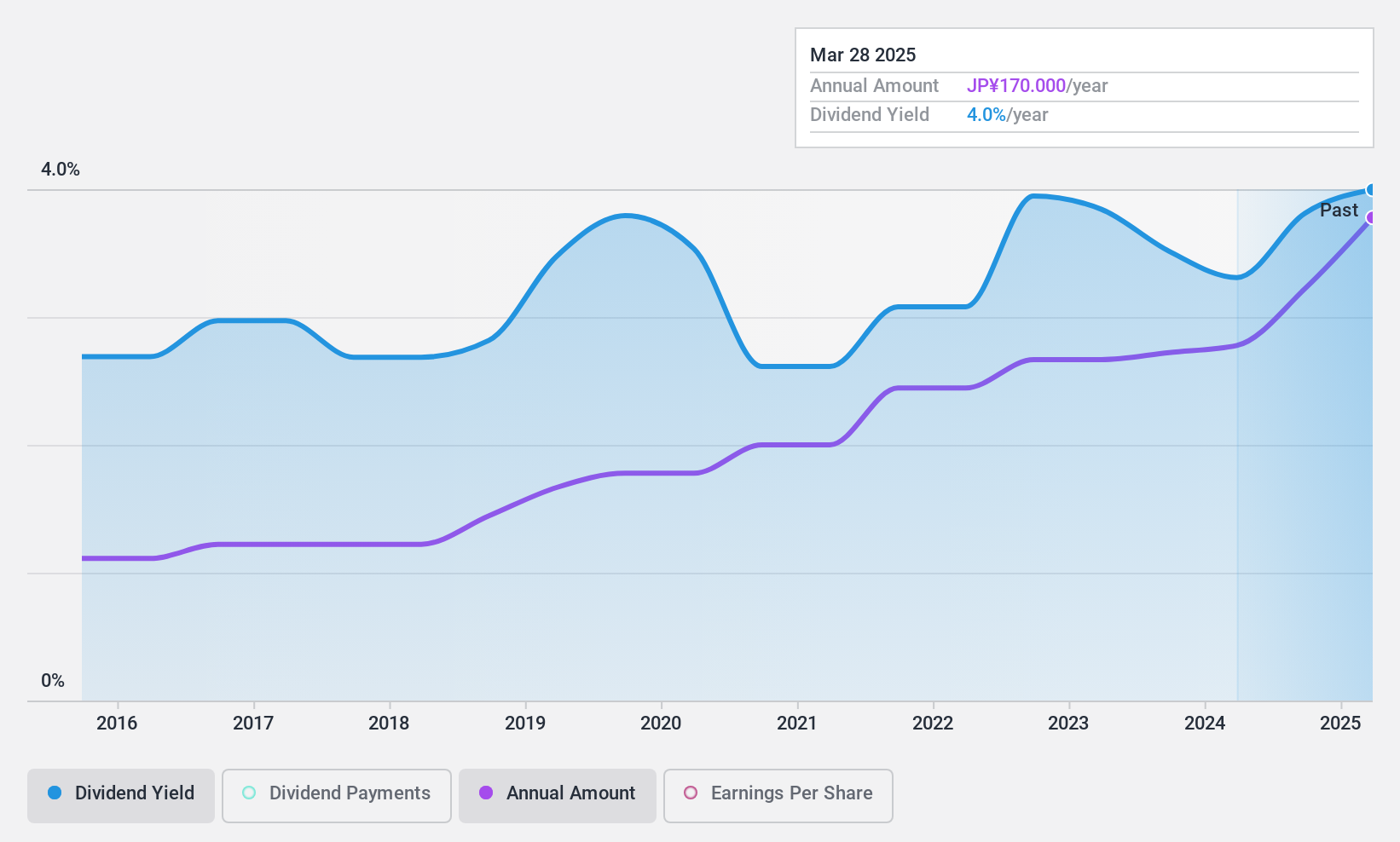

DMW (TSE:6365)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMW Corporation manufactures and sells fluid machinery both in Japan and internationally, with a market cap of ¥15.74 billion.

Operations: The company's revenue segments include Fluid Machinery at ¥10.45 billion and Industrial Equipment at ¥3.62 billion.

Dividend Yield: 3.5%

DMW's dividend payments are well-supported by earnings and cash flows, with payout ratios of 38.3% and 54.4%. Over the past decade, dividends have been stable and growing, though the yield of 3.5% is lower than Japan's top dividend payers. Recent share buybacks totaling ¥365.31 million aim to enhance capital efficiency, potentially benefiting shareholders through improved value per share while maintaining a reliable dividend policy amidst changing business conditions.

- Click here and access our complete dividend analysis report to understand the dynamics of DMW.

- Our comprehensive valuation report raises the possibility that DMW is priced lower than what may be justified by its financials.

Seize The Opportunity

- Dive into all 1956 of the Top Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New Hope Service Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3658

New Hope Service Holdings

Provides property management, value-added, commercial operational, and lifestyle services.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)