- France

- /

- Entertainment

- /

- ENXTPA:ALDNE

January 2025 Penny Stocks To Watch

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mix of gains and setbacks, with major U.S. stock indexes showing moderate growth despite declining consumer confidence and manufacturing orders. In this context, the allure of penny stocks remains significant for investors seeking affordable entry points into potentially high-growth sectors. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer substantial opportunities when backed by strong financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$42.73B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,812 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Don't Nod Entertainment (ENXTPA:ALDNE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Don't Nod Entertainment S.A. is a global video game developer and publisher with a market cap of €18.91 million.

Operations: The company generates €30.18 million in revenue from the development of video games.

Market Cap: €18.91M

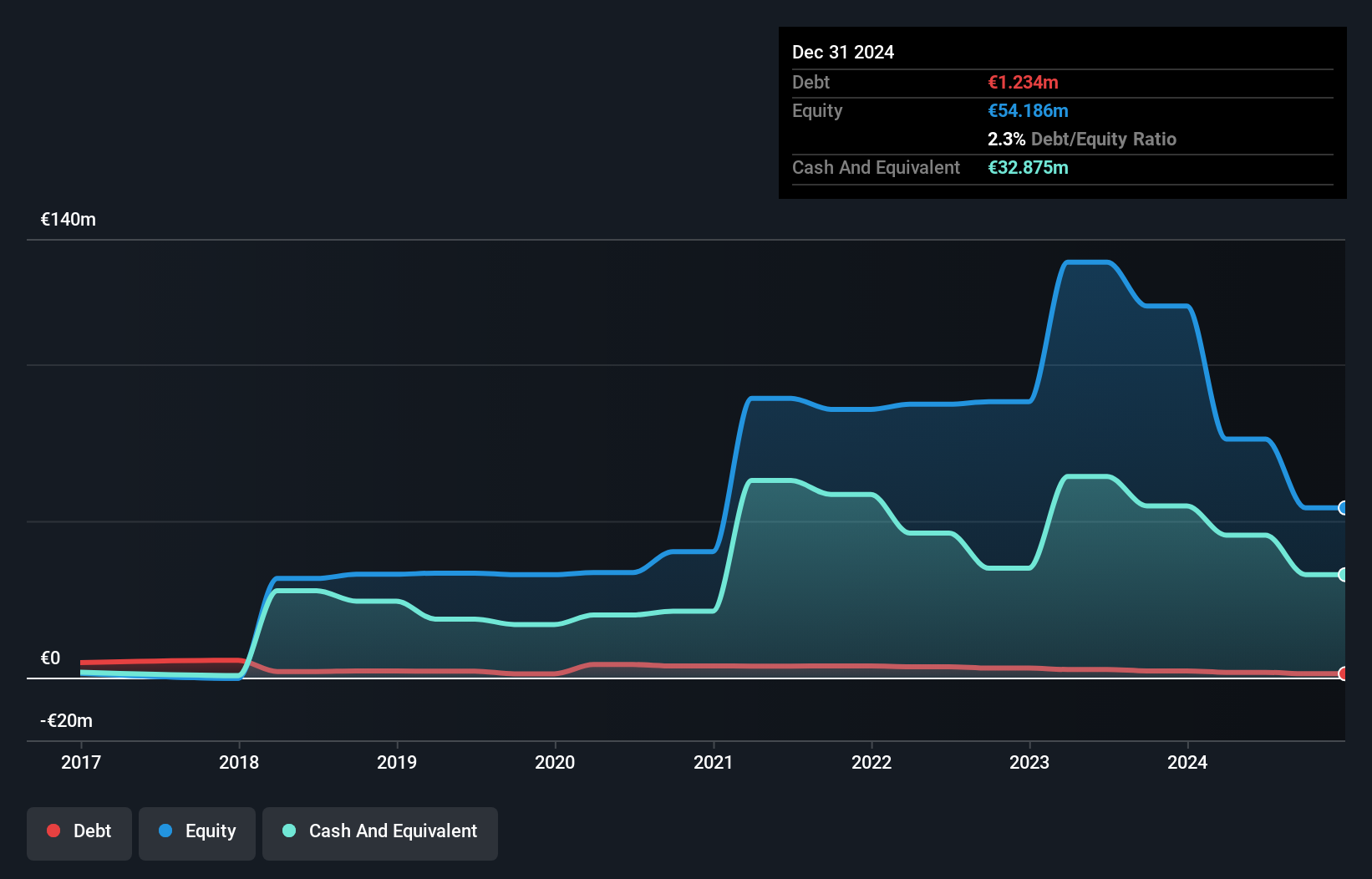

Don't Nod Entertainment S.A., with a market cap of €18.91 million, reported a net loss of €42.37 million for the half year ending June 30, 2024, despite generating €14.58 million in revenue. The company has a strong cash position with short-term assets of €55.9 million exceeding both short and long-term liabilities, providing a cash runway for over three years if historical free cash flow reduction rates persist. While unprofitable and experiencing high share price volatility, its debt-to-equity ratio has improved significantly over five years from 6.2% to 2.2%, indicating better financial management amidst challenging conditions.

- Click here to discover the nuances of Don't Nod Entertainment with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Don't Nod Entertainment's future.

Xinda Investment Holdings (SEHK:1281)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinda Investment Holdings Limited, with a market cap of HK$250.90 million, operates in the smart energy and public infrastructure construction sectors in the People's Republic of China.

Operations: The company's revenue is derived from its Smart Energy Business, which generated CN¥90.81 million, and its Public Infrastructure Construction Business, contributing CN¥12.73 million.

Market Cap: HK$250.9M

Xinda Investment Holdings Limited, with a market cap of HK$250.90 million, operates in the smart energy and public infrastructure sectors in China. Despite being unprofitable with a negative return on equity, the company has reduced its debt-to-equity ratio from 36.6% to 17.3% over five years and maintains more cash than its total debt. Short-term assets of CN¥661 million surpass both short- and long-term liabilities, ensuring a cash runway exceeding three years even as free cash flow shrinks annually by 33%. Recent board changes include appointing Ms. Zou Yanhong as an executive director effective December 2024.

- Navigate through the intricacies of Xinda Investment Holdings with our comprehensive balance sheet health report here.

- Understand Xinda Investment Holdings' track record by examining our performance history report.

Yoma Strategic Holdings (SGX:Z59)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yoma Strategic Holdings Ltd. is an investment holding company involved in real estate, motor, leasing, mobile financial services, food and beverages, and investment sectors across Singapore, Myanmar, and China with a market cap of SGD174.24 million.

Operations: The company's revenue is primarily derived from its operations in Myanmar, with $99.09 million from Yoma Land Development, $38.67 million from Mobile Financial Services, $30.52 million from Yoma F&B, $16.54 million from Yoma Land Services, $10.07 million from Yoma Motors (excluding Financial Services), and $7.83 million and $7.92 million respectively from Leasing and Investments across Myanmar and the PRC.

Market Cap: SGD174.24M

Yoma Strategic Holdings Ltd., with a market cap of SGD174.24 million, has seen its financial performance impacted by large one-off gains and shareholder dilution over the past year. Despite reporting a net loss of US$11.04 million for the half-year ending September 2024, Yoma's short-term assets significantly exceed both short- and long-term liabilities, indicating sound liquidity management. The company's debt-to-equity ratio has improved from 52.6% to 27.8% over five years, showing prudent debt management practices. Recent international expansion efforts include launching the first YKKO restaurant in Thailand as part of its regional growth strategy.

- Take a closer look at Yoma Strategic Holdings' potential here in our financial health report.

- Learn about Yoma Strategic Holdings' historical performance here.

Next Steps

- Get an in-depth perspective on all 5,812 Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALDNE

Excellent balance sheet with low risk.

Market Insights

Community Narratives