- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1257

There Is A Reason China Everbright Greentech Limited's (HKG:1257) Price Is Undemanding

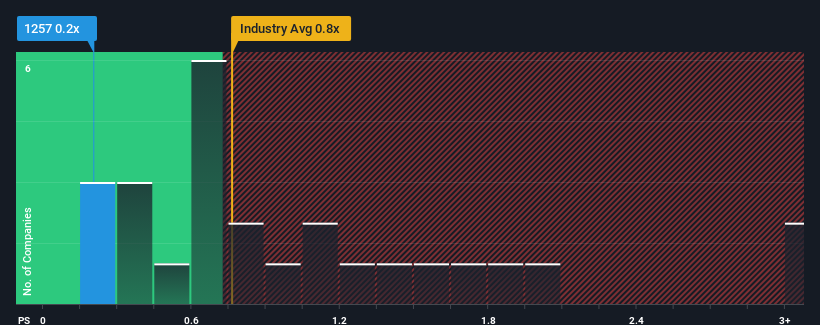

When you see that almost half of the companies in the Renewable Energy industry in Hong Kong have price-to-sales ratios (or "P/S") above 0.8x, China Everbright Greentech Limited (HKG:1257) looks to be giving off some buy signals with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for China Everbright Greentech

How Has China Everbright Greentech Performed Recently?

While the industry has experienced revenue growth lately, China Everbright Greentech's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on China Everbright Greentech will help you uncover what's on the horizon.How Is China Everbright Greentech's Revenue Growth Trending?

China Everbright Greentech's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 7.8% decrease to the company's top line. As a result, revenue from three years ago have also fallen 25% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 1.2% per annum during the coming three years according to the five analysts following the company. With the industry predicted to deliver 5.6% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why China Everbright Greentech's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of China Everbright Greentech's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 1 warning sign for China Everbright Greentech you should be aware of.

If these risks are making you reconsider your opinion on China Everbright Greentech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1257

China Everbright Greentech

An investment holding company, engages in the design, construction, operation, and maintenance of integrated biomass and waste-to-energy projects in China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives