- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1257

A Piece Of The Puzzle Missing From China Everbright Greentech Limited's (HKG:1257) 51% Share Price Climb

The China Everbright Greentech Limited (HKG:1257) share price has done very well over the last month, posting an excellent gain of 51%. The last 30 days bring the annual gain to a very sharp 26%.

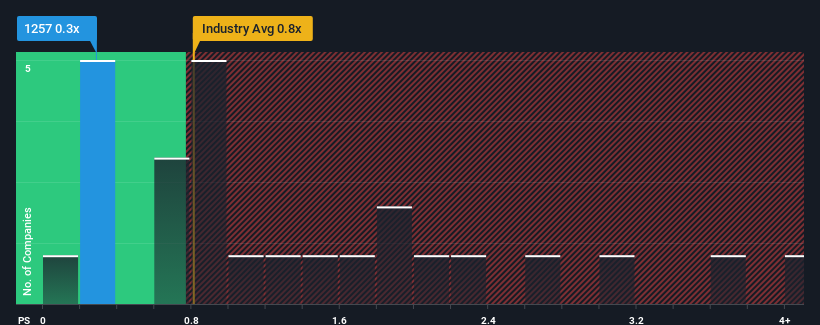

Although its price has surged higher, given about half the companies operating in Hong Kong's Renewable Energy industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider China Everbright Greentech as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for China Everbright Greentech

What Does China Everbright Greentech's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, China Everbright Greentech has been very sluggish. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Everbright Greentech will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like China Everbright Greentech's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.1% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.1% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.9%, which is not materially different.

With this information, we find it odd that China Everbright Greentech is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From China Everbright Greentech's P/S?

Despite China Everbright Greentech's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China Everbright Greentech's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware China Everbright Greentech is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1257

China Everbright Greentech

An investment holding company, engages in the design, construction, operation, and maintenance of integrated biomass and waste-to-energy projects in China.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives