- Hong Kong

- /

- Gas Utilities

- /

- SEHK:1083

Towngas Smart Energy Company Limited's (HKG:1083) Prospects Need A Boost To Lift Shares

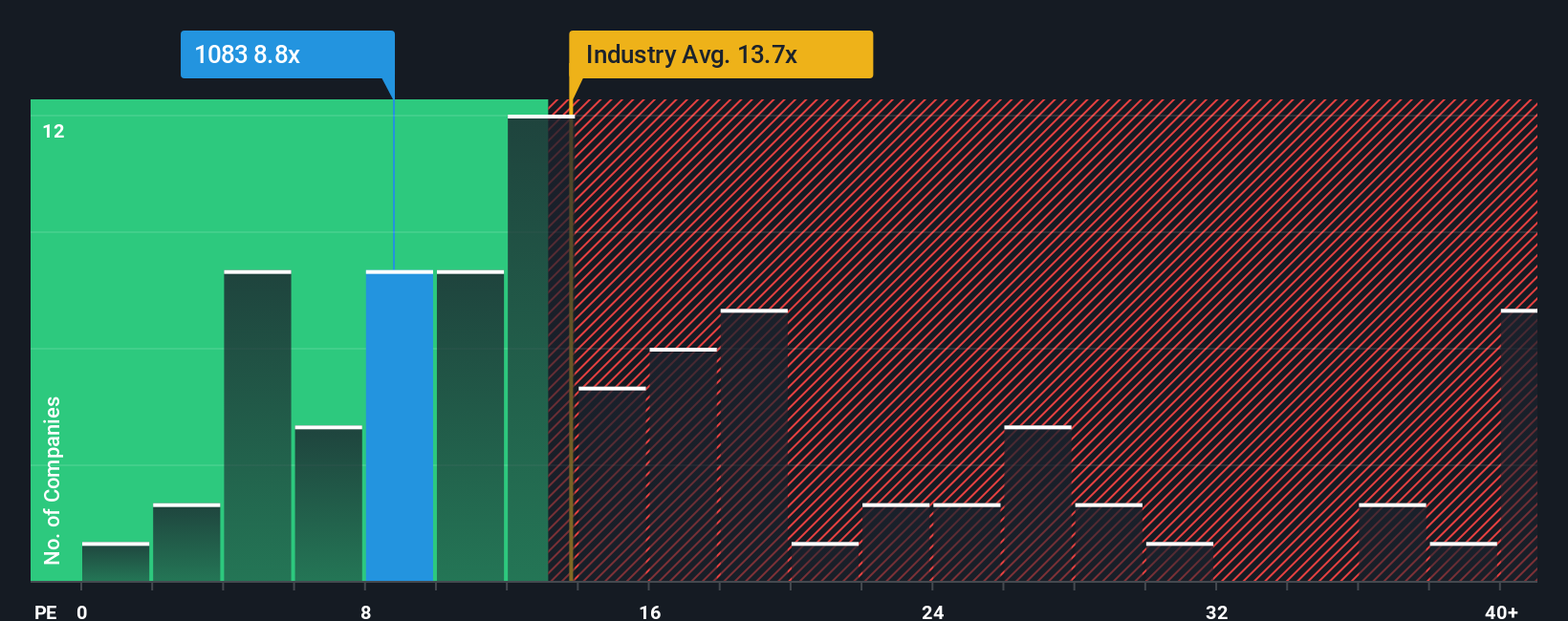

Towngas Smart Energy Company Limited's (HKG:1083) price-to-earnings (or "P/E") ratio of 8.8x might make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 25x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Towngas Smart Energy has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Towngas Smart Energy

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Towngas Smart Energy would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 8.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 4.0% per annum during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

With this information, we can see why Towngas Smart Energy is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Towngas Smart Energy's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Towngas Smart Energy maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Towngas Smart Energy (1 is concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Towngas Smart Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1083

Towngas Smart Energy

An investment holding company, sells piped gas, renewable energy, and other types of energy in the People’s Republic of China.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives