- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

3 Reliable Dividend Stocks To Consider With Up To 8.3% Yield

Reviewed by Simply Wall St

As global markets experience mixed performances, with major U.S. indexes like the S&P 500 and Nasdaq Composite reaching record highs while others such as the Russell 2000 face declines, investors are keeping a close watch on economic indicators and Federal Reserve decisions that could influence future market dynamics. In this environment of fluctuating growth stocks and value segments, dividend stocks offer a potential source of steady income; their reliability can be particularly appealing when broader market conditions are unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 1922 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

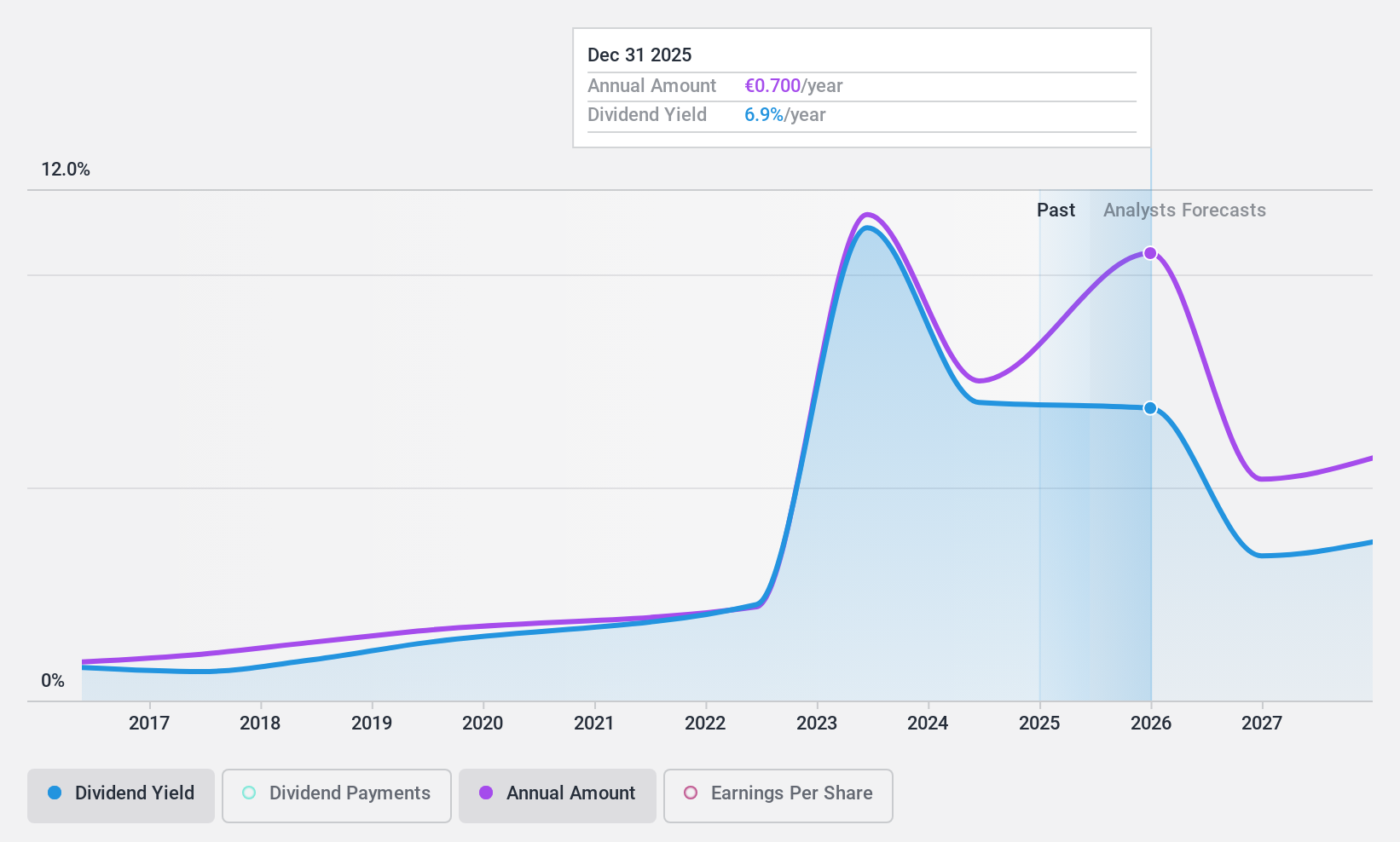

Ibersol S.G.P.S (ENXTLS:IBS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ibersol S.G.P.S. operates a network of restaurants in Portugal, Spain, and Angola through its subsidiaries, with a market cap of €311.36 million.

Operations: Ibersol S.G.P.S. generates revenue primarily from its extensive restaurant operations across Portugal, Spain, and Angola.

Dividend Yield: 6.7%

Ibersol S.G.P.S. offers a dividend yield of 6.67%, placing it in the top 25% of Portuguese dividend payers, but its sustainability is questionable due to a high payout ratio of 145.2%. Despite this, dividends are well covered by cash flows with a cash payout ratio of 48.6%. Earnings per share have shown improvement, yet profit margins have declined from last year. The stock trades at a significant discount to estimated fair value and has historically volatile dividends.

- Navigate through the intricacies of Ibersol S.G.P.S with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Ibersol S.G.P.S shares in the market.

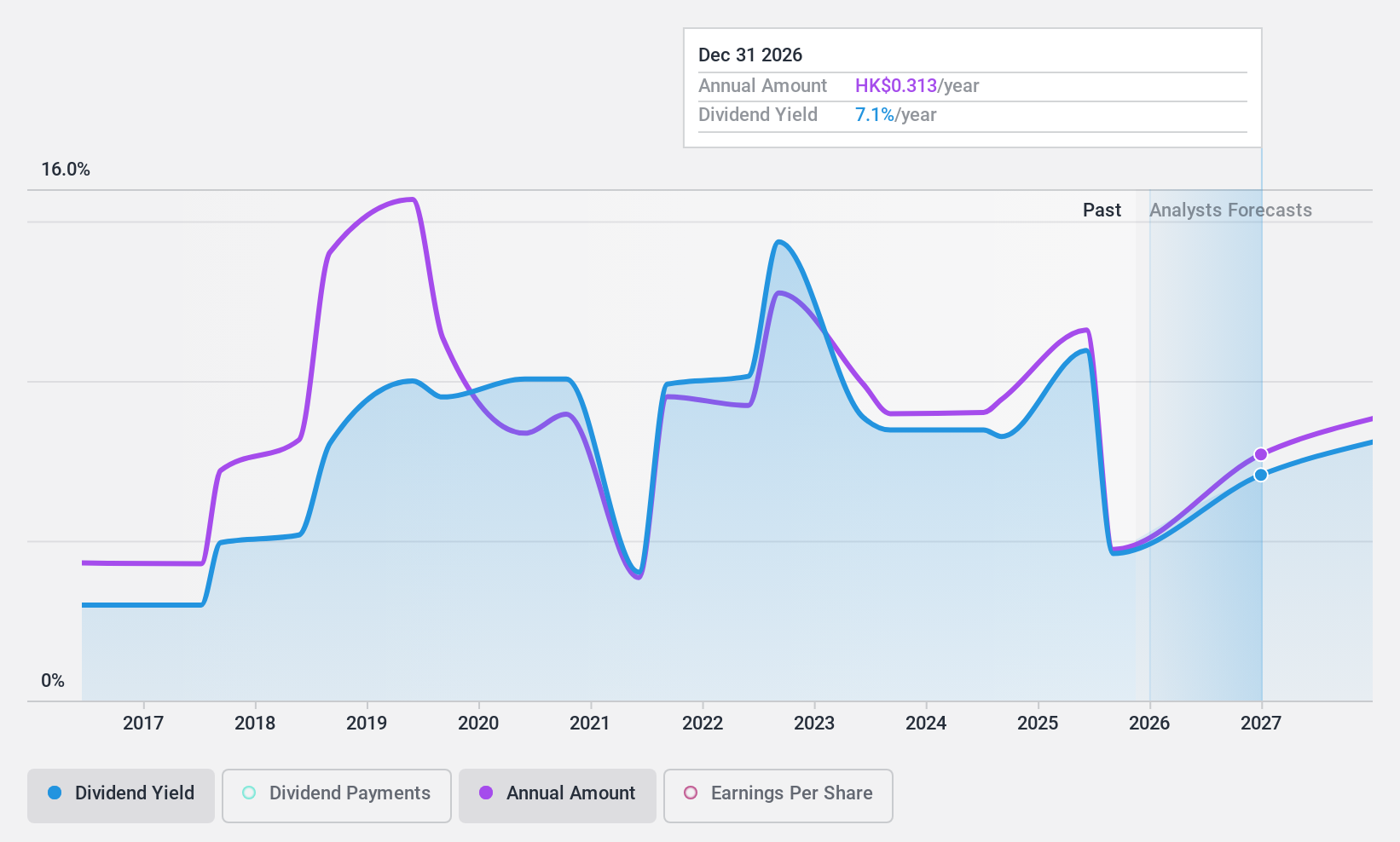

China Petroleum & Chemical (SEHK:386)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Petroleum & Chemical Corporation is an energy and chemical company involved in oil, gas, and chemical operations in Mainland China, Singapore, and internationally, with a market cap of HK$770.76 billion.

Operations: China Petroleum & Chemical Corporation generates revenue from several segments, including Refining (CN¥1.52 billion), Chemicals (CN¥528.87 million), Exploration and Production (CN¥304.40 million), and Marketing and Distribution (CN¥1.77 billion).

Dividend Yield: 8.4%

China Petroleum & Chemical's dividend yield of 8.4% ranks it among the top 25% in Hong Kong, yet its sustainability is questionable due to a high payout ratio of 84.5% and cash payout ratio of 164.7%. Recent share buybacks may enhance earnings per share, but dividends have been unreliable and volatile over the past decade. Despite trading at a significant discount to estimated fair value, earnings have declined year-over-year, impacting dividend stability.

- Take a closer look at China Petroleum & Chemical's potential here in our dividend report.

- The valuation report we've compiled suggests that China Petroleum & Chemical's current price could be quite moderate.

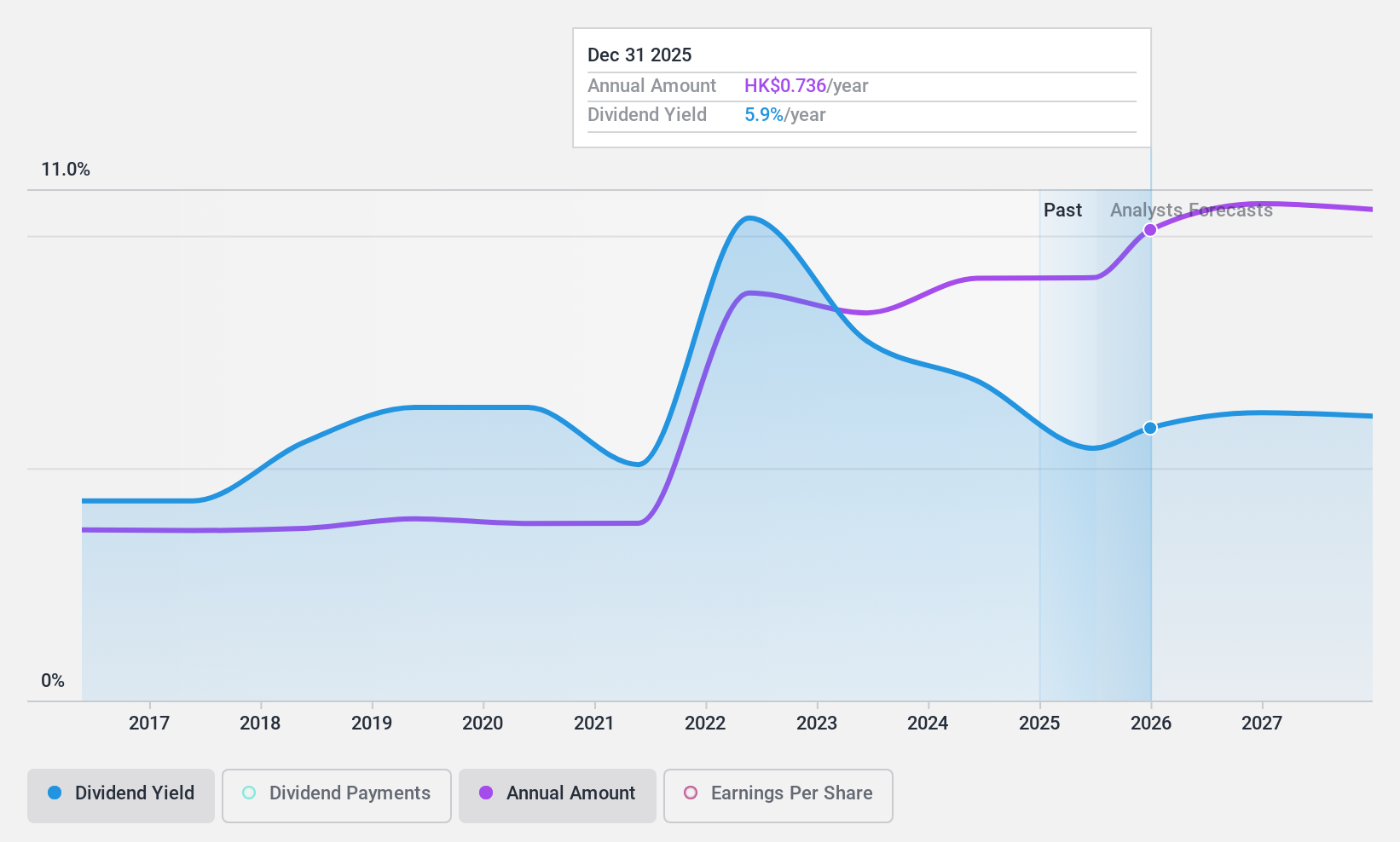

Anhui Expressway (SEHK:995)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Expressway Company Limited constructs, operates, manages, and develops toll roads and associated service sections in Anhui province, China with a market cap of HK$23.51 billion.

Operations: Anhui Expressway Company Limited generates revenue primarily through the construction, operation, management, and development of toll roads and related service areas in Anhui province, China.

Dividend Yield: 6.7%

Anhui Expressway offers a stable dividend history with consistent growth over the past decade, supported by a reasonable payout ratio of 65.1%. However, its dividend yield of 6.69% falls short of the top quartile in Hong Kong and is not well covered by free cash flows due to a high cash payout ratio of 321.5%. Recent earnings showed increased sales but decreased net income year-over-year, potentially affecting future dividend sustainability.

- Dive into the specifics of Anhui Expressway here with our thorough dividend report.

- Our valuation report here indicates Anhui Expressway may be overvalued.

Next Steps

- Embark on your investment journey to our 1922 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China, Singapore, and internationally.

Good value with adequate balance sheet and pays a dividend.