Stock Analysis

- Hong Kong

- /

- Infrastructure

- /

- SEHK:1785

3 High-Yield Dividend Stocks On SEHK With Yields Up To 8.5%

Reviewed by Simply Wall St

As global markets navigate through a period of mixed performances and heightened trade tensions, investors are increasingly seeking stable returns, making high-yield dividend stocks on the SEHK particularly appealing. In this context, understanding the characteristics that define a robust dividend stock is crucial, especially in an environment where economic indicators and market dynamics are constantly evolving.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.80% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.63% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.72% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 9.59% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.97% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.64% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.33% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.35% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.32% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.11% | ★★★★★☆ |

Click here to see the full list of 88 stocks from our Top SEHK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chengdu Expressway (SEHK:1785)

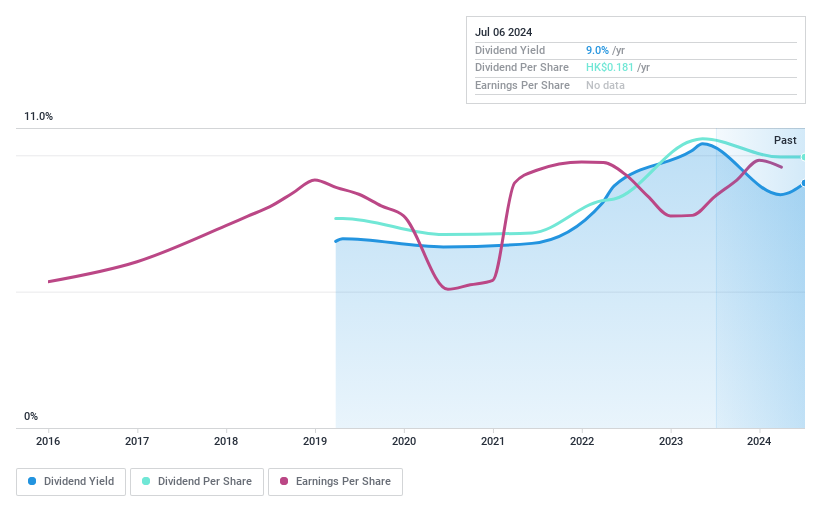

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Expressway Co., Ltd. operates and manages expressways in Chengdu, Sichuan province, China, with a market capitalization of approximately HK$3.48 billion.

Operations: Chengdu Expressway Co., Ltd. generates revenue primarily through the development, operation, and management of expressways in Chengdu, Sichuan province.

Dividend Yield: 8.6%

Chengdu Expressway offers a dividend yield of 8.59%, ranking in the top 25% among Hong Kong dividend stocks. Despite an unstable dividend history and less than a decade of payouts, dividends are well-supported by both earnings and cash flows, with payout ratios at 46.1% and 31.1%, respectively. Recent corporate reshuffling saw key executive changes, while Q1 sales increased to CNY 684.68 million from CNY 651.41 million year-over-year, though net income dipped to CNY 139.46 million from CNY 155.33 million.

- Click here and access our complete dividend analysis report to understand the dynamics of Chengdu Expressway.

- According our valuation report, there's an indication that Chengdu Expressway's share price might be on the cheaper side.

China Unicom (Hong Kong) (SEHK:762)

Simply Wall St Dividend Rating: ★★★★☆☆

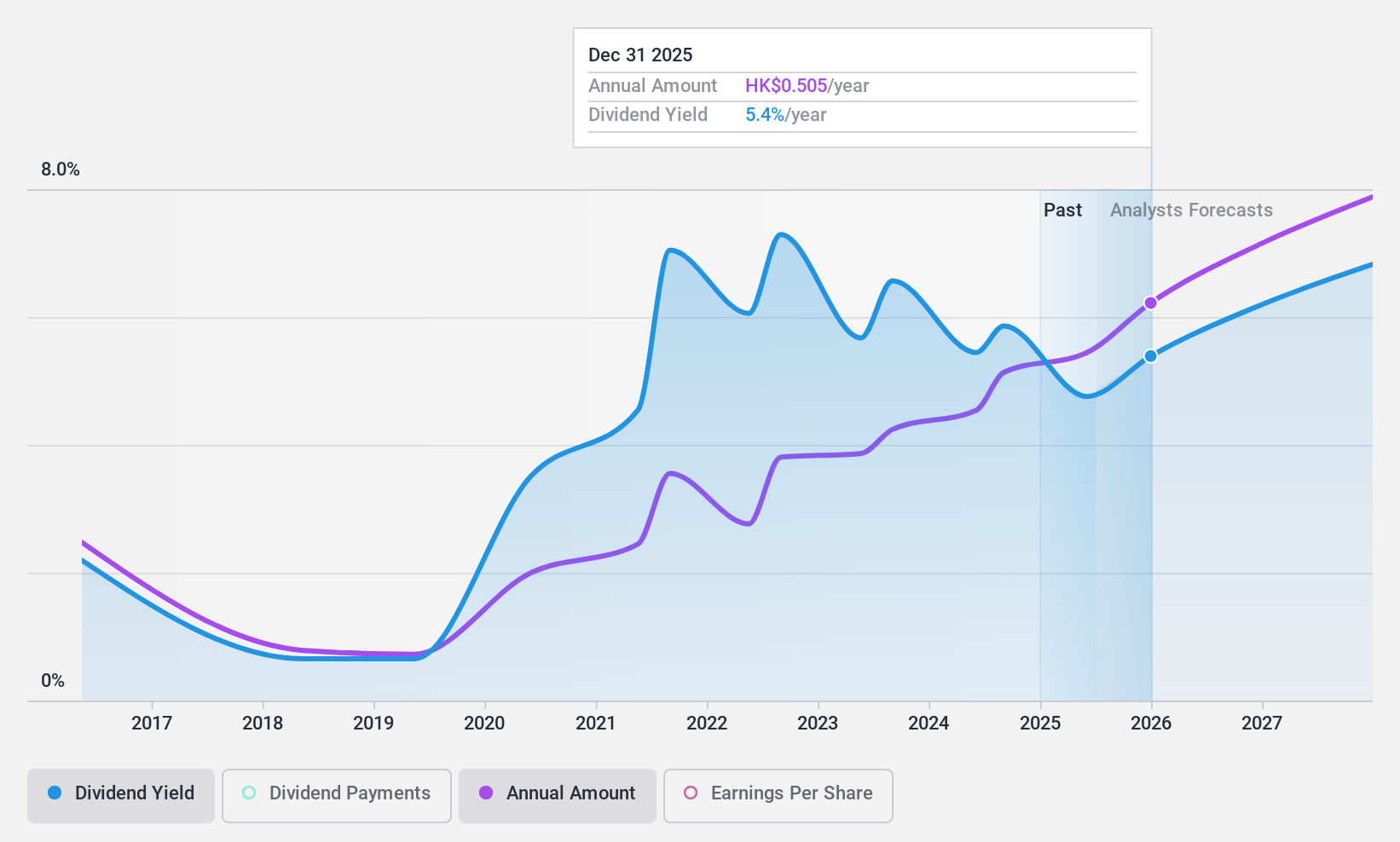

Overview: China Unicom (Hong Kong) Limited operates as an investment holding company, offering telecommunications and related value-added services in the People’s Republic of China, with a market cap of approximately HK$228.26 billion.

Operations: China Unicom (Hong Kong) Limited generates CN¥374.87 billion from its wireless communications services.

Dividend Yield: 4.8%

China Unicom (Hong Kong) Limited, while not a leader in Hong Kong's dividend market with a 4.84% yield, maintains robust dividend coverage with earnings and cash flow payout ratios at 55% and 44.7%, respectively. The company's dividends have shown volatility over the past decade, reflecting some instability. Recent operational data from May 2024 shows significant subscriber growth across various services, indicating potential support for ongoing dividend commitments despite historical fluctuations.

- Click to explore a detailed breakdown of our findings in China Unicom (Hong Kong)'s dividend report.

- Our valuation report here indicates China Unicom (Hong Kong) may be undervalued.

Anhui Expressway (SEHK:995)

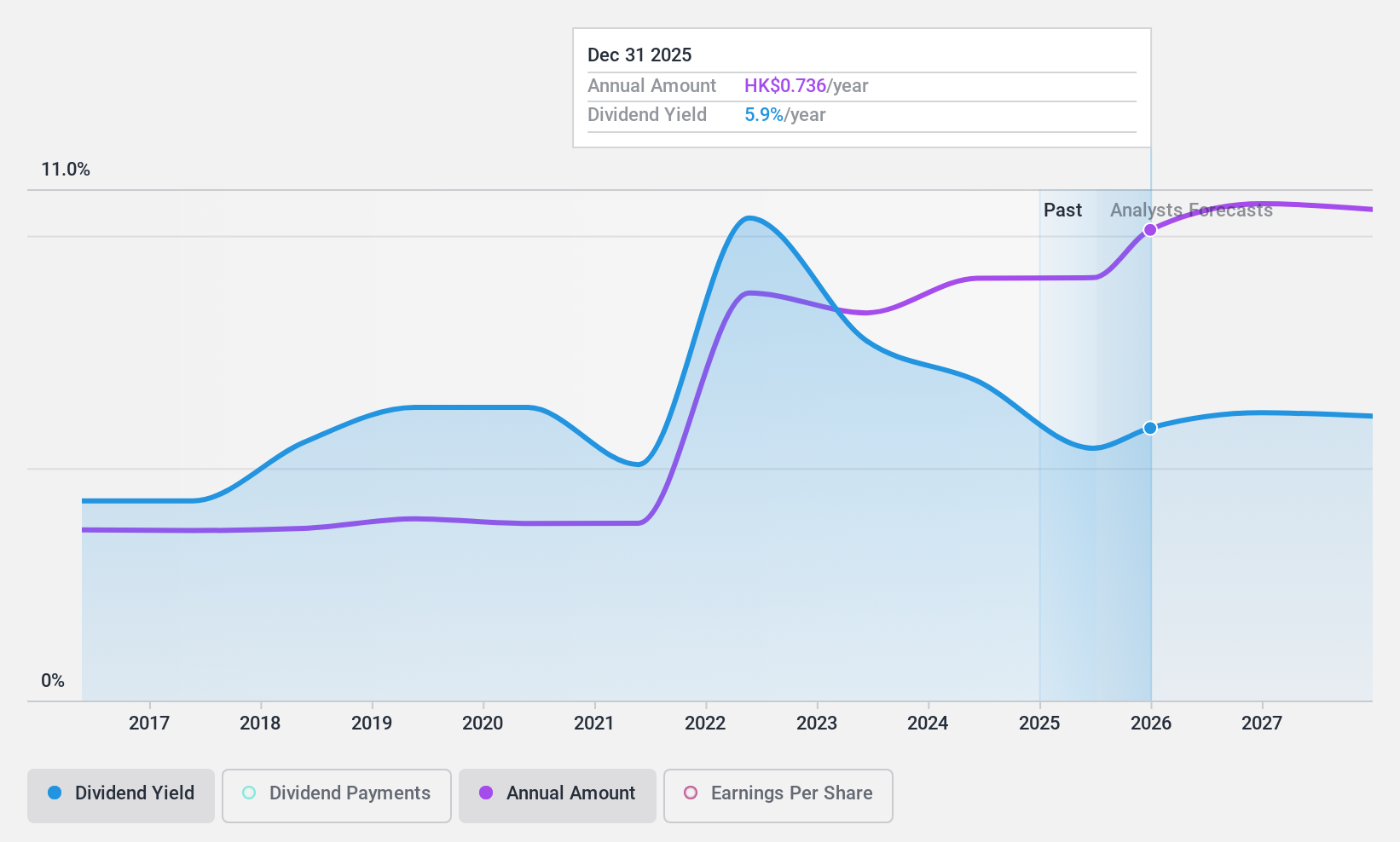

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anhui Expressway Company Limited focuses on constructing, operating, managing, and developing toll roads and related services in Anhui Province, China, with a market capitalization of approximately HK$21.58 billion.

Operations: Anhui Expressway Company Limited generates revenue primarily from the construction, operation, and management of toll roads in Anhui Province.

Dividend Yield: 7.0%

Anhui Expressway's 6.98% dividend yield trails behind the top Hong Kong dividend payers, with a coverage concern as it lacks sufficient free cash flows. Despite a reasonable payout ratio of 60%, indicating earnings coverage, the company faces challenges in sustaining its dividend due to financial constraints. Recent management changes and extended project timelines could impact operational stability and financial performance, potentially influencing future dividends. The company's earnings have grown by 10.8% over the past year, but this growth might not adequately support ongoing dividend payments without robust free cash flow generation.

- Dive into the specifics of Anhui Expressway here with our thorough dividend report.

- Our valuation report unveils the possibility Anhui Expressway's shares may be trading at a premium.

Key Takeaways

- Access the full spectrum of 88 Top SEHK Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1785

Chengdu Expressway

Engages in the development, operation, and management of expressways located in Chengdu, Sichuan province, China.

Solid track record, good value and pays a dividend.