Worldgate Global Logistics Ltd (HKG:8292) Might Not Be As Mispriced As It Looks

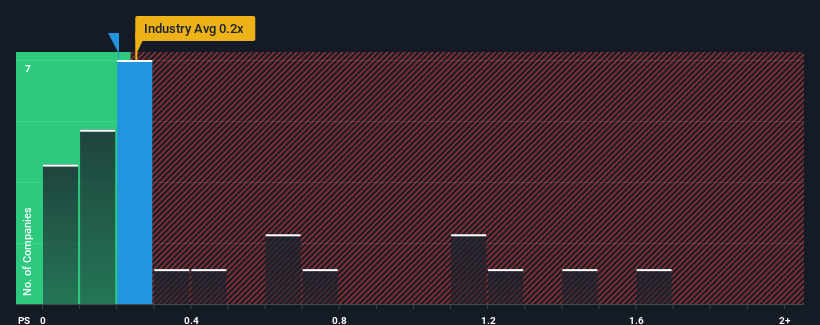

It's not a stretch to say that Worldgate Global Logistics Ltd's (HKG:8292) price-to-sales (or "P/S") ratio of 0.2x seems quite "middle-of-the-road" for Logistics companies in Hong Kong, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Worldgate Global Logistics

What Does Worldgate Global Logistics' P/S Mean For Shareholders?

For instance, Worldgate Global Logistics' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Worldgate Global Logistics' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Worldgate Global Logistics?

The only time you'd be comfortable seeing a P/S like Worldgate Global Logistics' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 59% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 4.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Worldgate Global Logistics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Worldgate Global Logistics' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Worldgate Global Logistics currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Worldgate Global Logistics (of which 2 don't sit too well with us!) you should know about.

If you're unsure about the strength of Worldgate Global Logistics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8292

VSING

An investment holding company, provides logistics solutions in Malaysia, Vietnam, Hong Kong, and the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives