How Sustained High Passenger Load Factors Could Influence Air China’s (SEHK:753) Investment Appeal

Reviewed by Sasha Jovanovic

- Air China has released its operating results for October and the year to date, reporting 14.63 million passengers carried in October and a total of 134.50 million so far in 2025, with overall load factors reaching 70.9% for the month and 68.4% year to date.

- These figures highlight sustained high passenger load factors, offering valuable perspective on Air China's recent demand trends and operational efficiency.

- We'll review how the company's robust October passenger load factor of 85.3% shapes Air China's investment narrative for stakeholders.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Air China's Investment Narrative?

For Air China shareholders, the investment thesis often depends on a belief in the sustained recovery and growth of air travel in China and abroad, plus the company's ability to restore margins amid operational and financial challenges. The latest monthly figures, showing an 85.3% passenger load factor and a jump in October traffic, give investors reason to feel encouraged about current demand and capacity utilization. Importantly, these results line up with earlier signs of improved profitability in the third quarter, and may offer some support to the view that short-term catalysts, like improving load factors and a recent capital injection, remain intact and perhaps even reinforced. However, risks such as heavy debt, recent board turnover, and reliance on one-off gains for earnings growth continue to loom large. While the latest operational data paint a positive near-term picture, these fundamental risks are unchanged and should not be overlooked by investors seeking longer-term performance. In contrast, ongoing board changes may affect management continuity, a key point investors should understand.

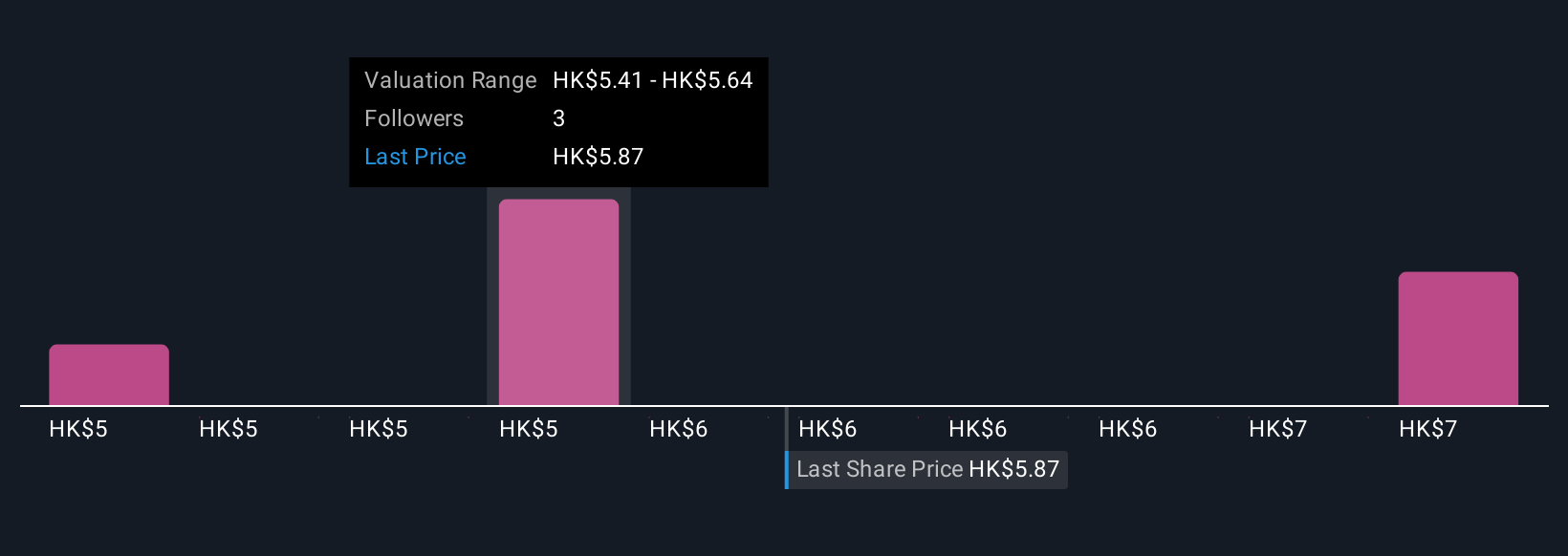

Despite retreating, Air China's shares might still be trading 10% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Air China - why the stock might be worth as much as 11% more than the current price!

Build Your Own Air China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air China research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air China's overall financial health at a glance.

No Opportunity In Air China?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:753

Air China

Provides air passenger, air cargo, and airline-related services in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives