How Investors May Respond To Air China (SEHK:753) Earnings Growth and Major Private Placement Announcement

Reviewed by Sasha Jovanovic

- Air China Limited recently reported its results for the nine months ending September 2025, showing higher sales of CNY 129.83 billion and net income of CNY 1.87 billion compared to the prior year, alongside the announcement of a CNY 20 billion private placement supported by major shareholders.

- This capital infusion and profit growth underline increased financial resources and the backing of key investors during a period of leadership transition.

- We'll examine how the sizable private placement and earnings improvement inform Air China's investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Air China's Investment Narrative?

To be a shareholder in Air China, an investor needs to believe that improved operational performance, recapitalization, and stability in management will unlock future value despite sector challenges. The latest earnings show a solid rebound in profitability, thanks partly to a non-recurring gain, while revenues continue to grind higher. Fresh capital from the CNY 20 billion private placement, with backing from top shareholders, addresses balance sheet concerns and provides flexibility as new leadership settles in. This development helps buffer short-term catalysts like demand recovery and network expansion but doesn’t erase ongoing risks, especially high debt and potential volatility during leadership transitions. The private placement’s 18-month lock-up by major investors points to confidence but may temper near-term trading activity. Compared to prior analysis, recent news enhances financial stability, easing some short-term risks even as long-term profitability and sector headwinds remain key concerns.

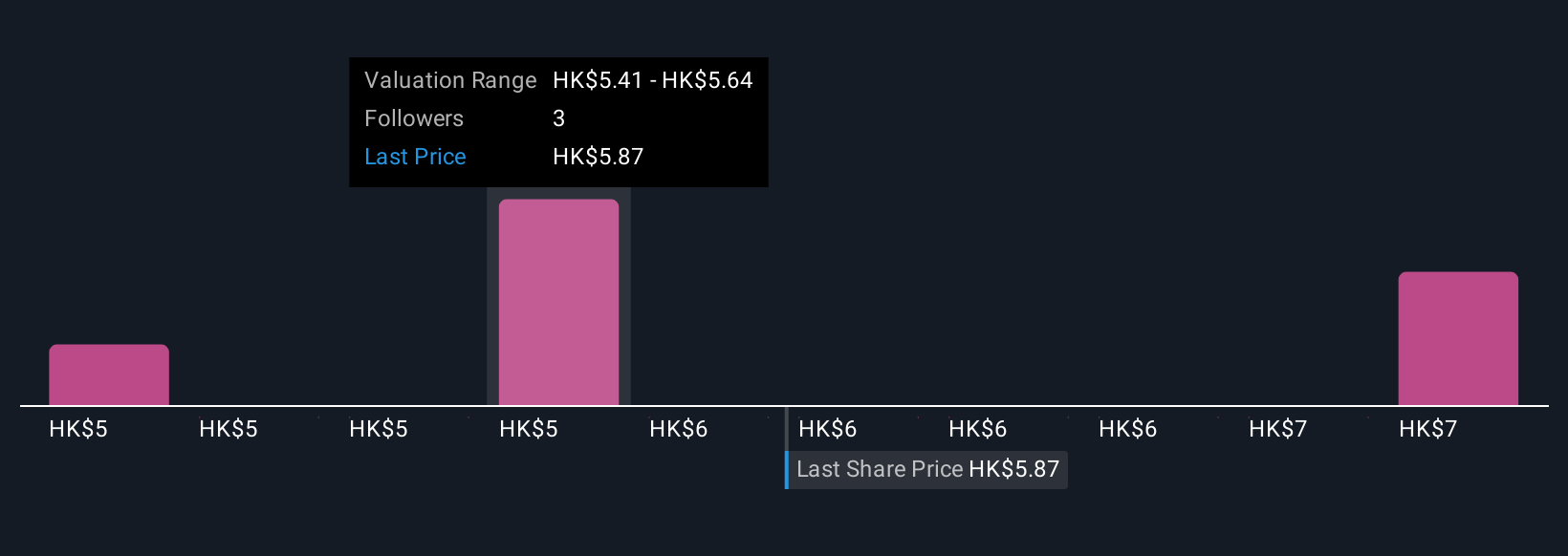

But unlike the headline profit, some recent gains stem from one-off items that may not repeat. Despite retreating, Air China's shares might still be trading 10% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Air China - why the stock might be worth 21% less than the current price!

Build Your Own Air China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air China research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air China's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:753

Air China

Provides air passenger, air cargo, and airline-related services in Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives