- Hong Kong

- /

- Infrastructure

- /

- SEHK:694

Is BCIA's Share Price Rally Sustainable After 30.9% Gain Despite Mixed Valuation Signals?

Reviewed by Simply Wall St

Thinking about what to do with Beijing Capital International Airport stock? You are definitely not alone. This name has been catching more eyes lately, especially after its steady 30.9% rally over the past year. That strength has come despite a less enthusiastic performance in the more distant past, with the stock still down just over 40% from where it was three years ago. In the nearer term, things have been a bit choppier. The stock is up 0.7% over the last week but has given back 5.0% in the last month. For many investors, this kind of mixed track record sparks two big questions: is the worst behind us, and is there something about the company’s value that the market is missing?

From a valuation perspective, Beijing Capital International Airport earns a score of 2 out of 6, meaning it shows up as undervalued in only a couple of key metrics. That does not make it a bargain-basement steal, but it does suggest there are at least a few ways the market might be underestimating this company compared to its peers. More importantly, what drives this score, and how much does it really matter to your buy or hold decision?

We are about to dig into these valuation checks in some detail. Later, I will share a practical lens for understanding value that goes beyond any one formula alone.

Beijing Capital International Airport scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Beijing Capital International Airport Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model predicts a company’s value by estimating future free cash flows and then discounting those back to today’s value to account for the time value of money. For Beijing Capital International Airport, this approach uses projections based on the company’s historical and expected cash generation.

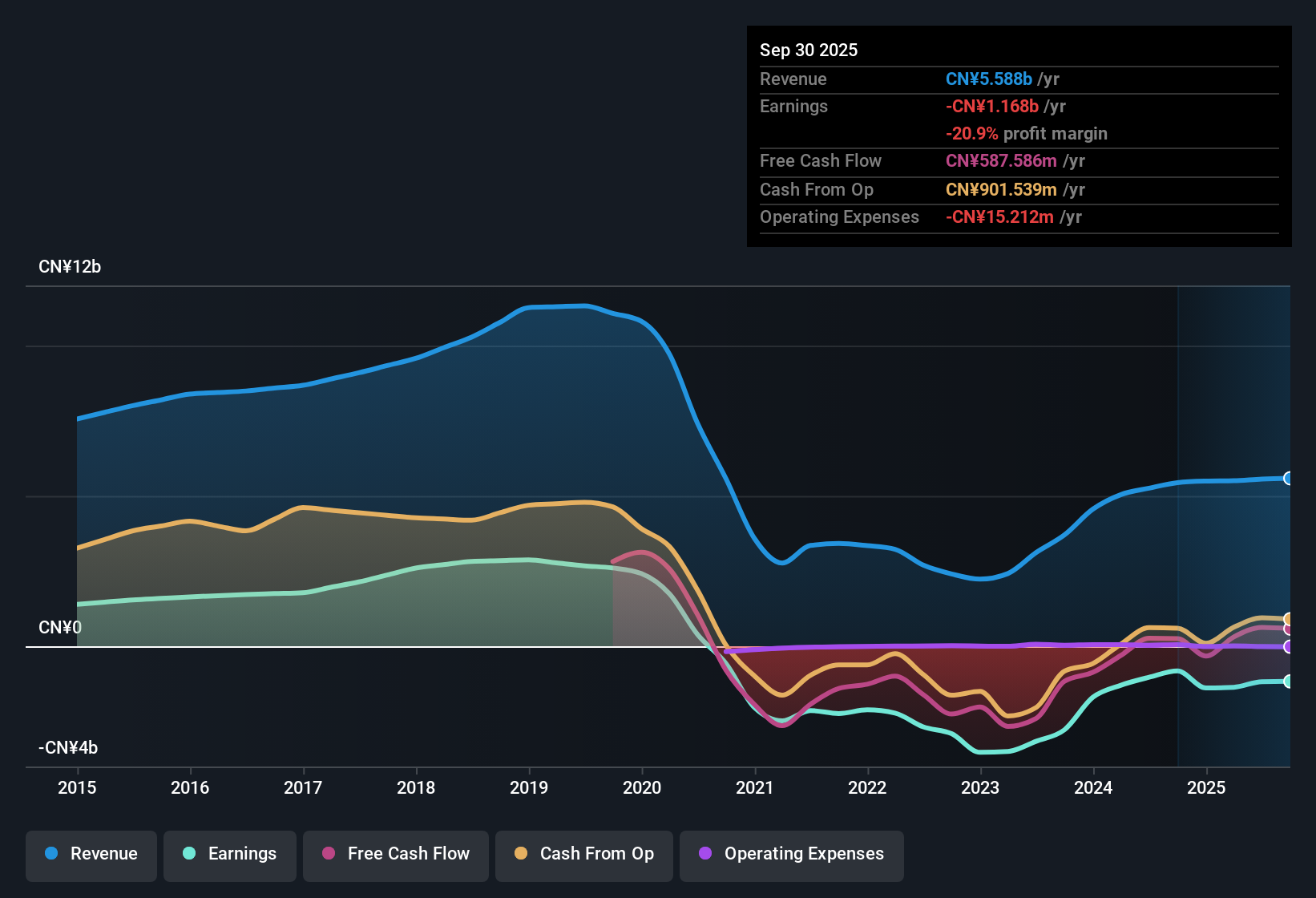

The company’s latest reported Free Cash Flow was CN¥216.9 Million. Analysts expect robust growth in coming years, projecting that annual free cash flows could rise to CN¥1.7 Billion by 2027. Looking further ahead, extrapolated estimates suggest free cash flow could reach as much as CN¥2.2 Billion in 2035, though such long-range projections are inherently less certain.

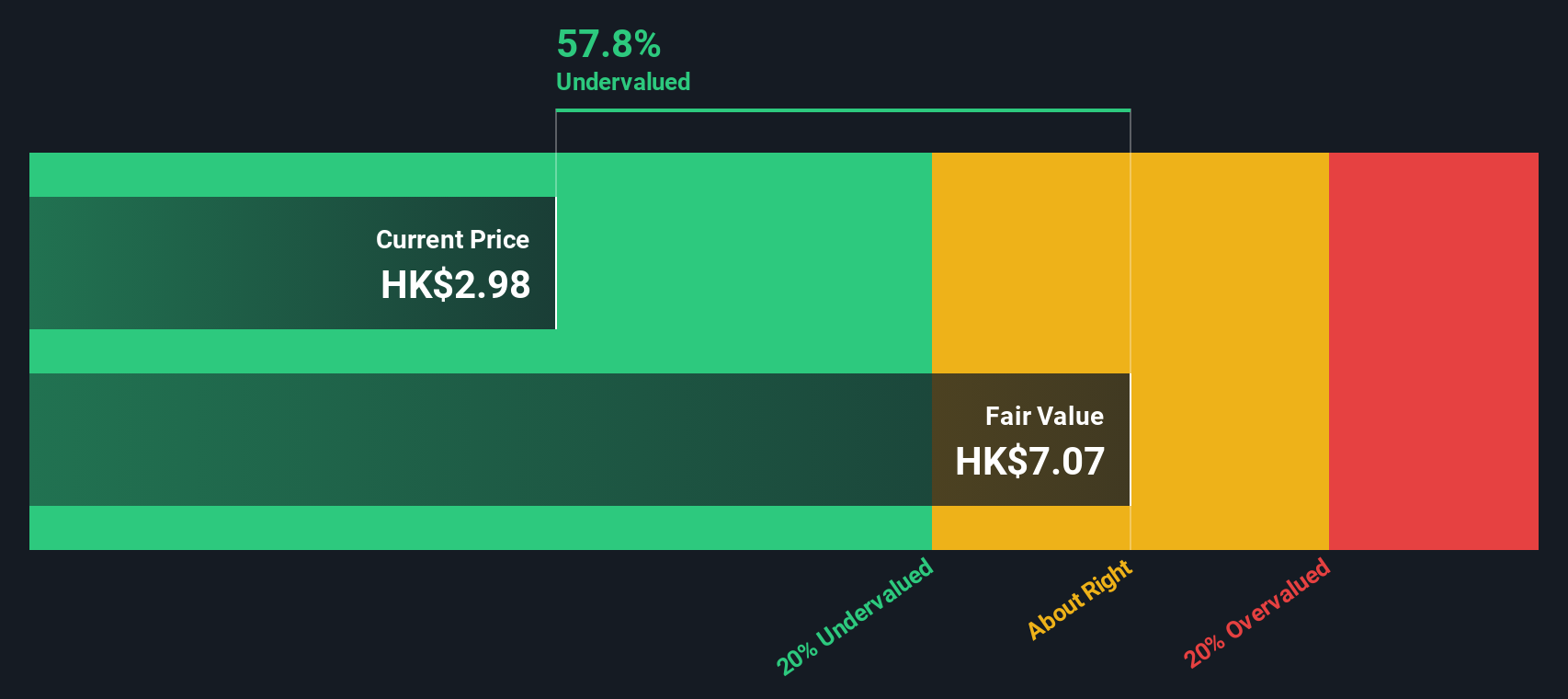

Using these forecasts, the DCF model estimates an "intrinsic value" of HK$4.93 per share. This is approximately 41.6% above the stock's current share price, suggesting the shares are meaningfully undervalued according to this methodology.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Beijing Capital International Airport.

Approach 2: Beijing Capital International Airport Price vs Sales

The price-to-sales (P/S) ratio is often favored for valuing companies in sectors like infrastructure, where profits may fluctuate but steady revenues are fundamental. For profitable companies, especially those with consistent sales even when earnings swing, the P/S ratio provides a clearer signal of what investors are actually paying for each dollar of revenue.

Of course, investors should remember that a “normal” or “fair” P/S ratio does not stand still. Companies with faster growth or lower risk can command higher multiples, while slower growth or more uncertainty typically pulls the ratio down.

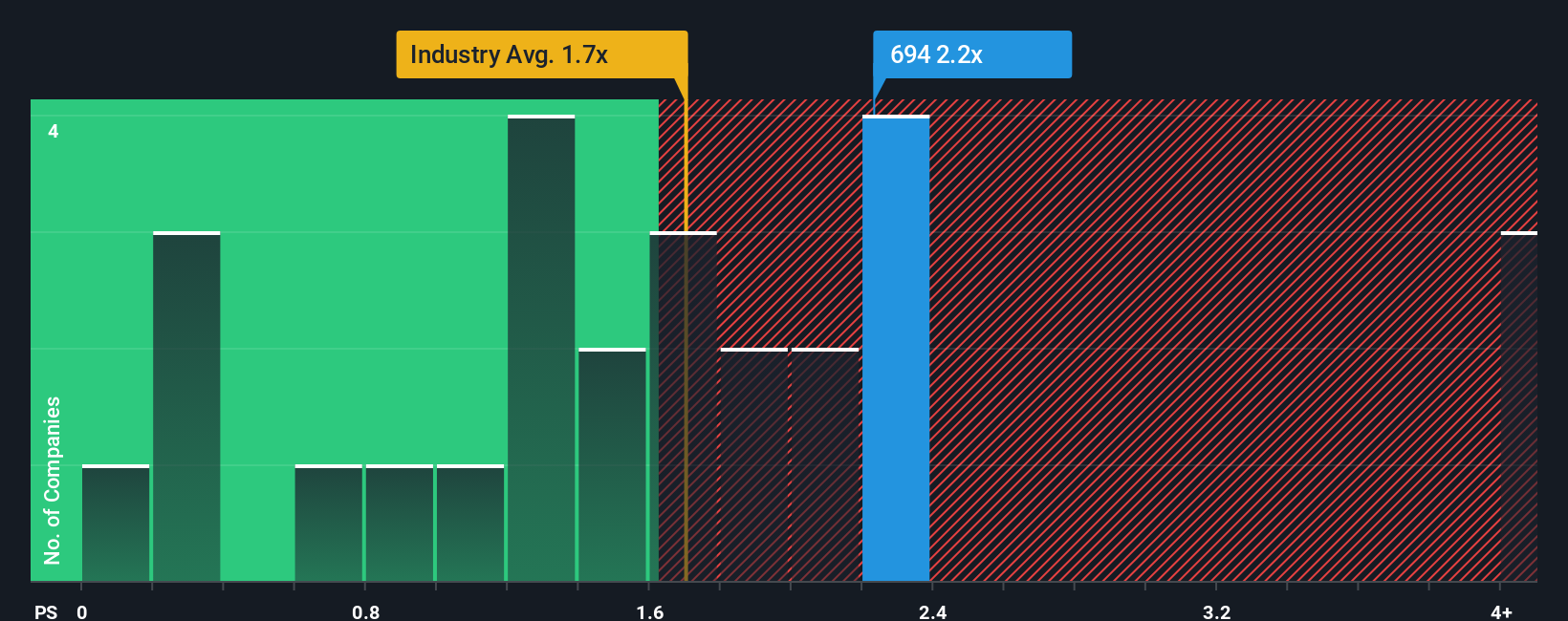

Looking at Beijing Capital International Airport, its current P/S ratio is 2.17x. That is noticeably above the industry average of 1.71x and also tops the average of its direct peers at 1.58x, suggesting at first glance the stock may be priced at a premium.

However, Simply Wall St’s Fair Ratio, which is 1.48x for Beijing Capital International Airport, offers a more tailored benchmark. This proprietary metric blends not just industry and size, but also the company’s unique growth outlook, profit margins, and risk profile. These factors can be overlooked by peer and industry averages.

Comparing the Fair Ratio to the company’s actual P/S ratio, we see a clear gap. With a Fair Ratio of 1.48x versus an actual P/S of 2.17x, the stock screens as overvalued on this basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Beijing Capital International Airport Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story about a company, directly connected to hard numbers such as your assumptions about fair value and future growth. With Narratives, you move beyond static ratios and formulas and instead tie your view of Beijing Capital International Airport's future to your own financial forecast. This approach creates a fair value that reflects your unique investment thesis.

Narratives are easy to use and available for every stock on Simply Wall St’s Community page, trusted by millions of investors. They help you decide when to buy or sell by comparing your calculated Fair Value to the current Price, all on one dynamic dashboard. In addition, Narratives update automatically whenever news or earnings are released, keeping your analysis current.

For example, one investor’s Narrative might forecast a quick recovery in passenger traffic and see a Fair Value as high as HK$7.20 per share. Another investor may expect slower growth, leading to a much lower Fair Value. Narratives empower you to invest with a story and the numbers to support it.

Do you think there's more to the story for Beijing Capital International Airport? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital International Airport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:694

Beijing Capital International Airport

Operates and manages aeronautical and non-aeronautical businesses at the Beijing Capital Airport in the People’s Republic of China.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives