KLN Logistics Group (SEHK:636): Assessing Valuation as Investors Reconsider Expectations

Reviewed by Simply Wall St

Price-to-Earnings of 9.4x: Is it justified?

KLN Logistics Group is considered good value on a price-to-earnings (P/E) basis when compared to both its peers and its industry. Its current P/E ratio of 9.4x is much lower than the Hong Kong logistics peer average of 36.3x and the Asian Logistics industry average of 16.4x.

The price-to-earnings ratio is a common valuation metric that compares a company's share price to its earnings per share. For logistics companies, this ratio indicates how much investors are willing to pay for each dollar of earnings, providing context for market expectations about growth, profitability, and risk in this sector.

With the company trading at a significant discount to industry and peer averages, the implication is that the market is currently underpricing KLN Logistics Group’s earnings potential relative to its sector. However, this could also reflect investor caution regarding its slower growth outlook compared to the broader market.

Result: Fair Value of $18.97 (UNDERVALUED)

See our latest analysis for KLN Logistics Group.However, slower medium-term returns and recent monthly declines could signal investor uncertainty. These factors may serve as potential catalysts for a shift in sentiment.

Find out about the key risks to this KLN Logistics Group narrative.Another View: What Does the SWS DCF Model Suggest?

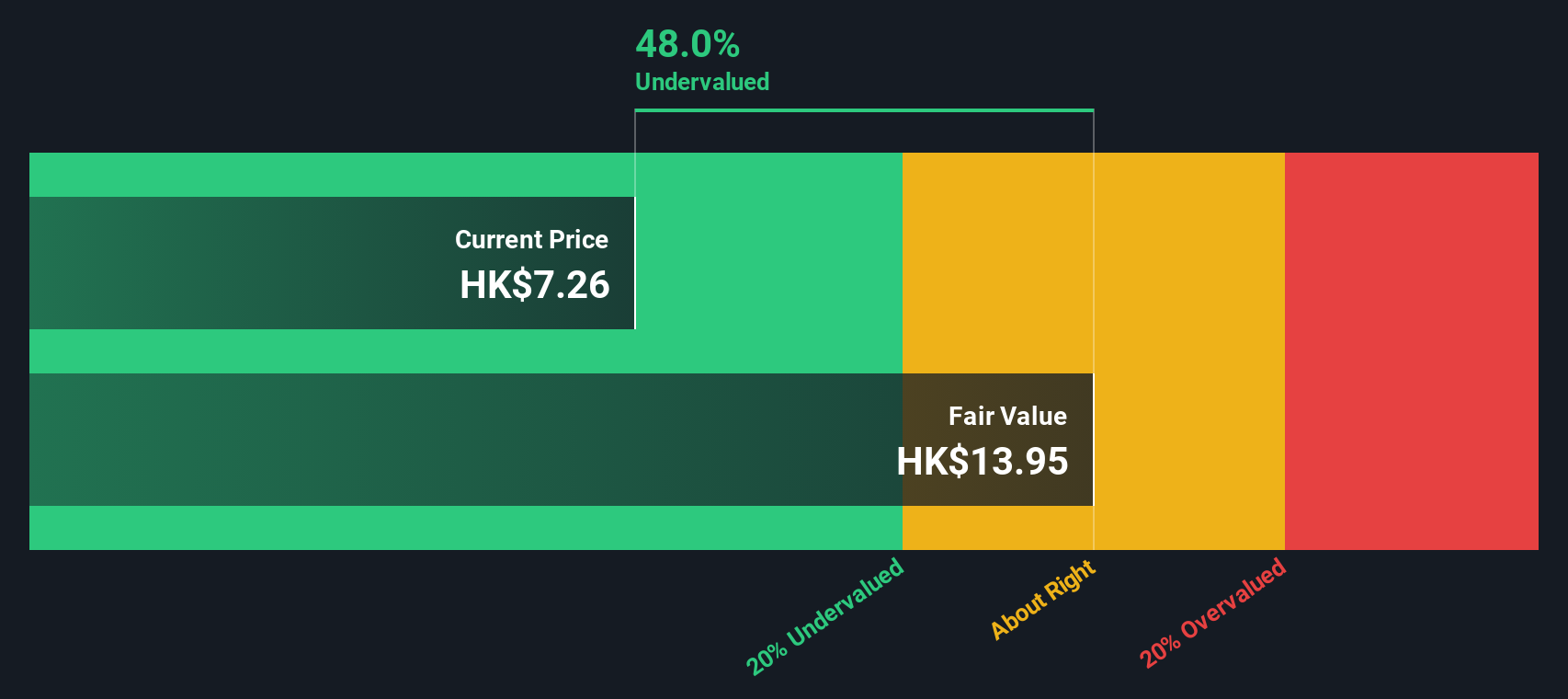

Turning to another approach, the SWS DCF model points to a very different picture. This method suggests the shares are undervalued as well, but it uses company cash flows to reach its conclusion. Should investors trust the discounted cash flow calculation or stick with traditional market ratios?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KLN Logistics Group Narrative

If you see things differently or want to dive into the numbers yourself, you can put together your own story in just a few minutes. Do it your way

A great starting point for your KLN Logistics Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit your portfolio to just one opportunity? Open up new possibilities by tapping into expertly curated stock ideas you might have overlooked.

- Accelerate your growth potential by targeting companies harnessing the power of artificial intelligence across industries with our AI penny stocks.

- Lock in stable income streams as you scan for businesses yielding more than 3 percent in dividends using the trusted insights from our dividend stocks with yields > 3%.

- Capture value opportunities in the market by finding stocks priced attractively against cash flows. Take action with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLN Logistics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:636

KLN Logistics Group

An investment holding company, provides logistics services in Hong Kong, Mainland China, the rest of Asia, the Americas, Europe, the Middle East, Africa, and Oceania.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives