Is KLN Logistics Group (SEHK:636) Undervalued? A Fresh Look at Its Latest Valuation Metrics

Reviewed by Simply Wall St

KLN Logistics Group (SEHK:636) shares have seen steady movement in recent sessions, drawing attention as investors weigh recent data and underlying trends. Many are curious if these shifts could signal broader changes for the company.

See our latest analysis for KLN Logistics Group.

KLN Logistics Group’s recent 1-day and 7-day share price returns reflect a modest upward move, but momentum has faded over the past three months. Over the past year, its total shareholder return edged slightly lower, while the longer-term picture is weighed down by deeper declines. This suggests that any growth optimism is met with ongoing caution from investors.

If you’re keeping an eye on what’s shifting in logistics and transport, this is a great time to expand your perspective and discover fast growing stocks with high insider ownership

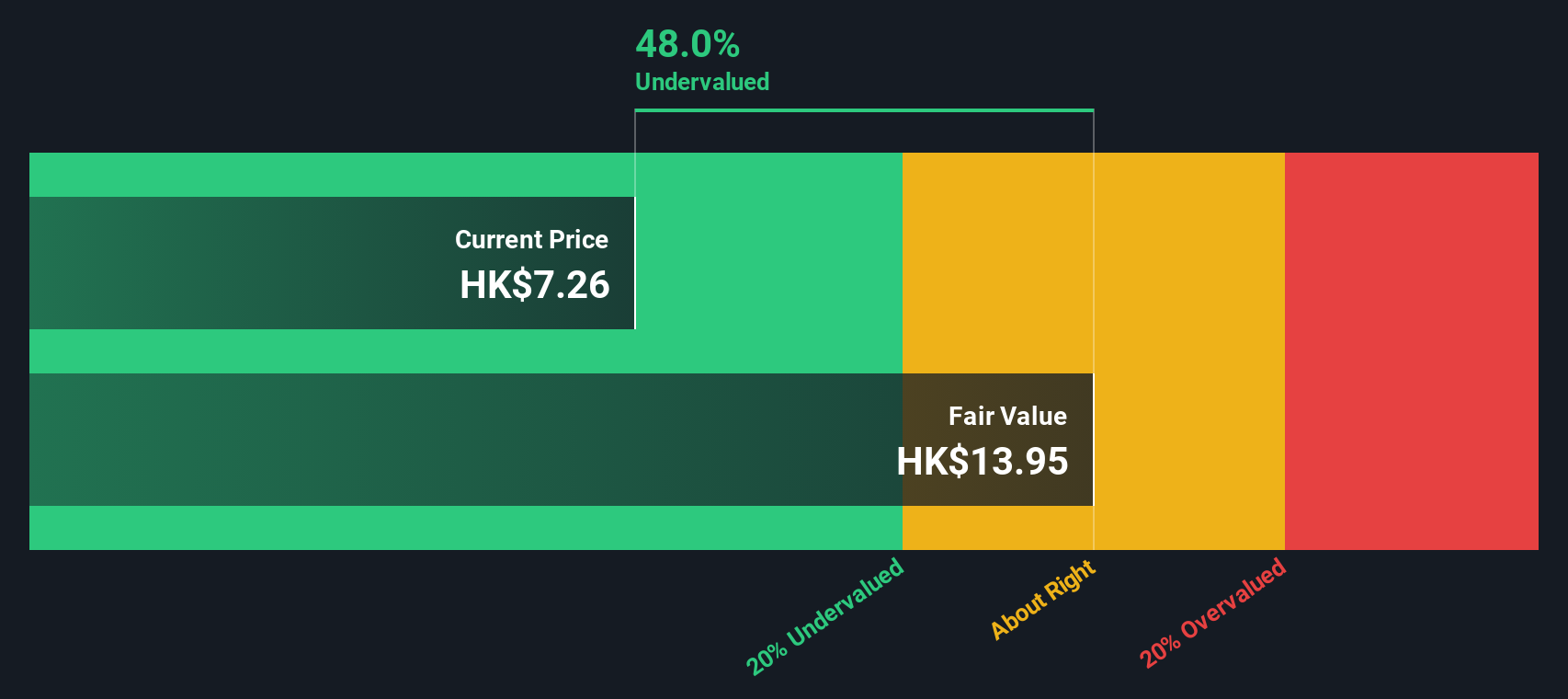

With analyst estimates and intrinsic value calculations both suggesting KLN Logistics Group trades well below fair value, investors are left to wonder if this is a hidden bargain or if the market is already factoring in all that future growth.

Price-to-Earnings of 9x: Is it justified?

KLN Logistics Group trades at a price-to-earnings (P/E) ratio of 9x, which is a central measure of how much investors are willing to pay per dollar of earnings when they buy the stock at its last close of HK$7.25.

The P/E ratio is a widely used indicator in public markets, showing whether a company is priced cheaply or expensively compared to its profits. For logistics companies, it helps investors gauge whether the stock’s value reflects its growth pace, margin trajectory, and competitive position in a capital-intensive sector.

KLN Logistics Group’s P/E of 9x sits well below the industry average of 16.5x and the peer group’s average of 36.8x. While it is also slightly higher than the estimated fair price-to-earnings ratio of 8.4x, suggesting a touch of overvaluation relative to this fair multiple, versus similar companies the shares stand out as inexpensive.

Explore the SWS fair ratio for KLN Logistics Group

Result: Price-to-Earnings of 9x (ABOUT RIGHT)

However, slower revenue growth and ongoing declines in longer-term returns could remain key risks that challenge any turnaround hopes for KLN Logistics Group.

Find out about the key risks to this KLN Logistics Group narrative.

Another View: What Does Discounted Cash Flow Suggest?

Looking at things through the SWS DCF model changes the story. This approach estimates KLN Logistics Group’s fair value at HK$14.06, which is about double the current price. If analysts are right, this stock could be much cheaper than it looks based on earnings. But is that too optimistic, or are investors overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out KLN Logistics Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own KLN Logistics Group Narrative

If you see things differently or believe your analysis tells a new story, you have the tools to shape your own view in just a few minutes. Do it your way

A great starting point for your KLN Logistics Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your investing further by checking out unique opportunities most investors are missing. Don’t leave your next big move up to chance. See what’s possible here.

- Boost your income stream by targeting high-yielding stocks with these 19 dividend stocks with yields > 3%, featuring industry-leading dividends above 3%.

- Ride the wave of innovation when you access these 27 AI penny stocks, filled with fast-growing companies pushing the boundaries of artificial intelligence.

- Get ahead of the market cycle and spot bargains early with these 870 undervalued stocks based on cash flows, based on strong future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLN Logistics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:636

KLN Logistics Group

An investment holding company, provides logistics services in Hong Kong, Mainland China, the rest of Asia, the Americas, Europe, the Middle East, Africa, and Oceania.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives